Last summer, the Dept. of Education began the process of reviewing a new rule aimed at those educational institutions that failed to demonstrate their students could find gainful employment in the fields in which they had been trained. The for-profit college industry has managed to weaken the rule, but today more than 51 different groups — including advocates for consumers, veterans, and students — asked the President to help prevent this rule from becoming toothless. [More]

college

51 Groups Call On President To Not Let For-Profit Colleges Weaken “Gainful Employment” Rule

How To Not Suck… At Borrowing For College

(This is Part Two of a two-part feature on paying for an education. Last week’s HTNS column focused on the best way to save up for college.)

With the rising cost of college tuition, many families figure they’ll have to beg, borrow and steal to pay for the cost of higher education. If those are the only options available to you, we recommend borrowing. [More]

College Student Protests Tuition Hike By Paying With Singles

Like many schools around the country, tuition at the University of Utah has soared in the last decade. In-state students at this school are now paying more than double what students paid only a decade ago, with another 5% increase coming. In minor protest of these rate hikes, one Utah student chose to express his feelings by paying his tuition in singles. [More]

College Senior Hopes To Pay Off Student Loans By Selling Ads On Graduation Cap

A student at the University of Michigan-Flint looked into the crystal ball and saw visions of student loan debt. But what if he could figure out a way to pay off that pile of debt before he even enters the job market? And so the young man started a campaign to sell advertising space on the top of his graduation cap. [More]

How To Not Suck… At Saving For College

(This is Part One of a two-part feature on paying for an education. Part Two looks at the best way to borrow for college.)

Next to a home purchase, sending your kids to college may be the biggest expense of your lifetime. And like all things money, this one is easy to screw up. [More]

The 10 Colleges That Received The Biggest Payouts From Credit Card Issuers Last Year

Last year, a group of around 15 credit card issuers paid a total of more than $50 million to various schools and school-affiliated organizations in order to market credit cards to people at those educational institutions. Around 70% of that money came from a single Bank of America-owned credit card company, and though hundreds of schools received some sort of payment for helping introduce cards to college students, just the 10 largest single payments account for nearly 30% of the $50 million. [More]

71% Of Recent College Grads Owe Average Of $29K In Student Loans, Are Scared Pantsless About Paying It Off

The total of student loan debt in the U.S. has long since passed the $1 trillion mark, and a new report shows that this mountain of owed money is just going to keep getting bigger, while a recently released survey indicates just how terrified young adults are of folks’ ability to repay that debt. [More]

4 Things You Don’t Really Need To Pay For

We all have things that we refuse to pay for when there are free or super cheap alternatives. But while everyone knows that you can get canning jars and scratched furniture on Freecycle, did you know that there are ways to expand your knowledge, see brand-new movies, watch premium streaming video, and listen to audiobooks, all for free? And legally. The “legally” part is key. [More]

Busting The Myth That Fine-Arts Degrees Lead To The Poorhouse

There’s a widely held conception that people who earn degrees in the fine arts — painting, sculpture, dance, music, theater, among others — are throwing money away on a degree that can reap no long-term benefits. But the fact is that a fine-arts degree is no real hindrance to making a decent living in the real world. [More]

College Board & ACT Sued For Selling Personal Info Of Test-Takers

As anyone who took the ACT or SAT tests remembers, shortly after you get your scores, your mailbox is flooded with brochures, pamphlets, and catalogs from schools that want your tuition money. This isn’t a coincidence, as The College Board and ACT, Inc. — the companies behind these tests — sells test-takers’ information to colleges. But a new lawsuit alleges that this practice is a breach of contract as it’s done without the test-takers’ consent. [More]

California Sues For-Profit College Operator For Lying To Students & Investors

California Attorney General Kamala Harris filed suit yesterday against a company that operates three for-profit colleges, alleging that it lied both to students about the prospects of job-placement, but also to investors about the success rate of its graduates. The complaint also accuses the colleges of illegally using military seals in its ads to lure in members of the armed services. [More]

How To Not Suck… At First Year College Budgets

Welcome to “How To Not Suck,” a new, weekly series in which personal finance writer and consumer advocate Karin Price Mueller gives you the essential information to avoid being foolish with your finances. [More]

New Rules Could Hold Career Education Programs Accountable For Graduates’ Success

While college tuitions and student loan debt has skyrocketed, a number of institutions — especially for-profit schools — have been criticized for failing to provide sufficient education and guidance to students who are then stuck without jobs and without the ability to pay back student loans. Starting Monday morning, the Dept. of Education will begin hearing feedback on a recently drafted regulation that would hold schools accountable for the performance of their students in the real world. [More]

6 Costs College Students Can Probably Skip Before Heading To School

If they haven’t already, college-age kids are probably bombarding their parents with requests for all the dingles, dangles and doodads that seem to go along with heading off to school. But there are plenty of ways to cut costs and winnow out unnecessary add-ons because let’s face it, you’re just going to end up sending extra “grocery” (read: beer) money later anyway. Snip expenses while you can or it’ll be a long four years.* [More]

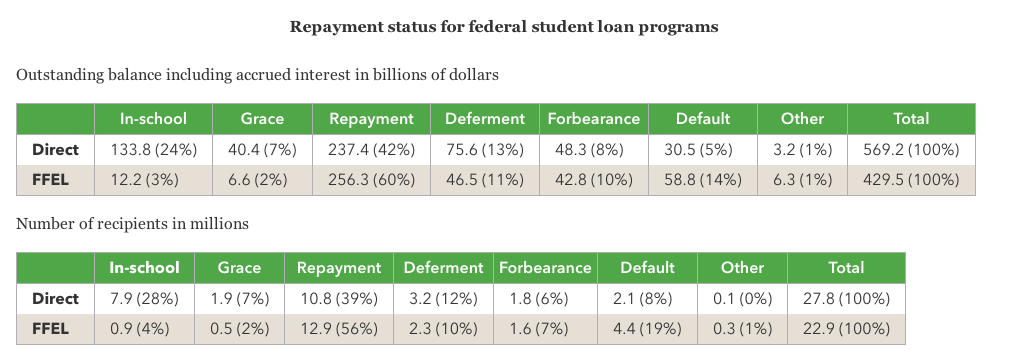

Fewer Than Half Of Federal Student Loans Currently Being Repaid

It’s scary enough to think that the federal government has around $1 trillion in student loan money out there waiting to be repaid. More frightening is the fact that not even half that amount is currently being paid back. [More]

Sen. Elizabeth Warren: It’s Obscene That The Govt. Profits Off Student Loans

There were several sticking points that bogged down the U.S. Senate from quickly passing legislation that would provide a long-term solution to the problem of interest rates on federal Stafford student loans. Among these was whether the government should be able to charge a rate that would allow it to make a profit. [More]

Senate Reaches Tentative Deal On Student Loan Interest Rates

One day after failing to move forward on a one-year extension of low interest rates on federal Stafford student loans, the U.S. Senate has reportedly reached a tentative agreement that tie interest rates to the 10-year Treasury bond, thus resulting in a moderate increase in interest rates for students taking out their first loan this fall. [More]

Senate Fails To Figure Out Solution To Keep Student Loan Rates In Check

As we mentioned before the holiday, the U.S. Senate had gone off to make sandcastles and enjoy fireworks without figuring out a way to keep interest rates on federal Stafford student loans from doubling. Now the first attempt to retroactively fix that problem has failed, with the Senate unable to move forward with a one-year extension on the lower rate. [More]