Each year banking institutions must send consumers a privacy notice through the mail. To cut costs and better streamline the practice, the Consumer Financial Protection Bureau is proposing a new rule that would allow customers to see the privacy disclosures online. [More]

consumer financial protection bureau

Report: Debt Collectors Now Using Court System To Unfairly Force Consumers To Pay Up

Debt collection is a big business that doesn’t look to be shrinking anytime soon. But along with the rapid expansion of the industry, there has been an increase in abusive and predatory collection practices. One of those practices, obtaining default judgements against consumers, has led the Center for Responsible Lending to call for stricter regulations over the process of selling debt to collectors. [More]

Private Student Loan Borrowers Face Automatic Default Because Of Co-Signer Provisions

College graduates with private student loans know the importance of staying current on their payments. But a new report by the Consumer Financial Protection Bureau finds that even consumers who pay their loans on time are finding themselves placed in default when the co-signer of their loan dies or declares bankruptcy. [More]

CFPB Proposes Rule Change So Banks Can Send Your Money Overseas

You should not send money overseas to an exiled prince who promises to split his fortune with you. That is likely a scam. But if for some reason you do need to send funds overseas for legitimate reasons, the Consumer Financial Protection Bureau’s proposed rule change could help get your money where it needs to be. [More]

Believe It Or Not, Outlawing Payday Loans Will Not Lead To Looting & Pillaging

Critics of payday lending say the practice traps many borrowers in a debt spiral, forcing them to take out additional loans to pay back the first. Yet these short-term loans do have proponents (many of them profiting from the industry) who claim that without this pricey option for quick cash, desperate consumers will turn to more unsavory means, leading to increased crime rates and other doom and gloom predictions. But does that really happen? [More]

CFPB Receives Double The Consumer Complaints In 2013, But Sought Fewer Explanations

The Consumer Financial Protection Bureau heard a lot from consumers in 2013. The agency received the most complaints in its history, including those from three new areas – payday loans, money transfers and debt collections. But it appears that fewer complaints were sent to offending companies for review and response. [More]

Despite Regulations, Survivors Face Foreclosures After Reverse Mortgage Borrower’s Death

There are a number of reasons someone might take out a reverse mortgage: to pay for prescriptions or medial care, to subsidize their daily living expenses or even to settle their fear of becoming a burden to their family. But the product that was designed to keep elderly consumers in their homes is now wreaking havoc on their surviving loved ones. [More]

CFPB In “Late Stages” Of Working On Rules To Stop Predatory Payday Lending

Lisa took out a payday loan to help pay her rent. When she couldn’t repay the loan after 14 days she rolled it over, bringing her total debt to $800. After repaying more than $1,400, she remains stuck in the revolving door of debt associated with payday lending. It’s stories like these that the Consumer Financial Protection Bureau aims to stop with new rules to regulate the payday loan industry. But those in the payday industry say Lisa should have simply known better. [More]

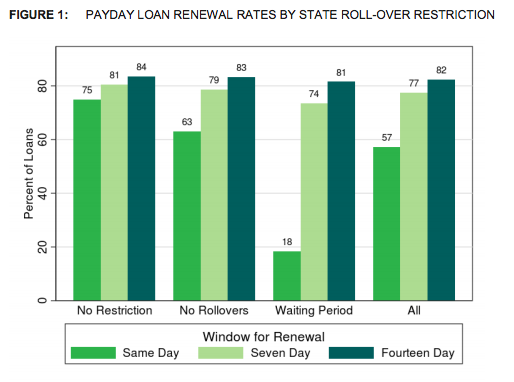

4 Out Of 5 Payday Loans Are Made To Consumers Caught In Debt Trap

The revolving door that is the payday lending debt trap is real. The high-interest, short-term loans may even be more damaging to consumers that previously thought. Four out of five payday loans are rolled over or renewed every 14 days by borrowers who end up paying more in fees than the amount of their original loan, a new Consumer Financial Protection Bureau report finds. [More]

Most Debt Collector Complaints Made By Consumers Being Hounded For Money They Don’t Owe

We’re not sure how many times we’ve said it, but it’s worth repeating: Debt collectors are the worst. It’s not just that they’re often rude and occasionally violate the law. What really puts collection agencies at the bottom of the barrel is the fact that they consistently go after debt that consumers simply don’t owe. [More]

States’ Attempts To Reform Payday Lending Are Often Just Smoke & Mirrors

Payday lending has been getting a makeover of sorts recently. A number of banks, including Wells Fargo, have discontinued their payday-like direct deposit advance programs after federal regulators tightened their guidance over the high-cost products. Now, a number of state legislatures are discussing payday lending reform bills, which they say will make short-term loans safer for consumers. But are they truly helpful to those who need them? Not quite, say consumer advocates. [More]

Prepaid Debit Cards: Salvation From Overdraft Fees Or Putting Your Money At Risk?

No overdraft penalties, no overspending and sometime low but occasionally ridiculous fees are all perks that have led consumers to an increased use of prepaid debit cards in the last year. And while the cards are convenient there are plenty of reasons consumers should by wary. [More]

CFPB Alleges Mortgage Insurer Operated 15-Year-Long Kickback Scheme

The Consumer Financial Protection Bureau has begun proceedings against PHH Corporation for its involvement in a 15-year-long mortgage insurance kickback scheme that collected hundreds of millions of dollars from homeowners. [More]

CFPB Outlines Common Sense Ways You Can Protect Yourself From Hacks

On the heels of yet another announcement of a consumer information hack, the Consumer Financial Protection Bureau has issued a consumer advisory to help consumers protect themselves and where to get help if they suspect their information has been compromised. [More]

New Rule Requiring Banks To Make Sure Borrowers Can Actually Repay Mortgages Goes Into Effect This Week

Want a mortgage? Go for it! But thanks to new rules from the Consumer Financial Protection Bureau, the banks are going to need some proof first that you can actually, you know, pay it back. [More]

CFPB: Many Of The 33 Million American Workers Eligible For Loan Forgiveness Aren’t Using It

Are you working in a job that serves other Americans — in a school, hospital, city hall perhaps — while living saddled with student loan debt? You could be part of the more than 33 million workers eligible to have student loans forgiven, a large number of which aren’t even aware they can do so. The Consumer Financial Protection Bureau says loan forgiveness program are too confusing for many to take advantage of, leading to a large number of wasted opportunities. [More]

Are Prepaid Cards Improving Or Are They Still A Confusing Mess Of Hidden Fees?

First, the good news: Our wiser, elder siblings at Consumer Reports have ranked the best and worst prepaid cards for the very first time, and it seems many cards have lower fees and act a lot like traditional bank accounts. But now for the bad news: Fee information can still be tricky to find and many cards don’t come with the guarantees you can get with a regular debit card. [More]