Report: Debt Collectors Now Using Court System To Unfairly Force Consumers To Pay Up

A new report [PDF] from the Center for Responsible Lending highlights how a lack of regulations over the debt buying and collection industries has become a billion dollar business while financially devastated consumers.

Nearly one in seven Americans are currently being pursued by a debt collector, but most of the debts being sought aren’t even owed. How can collectors be hounding consumer for debts that simply don’t exist anymore?

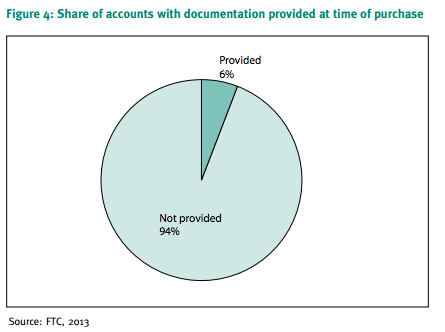

The situation occurs when a collector buys a debt from the original issuer, generally a bank, at rock-bottom prices. The purchaser then receives limited or inaccurate information about the consumer’s debt; often only a name, last known address and purported amount owed. In fact, in 2009 only 6% of debts purchased came with any documentation.

But a lack of information doesn’t stop collectors from making attempts to acquire payments from consumers. And that, according to consumer complaints received by the Federal Trade Commission, is when predatory and abusive practices begin. Complaints filed by consumers include the use of harassing phone calls, threats of arrest, obscene or abusive language, and unlawful threats to sue when attempts to collect are made.

When these, often illegal, tactics don’t work collectors more frequently turn to the justice system to sue consumers for their debts. Collectors then obtain default judgement in their favor when the consumer does not appear in court. CRL reports that consumers generally fail to show because they never received notice of the lawsuit, can’t afford legal representation, or simply don’t understand the need to appear.

Pursuing default judgements is becoming the norm for debt collectors. The report found that in 2011 nearly 80% of all default judgements in New York state were in debt-collection cases. In Minnesota, an estimated 2,400 default judgements were made per month in 2007. That same year, 60,699 cases out of 130,000 cases filed in Cook County, IL, were default judgements.

By receiving a default judgement, the collector can legally freeze a consumer’s bank account, garnish wages, report the judgement to a credit reporting agency, and pressure a consumer into a payment plan. In some states, collectors can even have a consumer arrested for lack of payment or seize personal property to satisfy the judgement.

Not surprisingly, the CRL report found that minorities, senior citizens and low- and middle-income communities experience a higher rate of debt buyer lawsuits and abuses.

Small-claims courts, that are often faced with hearing these cases, have been overwhelmed by the debt collection industry. Generally, these courts are not equipped to deal with the volume of cases and, as a result, are not run inefficiently. CRL found that cases aren’t given the attention they need, judges stubble to adequately handle all the cases and consumers are sometimes pressured into settlements.

CRL proposes that firmer oversight at both the federal and state level would ensure that debt collection happens fairly and responsibly. Recommendations include:

- Holding banks responsible for the debts they sell – Banks should be required to repurchase accounts that are not collectible due to insufficient documentation, be held accountable for their own practices, and retain liability for the debts they sell.

- Require banks to conduct more oversight of the debt sales process and of the debt buyers to whom they sell – Banking regulators should establish rules and guidance on the policies and practices that banks must follow if they are going to sell debt.

- Regulate the flow of information in the debt-collection market – Federal regulators should require increased and accurate documentation and information for each debt sold at the time of sale.

- Prohibit the initiation of collection efforts on any debt unless the debt buyer has the information necessary to substantiate and verify the debt being sought.

- Prohibit the sale, collection of, and lawsuits on time-barred debt.

- Prohibit the sale of certain accounts.

- Clarify and improve available remedies for harmed consumers.

Tighter regulations could be forthcoming from the Consumer Financial Protection Bureau.

In January 2013 , the Bureau’s larger participant rule for debt collection went into effect. Under the rule, the Bureau has supervisory authority over any firm with more than $10 million in annual receipts from consumer debt collection.

In November, the CFPB created the Advance Notice of Proposed Rulemaking, the first step toward considering consumer protection rules for the debt collection market.

While ANPR is an adequate start, consumer advocates say more can be done to ensure consumer protection.

Our colleagues at Consumers Union continue to urge the Bureau to write rules that achieve: sensible regulations that apply to all persons collecting debt and strong federal standards for information flow and verification procedures.

“The debt collection system has been long overdue for a comprehensive overhaul, to address current market realities and provide meaningful protections to consumers,” officials with Consumers Union posted on its DefendYourDollars blog last month. “By writing strong rules of the road at the federal level, the Bureau can help ensure that consumers across the country have basic important protections against improper collection practices.”

Debt Buyers Found to Routinely Scam Courts to Pursue Debts [Center for Responsible Lending]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.