Student loan borrowers have enough to worry about, so they shouldn’t have to deal with being hounded by so-called debt relief companies promising to provide consumers with repayment benefits that actually come free of charge with federal loans. Today, the Consumer Financial Protection Bureau took action to put a stop to two such relief scams that reaped millions of dollars from thousands of consumers. [More]

consumer financial protection bureau

Consumer Advocates Shine Spotlight On Too-Common Credit Reporting Errors

By now we know that credit reporting agencies are notoriously difficult to work with when it comes to fixing errors on one’s credit report. While legislators and consumers groups have long called upon credit reporting agencies to provide better service to disputing customers, little has been done to actually affect change. Now, advocates with Consumers Union are putting the spotlight on how devastating these errors can be for consumers. [More]

New DoD Protections Aim To Keep Shady Businesses From Taking Advantage of Military Members

Members of the military — particularly younger members from lower-income backgrounds — are too often the target of shady, predatory businesses looking to take advantage of their youth and inexperience with finances. The Military Lending Act offers some protections, but these operators find ways to get around the law. On Friday, the U.S. Dept. of Defense took steps to eliminate some of those exploitations by creating reforms to the current military discretionary allotment system. [More]

CFPB Proposes Rules To Protect Consumers From Shoddy Foreclosure Practices

Since the recession began in the late 2000s, many homeowners have struggled to keep their homes, often fighting off aggressive and shady foreclosure attempts. Over the years, consumers groups have fought to extend protections for these consumers. On Thursday, the Consumer Financial Protection Bureau took steps to ensure that homeowners and struggling borrowers are treated fairly by mortgage servicers. [More]

CFPB Orders ‘Buy-Here, Pay-Here’ Auto Dealer DriveTime To Pay $8M Penalty For Unfair Debt Collection Practices

For the first time in its existence the Consumer Financial Protection Bureau took action against a so-called “buy-here, pay-here” vehicle dealer, ordering the company to pay $8 million and fix its egregious ways. [More]

CFPB: Mortgage Lender Must Refund Consumers $730,000 for Steering Them Into Costlier Mortgages

Taking out an expensive loan is often the only option when it comes to financing a new home. And while most prospective home buyers might expect their mortgage lender to find them the best deal, that isn’t always the case. Take for example a California-based mortgage lender being ordered to provide $730,000 in consumer redress for an illegal compensation system that offered bonuses to employees for steering borrowers into higher interest loans. [More]

Treasury Dept. Urges Student Loan Servicers To Do A Better Job, Try Incentives

Hot of the heels of a report from the Consumer Financial Protection Bureau detailing how loan servicers trick consumers into paying more, top officials with the Department of Treasury implored the industry to fix their often nefarious ways. [More]

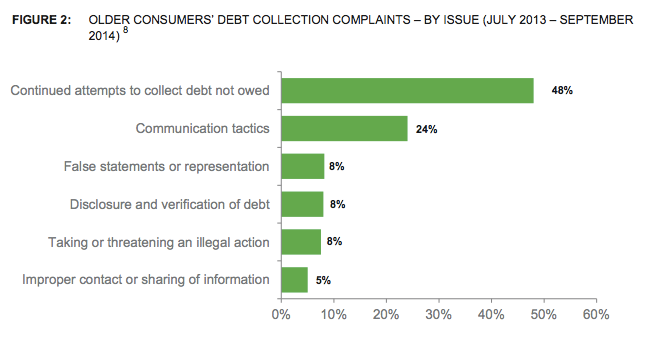

CFPB Finds Older Consumers Face Illegal, Harassing Tactics From Debt Collectors

As if we hadn’t said it enough, but debt collectors are the worst, especially when they use illegal tactics to pry money from older American’s living on fixed incomes. A new report from the Consumer Financial Protection Bureau shines light on the issues older consumers face when it comes to their financial well-being. [More]

Student Loan Servicers Tricked Borrowers Into Paying More, Made Illegal Collection Calls

As if student loan borrowers needed more bad news, the Consumer Financial Protection Bureau released a report this week detailing how some student loan servicers have tricked consumers into paying higher fees and misrepresented balances due. [More]

Banks Can Stop Wasting Stamps; Can Post Privacy Disclosures Online Instead

Customers of some banks may be receiving one less communication by mail following the Consumer Financial Protection Bureau’s finalization of a rule to promote more effective privacy disclosures. Translation: some banks can post their privacy notices online rather than slapping a stamp on them. [More]

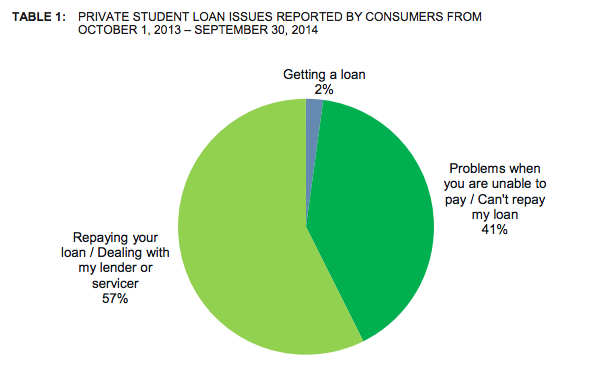

CFPB: Private Student Loan Companies Provide Few Options For Borrower, Driving Them To Default

By now we all know that for many consumers taking out private student loans is the only option when it comes to financing their higher education. We also know that many of those same borrowers will ultimately end up defaulting on their debt. A new report from the Consumer Financial Protection Bureau suggests that it’s not borrowers’ lack of willingness to repay that lands them further in debt, but a lack of resources provided by lenders that drives consumers to default. [More]

CFPB: Michigan Bank Must Pay $37.5M For Failure To Provide Consumers With Relief From Foreclosure

Consumers facing the prospect of losing their homes have few avenues of recourse and when even one of those options is taken away, the results can be devastating. That’s just one reason why the Consumer Financial Protection Bureau announced action – to the tune of a $37.5 million – against a Michigan bank for its illegal conduct in blocking borrowers’ attempts to save their homes. [More]

CFPB: Reverse Mortgages Still A Risky Financial Decision Despite Some Added Protections

The decision to take out a reverse mortgage should never be taken lightly, and the Consumer Financial Protection Bureau wants to make sure consumers are considering all of the perks and numerous pitfalls. [More]

CFPB Proposes Rule To Oversee Automakers’ Financial Units, Stop Discriminatory Lending

The lending arms for national car dealers, such as Ford and Toyota, may soon have to answer to federal regulators. The Consumer Financial Protection Bureau released a proposed rule that would give the agency oversight of automakers’ financing units in a step to prevent discrimination and other harmful practices – marking a move that was applauded by several consumer advocacy groups. [More]

Feds Sue Corinthian Colleges For Pushing More Than $560M In Predatory Loans On Students

Tens of thousands of students were duped by Corinthian Colleges Inc. into taking out costly predatory, and often financially devastating, private student loans to finance their post-secondary education, the Consumer Financial Protection Bureau alleges in a recently filed lawsuit against the large for-profit education company. [More]

CFPB Warns Consumers That Some Credit Card Companies Aren’t Disclosing Risks Of Promotional Offers

With a plethora of credit cards on the market, consumers may be drawn to companies and banks that offer the best promotion at any give time. While those deals might seem like a steal at first, the Consumer Financial Protection Bureau is concerned that companies aren’t clearly disclosing the costs and risks of those offers in a way that consumers can easily understand. [More]

CFPB: Company Should Pay $7M For Processing Illegal Fees For Debt-Relief Services

Charging up front for debt-relief services without any actual results for the customer is illegal. But despite that, says the Consumer Financial Protection Bureau, a payment processing company processed millions of dollars worth of illegal fees from consumers. [More]