Last year, a group of around 15 credit card issuers paid a total of more than $50 million to various schools and school-affiliated organizations in order to market credit cards to people at those educational institutions. Around 70% of that money came from a single Bank of America-owned credit card company, and though hundreds of schools received some sort of payment for helping introduce cards to college students, just the 10 largest single payments account for nearly 30% of the $50 million. [More]

cfpb

Ally Bank To Pay $98 Million For Charging Higher Interest To Non-White Borrowers

Earlier today, the Justice Dept. and the Consumer Financial Protection Bureau announced the largest auto loan discrimination settlement in U.S. history with the news that Ally Bank has agreed to pay $98 million, including $80 million in refunds to settle allegations that it has been charging higher interest rates to minority borrowers of car loans. [More]

CashCall Tries To Collect On Illegal Payday Loans, CFPB Says “Nice Try”

Collecting a debt from people who owe money is one thing. Collecting a debt from people who don’t legally owe because those loans should never have been written in the first place? That’s another problem altogether, and the Consumer Financial Protection Bureau is very upset with one company . [More]

CFPB Report Confirms That Banks & Credit Card Companies Are Taking Away Your Right To Sue

In 2011, the Supreme Court held that it was A-OK to not only hide a complicated forced-arbitration clause in a novel-length contract for a consumer product or service, but that it was also just peachy that such a clause stripped the consumer of his/her right to bind together with other affected customers in a class action. Since then, sellers of everything from cellphone service to video games have added these complicated clauses in an attempt to keep complaining consumers out of court and into the unfair arena of arbitration. Today, the Consumer Financial Protection Bureau issued its first report on forced arbitration, and the results are, sadly, not shocking. [More]

GE’s CareCredit To Refund $34.1 Million To Misled Consumers

CareCredit is a medical financing service operated by the folks at GE Capital. For almost all of its 4 million customers, CareCredit is a deferred interest loan, meaning cardholders who don’t pay off their balances in full by the end of the initial promotional period are hit with all of the interest that had been accruing during those months. That would be fine (and is quite common in retail credit cards), if the company hadn’t misled consumers into thinking CareCredit was an entirely interest-free product. [More]

CFPB Adds Oversight Of Largest Student Loan Servicing Companies

While many banks offer student loans, much of the servicing of that $1 trillion in loans is actually done by non-bank, third-party companies, some of which have been criticized for being difficult to deal with and having byzantine repayment rules. Today, the Consumer Financial Protection Bureau, which already oversees student loan servicing by large banks, issued a new rule giving the agency the authority to supervise certain non-bank servicers in an effort to further ensure borrowers are being treated fairly and to rein in abusive loan servicing practices. [More]

Payday Lender To Pay $19 Million For Robo-Signed Collections & Overcharged Servicemembers

Last week, the Consumer Financial Protection Bureau took a big step toward reining in irresponsible, predatory lenders by taking its first enforcement action against a large payday loan operation accused of robo-signing court documents related to debt-collection lawsuits, illegally overcharging military servicemembers and their families, and trying to cover these actions up by destroying documents before the CFPB could investigate. [More]

CFPB Looking Into “Confusing Rules” Of Credit Card Rewards Programs

As we mentioned earlier this week, credit card rewards programs can be overly complicated and come with rules and limits that drain their value. Now the Consumer Financial Protection Bureau says it is looking into these programs to determine if cardholders are being misled about the costs and benefits of these offers. [More]

Getting Ahead On Paying Down Student Loans Is A Good Plan, But Not Without Problems

For people looking to get out from under student loan debt before they have grandchildren, paying more than is owed each month has traditionally been an option. But according to a new report from the Consumer Financial Protection Bureau, questionable practices and a lack of transparency at loan servicing companies have resulted in prepayment causing undue headaches. [More]

Regulators Ask Banks To Not Be Jerks To Customers Affected By Shutdown

The shutdown of the federal government is now a week old, meaning a growing number of furloughed workers — and employees of businesses whose income depends on government contracts — are having trouble keeping up with their bills. In a joint statement today, five regulators have asked banks and other financial institutions to be mindful of customers who are directly impacted by the current staring contest. [More]

Consumers Saved $4 Billion In Credit Card Fees Last Year, But Fewer Have Access To Credit

It’s been four years since lawmakers passed the CARD Act, a massive set of reforms for the credit card industry. As a result, consumers have saved billions in fees and other charges, but access to credit has also become more difficult for some people. [More]

Chase To Pay $389 Million Over Illegal Charges For Credit-Monitoring Services

It’s not been a banner week for JPMorgan Chase, which has agreed to pay out nearly a billion dollars to close investigations related to the 2012 “London Whale” trading fiasco, and now is told it must pay out $309 million in refunds and $80 million in penalties over illegal credit card charges for ID and fraud-protection services customers never ordered. [More]

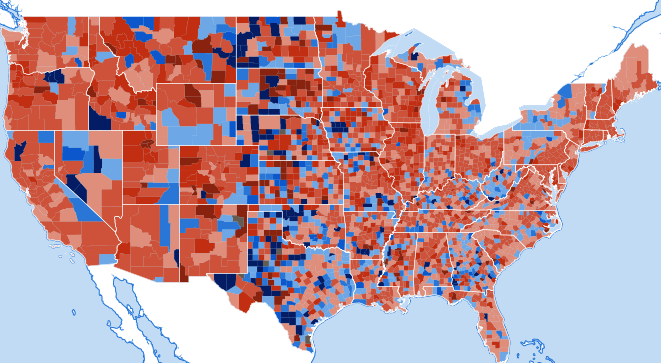

New CFPB Tool Provides County-By-County Snapshot Of Home Mortgages

We hear all the time about how national home sales are up, down, flat, bouncing like a rubber ball, or twirling like a ballerina, but we rarely get information that goes down to the local while also allowing you to instantly make comparisons to nationwide and regional trends. A new interactive tool from the Consumer Financial Protection Bureau aims to put that ability at your fingertips. [More]

Companies That Furnish Info For Credit Reports Are Obligated To Investigate Disputes

More than 1-in-4 credit reports contain some sort of error, according to a recent Federal Trade Commission report, but one can’t lay all the blame at the feet of the three major credit bureaus — Experian, TransUnion, Equifax — as the companies that supply this information are not always fulfilling their legal obligation to investigate disputes by consumers. [More]

CFPB: Many Of The 33 Million American Workers Eligible For Loan Forgiveness Aren’t Using It

Are you working in a job that serves other Americans — in a school, hospital, city hall perhaps — while living saddled with student loan debt? You could be part of the more than 33 million workers eligible to have student loans forgiven, a large number of which aren’t even aware they can do so. The Consumer Financial Protection Bureau says loan forgiveness program are too confusing for many to take advantage of, leading to a large number of wasted opportunities. [More]

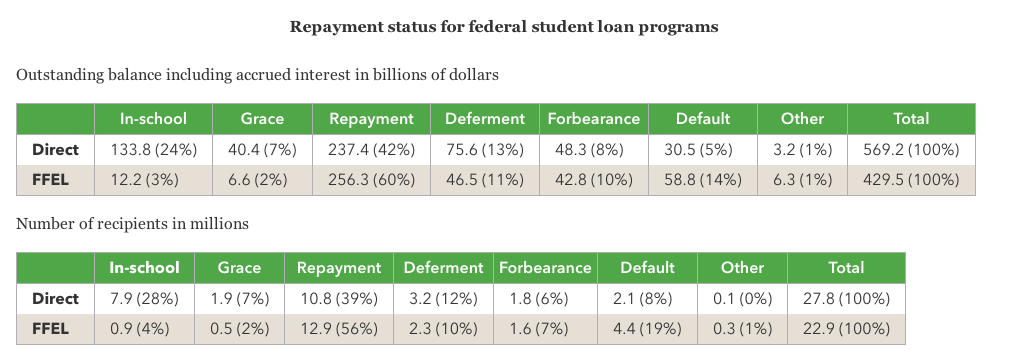

Fewer Than Half Of Federal Student Loans Currently Being Repaid

It’s scary enough to think that the federal government has around $1 trillion in student loan money out there waiting to be repaid. More frightening is the fact that not even half that amount is currently being paid back. [More]

Are Prepaid Cards Improving Or Are They Still A Confusing Mess Of Hidden Fees?

First, the good news: Our wiser, elder siblings at Consumer Reports have ranked the best and worst prepaid cards for the very first time, and it seems many cards have lower fees and act a lot like traditional bank accounts. But now for the bad news: Fee information can still be tricky to find and many cards don’t come with the guarantees you can get with a regular debit card. [More]