The college textbook racket is a cruel exploitation of a captive market, and book prices seem to rise faster than Google stock.

college

Jobless College Grad Sues To Get Tuition Back, Misspells "Tuition"

The job market is tough. No one seems to know it better than our nation’s fresh-faced recent college graduates. They’ve discovered a harsh truth—despite hounding alumni for donations, colleges aren’t able to find jobs for them. One recent college grad in New York City is fighting back, since she graduated three whole months ago and her alma mater hasn’t found her a job yet.

College Career Services Offices Can Help Mid-Career Professionals, Too

College career offices aren’t just for students and recent alumni. They’re also for mid-career professionals who want help with resume touchups, interview preparation, and meeting other alums. Best of all, the assistance is entirely free!

Students, That College I.D. Is A Universal Coupon

One great thing about being in college is everyone — including businesses — expects you to be poor. Thus, your student I.D. is good for a range of discounts, ranging from movies, restaurants, museums and sundry services. Wisconsin’s WSAW 7 cobbled together a list of 10 such targets.

../../../..//2009/07/03/robert-bowman-graduated-from-college/

Robert Bowman graduated from college and law school despite great adversity, and passed the New York bar exam on his fourth try. Now, the state bar association refuses to admit him because of his substantial student loan debt. You know, instead of letting him practice law so he can pay it off. Disturbing, and a cautionary tale: just because your student loan company isn’t sending you letters, that doesn’t mean they aren’t charging you fees. [New York Times]

FAFSA To Get Dramatically Shorter, Less Painful

The Department of Education has announced that the FAFSA, considered (by me) to suck worse than any form ever, is getting shorter and less painful. Most importantly for those of you who have procrastination-prone parents that just don’t enjoy filling out forms (me, again), the FAFSA will allow students applying for financial aid in the spring semester of 2010 to “seamlessly retrieve their relevant tax information from the IRS for easy completion.”

College Students: Before You Bog Yourself Down With Loans Fill Out A FAFSA To Snag Free Pell Grants

Exactly how much academic knowledge you glean from college is debatable, but the experience gives most people a thorough lesson of how to drown yourself in debt. But there is financial aid out there, some of it free, for those willing to look for it. This HowToDoThings post offers some helpful tips on how to sniff out federal Pell Grants by getting a Free Application for Federal Student Aid (FAFSA).

Save On Federal Student Loans July 1

If you have a bunch of variable rate Federal student loans, July 1st could be your lucky day. July 1st is when the interest rates on Federal student loans changes, and one financial id expert is predicting they’re going to drop to “historic lows.” What this means is you will have an opportunity to consolidate your variable rate Federal student loans together at the new, lower, rate, and save yourself some cash. How much?

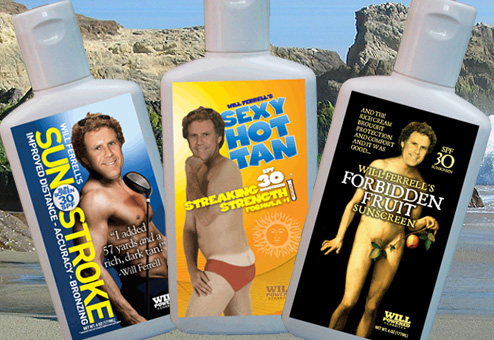

Will Ferrell Introduces Sunscreen For Men

Okay, maybe it’s not just for men, but you can’t help but feel studly when you look at the labels for these bottles of 30 SPF sunscreen. And yes, it’s real; apparently Ferrell is pulling a Paul Newman and selling Completely Random Products for charity. In this case, the proceeds go to a scholarship fund for cancer survivors.

Tax-Saving Moves For 14 Big Life Events

Life is full of surprises and challenges. Luckily, there’s a tax form for just about all of them. Via Kiplinger’s, here’s 14 major life events that allow for smart tax-saving moves, and how to make those moves.

../../../..//2009/05/29/consumer-reports-picks-top-529/

Consumer Reports picks top 529 plans. If you have a little spare cash to squirrel away for college, you’ve probably given some thought to those state-sponsored, tax-advantaged 529 plans. But with over 50 to choose from, where do you start? How about right here, with some tips from the Consumer Reports Money Lab. The blue-coated boffins picked their five fave funds, paying particular attention to those that offered “below-average fees and an investment strategy that was sufficiently aggressive in the early stages and appropriately conservative later on.” Oh, and parents, here’s another tip: You can usually change the beneficiary on a plan to another family member. So, if you were saving for Johnny and he goes deadbeat after high school, you can pass his cash along to Janie. Or just use it for yourself. Admit it: you always wanted to ditch it all and go to film school, right? [Consumer Reports Money Adviser]

Costly Private Loans Masquerade As Federal Student Loans

Some students who didn’t read the fine print are finding out too late that what they thought were federal student loans were actually private loans. The mistake is the difference between a 6% and 18% interest rate.

Five Money Lessons For New Grads That Everyone Should Follow

New graduates are about to walk smack into the Great Recession, and they need every bit of financial advice they can get. The Wall Street Journal has five excellent money tips that should apply not just to new graduates, but to everyone.

Big Shocker: Students Are Abusing Credit Cards

Sallie Mae‘s 2009 study of credit card use shows that students just love binging on plastic. Kids these days have more than four cards on average, and most of them carry a balance pushing $3,000. Many don’t tell their parents, and almost a fifth graduate with more than $7,000 of debt. This is how meltdowns start…

Save For College

Having a baby soon? Congrats! Now you can begin the 18-year process of saving for college (not to mention the even more costly option of paying for their upbringing.) Luckily for you, the New York Times has a simple formula that makes the saving process as painless as possible, requiring only small sacrifices (over a long period of time). They dub the approach “20-20-20” and it goes like this: