Under the guidelines for the Troubled Asset Relief Program, which invested billions of taxpayer dollars in bailing out the nation’s banks and carmakers, executive pay is supposed to kept to reasonable levels. In the case of General Motors, it pledged to cap salaries at $500,000; not bad for a company that allowed nearly two dozen people to die rather than fix an ignition switch. But the TARP watchdog says that once again the Treasury Dept. has allowed GM to pay execs more than it agreed to. [More]

ally

Ally Bank To Pay $98 Million For Charging Higher Interest To Non-White Borrowers

Earlier today, the Justice Dept. and the Consumer Financial Protection Bureau announced the largest auto loan discrimination settlement in U.S. history with the news that Ally Bank has agreed to pay $98 million, including $80 million in refunds to settle allegations that it has been charging higher interest rates to minority borrowers of car loans. [More]

BofA’s Customers Don’t Hate Bank As Much As Non-Customers (But They Aren’t Happy)

It’s no secret that Bank of America is the most-reviled of the nation’s large banks, mostly for its handling of the mortgage mess, including the most recent allegations that it deliberately deceived troubled borrowers in order to nudge them toward foreclosure. But even though BofA’s customers gave it the lowest marks in a new survey of banks’ reputations, those customers don’t hate the bank anywhere near as much as people who have no financial ties to it. [More]

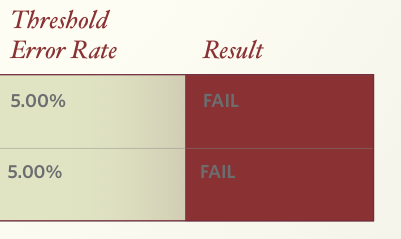

Big Banks Failing To Comply With All The Rules For National Mortgage Settlement

Remember that massive $25 billion settlement between the nation’s largest mortgage servicers — Bank of America, Wells Fargo, Chase, Citi, Ally — and attorneys general from around the nation? Well, it comes with a lot of rules for these institutions to follow. But the person in charge of monitoring the settlement says most of the banks are failing to comply fully. [More]

Report Rips Treasury Dept. For Giving Out Raises To Execs At Bailed-Out Companies

Today, the Special Inspector General for the Troubled Asset Relief Program released her report on 2012 compensation for executives at institutions that received TARP bail-out money, and well… the title — Treasury Continues Approving Excessive Pay for Top Executives at Bailed-Out Companies — is about as on-the-nose as it gets. [More]

Deadline For Foreclosed-Upon Homeowners To File Claim In National Mortgage Settlement Is This Friday

It took years to reach the $25 billion settlement between the nation’s largest lenders and 49 states, but affected homeowners were only given months to claim their piece of the pie. [More]

Treasury Freezes Compensation For Top AIG, Ally, GM Executives

While a majority of the American corporations that received “exceptional” bailout assistance form the Troubled Asset Relief Program, there are still three businesses — AIG, Ally Financial (you may know it by its pre-bust name of GMAC), and General Motors — remaining. Today, Treasury Dept. announced that the Acting Special Master for TARP Executive Compensation has determined that the top executives at this trio of companies will not get a pay raise in 2012. [More]

How Much Have The Big Banks Been Penalized Over Mortgage Mess And Where Is All That Cash Going?

The last few years have seen numerous settlements between the nation’s biggest mortgage lenders and various federal and state authorities. And while we hear numbers like “a total of $25 billion,” exactly which banks are responsible for the biggest chunks of these settlements? [More]

$25 Billion Mortgage Settlement Is Just The First Step Toward Cleaning Up Mortgage Mess

There are a lot of good things about today’s $25 billion settlement between the five largest mortgage servicers, the Dept. of Justice and the attorneys general of 49 states. But in spite of the huge price tag on the deal — which could grow even larger if other lenders sign on — it’s only the beginning of cleaning up the aftermath of housing market collapse. [More]

DOJ, 49 States Reach $25 Billion Settlement With Five Largest Lenders Over Robosigning

More than a year after several of the nation’s largest mortgage lenders temporarily suspended foreclosures after it was revealed that they had been using untrained, unqualified “robosigners” to process foreclosure documents, the U.S. Justice Dept. and the attorneys general of 49 states have announced a $25 billion settlement that will result in mortgage reductions to some homeowners. [More]

Big Banks Pinky-Swear To Overhaul Lending & Foreclosure Practices

Nearly a half-decade after the U.S. housing market collapsed like something that collapses really badly, the country’s five biggest mortgage providers — Bank of America, Chase, Wells Fargo, Citi and Ally — are oh-so-close to reaching a settlement with the states that could include overhauls to how they operate when it comes to the whole lending/servicing/foreclosing process. [More]

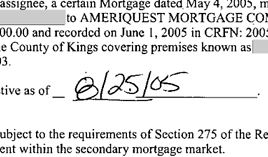

Paperwork Shows GMAC Created Fake Document To Foreclose On Property

Last summer, GMAC was looking to foreclose on a property here in Brooklyn. Only problem was, it didn’t have documentation proving that it actually owned the mortgage and the original lender, Ameriquest, couldn’t help because it had gone the way of the dodo a few years earlier. So what’s a mortgage servicer to do but fabricate the paperwork? [More]

Ally Bank Thinks My Fiancee Is A Scammer, Bans Me For Life

Is it a crime to get engaged to someone from another country? No, but it does raise red flags for wire fraud when you’re trying to transfer money. That’s what Robert learned when his Egyptian-born fiancée tried to deposit money into their wedding savings account that they share, but is in her name because she doesn’t yet have a Social Security number. [More]

GMAC Resumes Foreclosures; White House Warns Banks To Not Be Stupid

One month ago, GMAC/Ally was the first major mortgage lender to freeze foreclosures and foreclosure sales in about half the U.S.. But the day after Bank of America announced it was thawing its foreclosure freeze, GMAC followed suit. Meanwhile, the White House has warned all lenders that it will go after banks who are found to employ any of the tactics that got them into this mess in the first place. [More]

Texas AG Calls For Statewide Foreclosure Freeze

Hot on the heels of foreclosure and eviction freezes by GMAC/Ally, JPMorgan Chase and Bank of America, the Attorney General for the state of Texas has become the latest AG to request that loan servicing companies put a temporary halt to foreclosures. [More]

Ally Launches Free Online Checking

Online bank Ally has launched a new free online checking account that looks pretty decent. Free ATM access, free online bill pay, free checks, with no monthly minimum balance or maintenance fees. And get this, insufficient fund fees are only $9. That’s not per item, that’s just $9 for every day you are overdrawn. [More]

2.5% Online Savings Accounts At Ally Bank (The Rebirth Of Gmac)

Even though GMAC spun off from GM years ago, they recently changed their name to “Ally” in a re-branding, stain-of-association-removing effort. Their whole game seems to be a USAA for civilians, advertising “No minimum deposits. No fees. No min balance. No sneaky discalimers.” Ally Bank is also offering very juicy APYs, like 2.25% for an online savings account, more than double the national average…