The Servicemembers Civil Relief Act (SCRA) is intended, in part, to help protect active-duty members of the armed forces from having their homes taken away by foreclosure, but as we’ve seen, this hasn’t stopped banks from ignoring the law and taking those houses anyway. Now comes a report that banks have recently uncovered hundreds of additional wrongful foreclosures on the homes of servicemembers. [More]

citi

Survey: Top Brands For Buzz In 2012 Were Subway, Amazon And… Cheerios?

When you think about popular fast food chains, Subway is certainly among them. And Amazon.com is without a doubt the leader in online retail. But apparently the U.S. brand with the third-best “buzz” from consumers in 2012 was a cereal we’ve all been eating since the dawn of time. [More]

Deadline For Foreclosed-Upon Homeowners To File Claim In National Mortgage Settlement Is This Friday

It took years to reach the $25 billion settlement between the nation’s largest lenders and 49 states, but affected homeowners were only given months to claim their piece of the pie. [More]

Bank Of America Dead Last In Customer Satisfaction Study

The folks at the American Customer Satisfaction Index have released their latest report on the banking industry and for the sixth year in a row, credit unions and small banks have outscored all the large financial institutions. And for the second consecutive year, Bank of America is bringing up the rear. [More]

Citi Has A Very Loose Definition Of “Expedited” When It Comes To Fixing Huge Holes In Roof

When a bank approves a short sale, you would think that it would do everything it can to not put that sale at risk, lest it lose even more money on the deal. But one pending short sale property in New Jersey has had holes in its roof for months because Citi thinks that not approving repairs to the roof is somehow a good idea. [More]

Citigroup Is Suddenly Without Its CEO And COO, After Both Abruptly Resign

With no specific reasons given, Citigroup CEO Vikram Pandit and Chief Operating Officer John Havens both resigned their positions this morning. [More]

Data Shows Bank Of America Is Also Bad At Dealing With Credit Card Complaints

Earlier this year, the Consumer Financial Protection Bureau launched a complaint portal for people with credit card-related issues. Banks and card companies are not obliged to provide a happy ending to the complainant, but they are obliged to reply in a timely manner. And even with the bar lowered that much, Bank of America still manages to disappoint. [More]

Study Says 800K Homeowners Should've Avoided Foreclosure But Big Banks Messed It All Up

Getting a mortgage modification has been hard enough for homeowners, what with disorganized big banks not having enough well-trained people on staff to deal with the necessary ins and outs of the process. But a new study says that things should’ve been easier under the Home Affordable Modification Program and resulted in 800,000 fewer foreclosures than we ended up with. [More]

Citi Has Some Very Strange Ideas On How I Plan To Spend My Extra Cash Points

Is there no limit to what banking rewards programs will cover these days? Flights, hotel rooms, rental cars, electronics, women. Wait — what? [More]

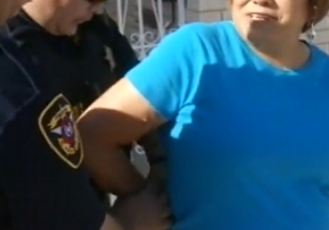

Woman Forcibly Removed From Home, In Spite Of Restraining Order Against Citibank

A woman in El Paso has been fighting foreclosure for several months, saying she was making payments and that Citibank was crediting them to an escrow account without telling her or explaining why. A federal court recently issued a temporary restraining order preventing the bank from foreclosing while the case is litigated, but that didn’t stop county constables from forcibly removing her from her home last week. [More]

Citi Decides Customers Want $5.95 Security Service, Check Off Box In Advance For Them

If there is anything Americans love, it’s when big banks make decisions for them. For example, some Citi customers recently looked at their credit card bills and noticed that the bank had already checked off the opt-in box for some sort of security service called “Watch-Guard Preferred” at the low, low price of $5.95/month. [More]

Citi Shareholders Sue Bank's Directors For Paying Executives Too Much

Earlier this week, the shareholders of Citigroup said “hell no!” to the notion of paying company CEO Vikram Pandit $15 million. Today, they took their anger a step further and filed a lawsuit in federal court, saying Citi execs should not be rewarded for doing a so-so job. [More]

Worst Company In America Sweet 16: Bank Of America Vs. Citi

A perennial Golden Poo favorite slips into a red, white and blue unitard and struts into the WCIA Rollerball arena to the strains of Hulk Hogan’s “Real American,” thinking this is the year they win it all… Well, not if a scrappy underdog from New York City has anything to say about it. [More]

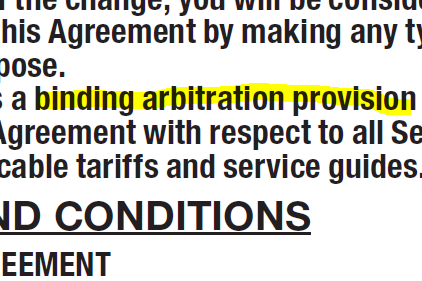

Which Worst Company Contenders Force Customers Into Mandatory Arbitration?

As we sifted through the mountain of nominations for this year’s Worst Company In America tournament, we noticed a trend of readers who cited companies’ mandatory binding arbitration clauses as a reason for nominating. And while it’s businesses like AT&T and Sony that have made all the headlines for effectively banning class action lawsuits, there are a lot of other WCIA contenders who are forcing customers into signing away their rights. [More]

Worst Company In America Round One: Wells Fargo Vs. Citi

Welcome to Day 2 of corporate carnage in the Worst Company In America Octagonal Steel Cage! Starting things off for today is another pair of bloodthirsty bankers out to prove they are just as astoundingly inept as any other business in the bracket. [More]

Here It Is, Your Lineup For Worst Company In America 2012!

Welcome to Consumerist’s 7th Annual Worst Company In America tournament, where the businesses you nominated face off for a title that none of them will publicly admit to wanting — but which all of them try their hardest to earn. So it’s time to fill in the brackets and start another office pool. That is, unless you work at one of the 32 companies competing in the tournament. [More]

$25 Billion Mortgage Settlement Is Just The First Step Toward Cleaning Up Mortgage Mess

There are a lot of good things about today’s $25 billion settlement between the five largest mortgage servicers, the Dept. of Justice and the attorneys general of 49 states. But in spite of the huge price tag on the deal — which could grow even larger if other lenders sign on — it’s only the beginning of cleaning up the aftermath of housing market collapse. [More]