Pop the bubbly and take a deep breath of relief, Richard Cordray. The Senate finally reconfirmed Cordray today as the director of the Consumer Financial Protection Bureau, a post he’s held since the bureau’s creation in January 2012. It’s about dang time, as the vote had been idling along in light of a stalemate among some lawmakers who wanted changes to be made to the CFPB first before any nominee was even considered. [More]

cfpb

Survey Says: 74% Of Consumers Support Approving A CFPB Director

This week the Senate is preparing to vote on whether or not to confirm Richard Cordray as Director of the Consumer Financial Protection Bureau, something that’s not a shock considering he’s been overseeing the bureau for the entirety of its existence, since January 2012. And while there has been some pushback against his confirmation, a survey from the Consumer Reports National Research Center shows 74% of consumers support the approval of a director. [More]

CFPB: Bank Customers Leaking $225 In Overdraft Fees Per Year On Average

Why is your bank account leaking so much money ever year? Where does it all go? Checking account customers are bleeding funds to the tune of about $225 per year on average, the Consumer Financial Protection Bureau says in a new study. That means that despite regulations aimed at lessening the effects of overdraft fees and clear up the whole process. [More]

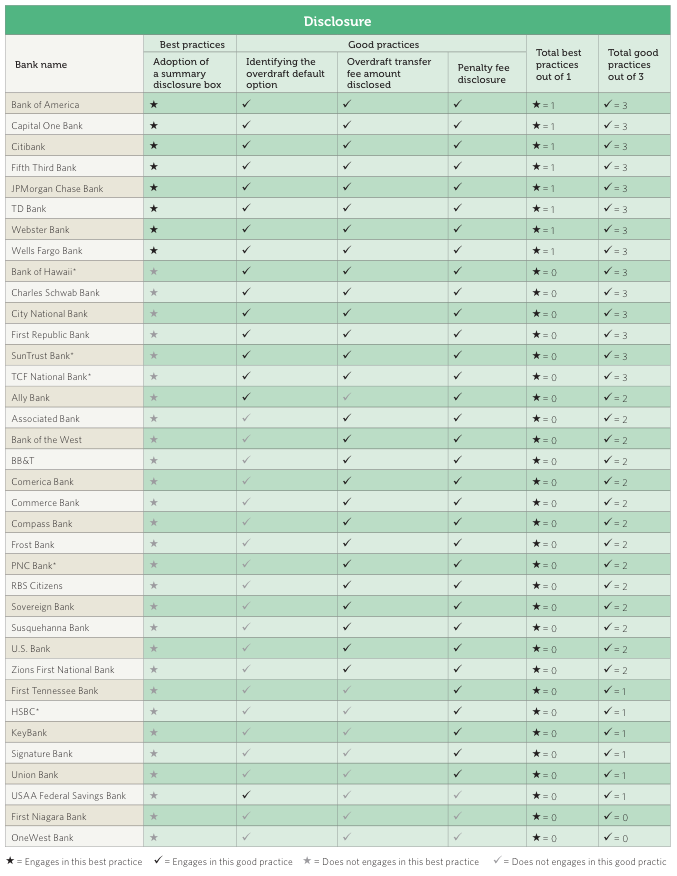

Consumer-Friendly Checking Account Practices Vary Wildly From Bank To Bank

Unless you’ve been hiding under a bed for the last six years, you probably know that the banking industry isn’t exactly beloved by many American consumers. As a reaction to public sentiment (and threats of regulation), a number of banks have begun phasing in some more consumer-friendly practices, but a new study shows these changes are not industry-wide and that several banks are still years behind. [More]

CFPB Student Loan Ombudsman Now Taking Questions On Reddit

In a series of posts on Consumerist, Rohit Chopra, the Consumer Financial Protection Bureau’s Student Loan Ombudsman, answered readers’ questions about comparing, paying for, and getting out from under student loans. If you missed it, or didn’t get your question answered, head on over to Reddit where Rohit is currently taking part in an Ask Me Anything session with readers. [More]

CFPB’s First Criminal Referral Leads To U.S. Indicting Debt-Repair Firm For Defrauding 1,200

In the first criminal referral from the Consumer Financial Protection Bureau, the U.S. is coming out swinging against a debt-settlement company in a new indictment. The firm has been charged with defrauding more than 1,200 people struggling with credit-card debt, with prosecutors saying the defendants “systematically exploited and defrauded” people around the U.S. [More]

Report Claims Payday Loans Result In Net Loss Of Money, Jobs

Among the reasons given in support of payday loans — short-term, high-interest loans intended to get the borrower through to the next paycheck — is that they ultimately provide a net good to the economy, allowing the borrower to keep spending and earning interest for the lender. But a recent report casts some doubt on that belief. [More]

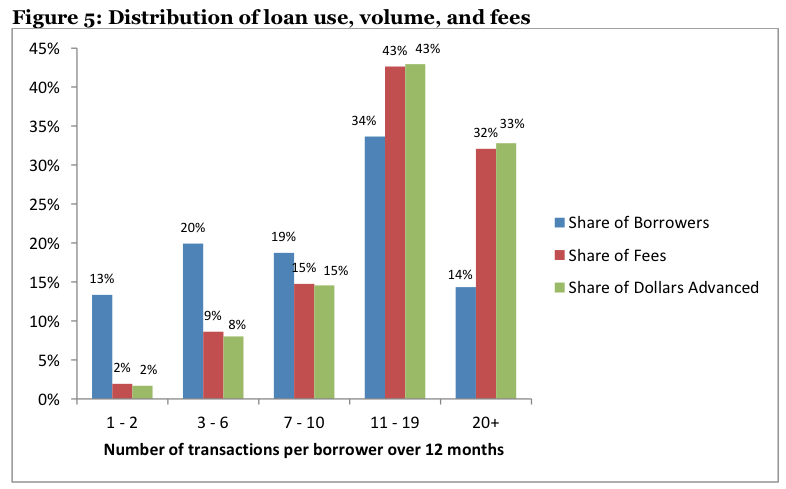

The Average Payday Loan Borrower Spends More Than Half The Year In Debt To Lender

The idea of the payday loan — a short-term, high-interest loan intended to help the borrower stay afloat until his next paycheck — is not inherently a bad notion. However, a new study confirms what we’ve been saying for years: That many payday borrowers are taking out loans they can’t pay back in the short-term, and that lenders rely on this revolving door format to keep the fees rolling in. [More]

The CFPB Answers Your Student Loan Questions, Part 3: Defaulting And Loan Forgiveness

In the second set of questions and answers about student loans, the Consumer Financial Protection Bureau’s Student Loan Ombudsman Rohit Chopra made a few mentions of the various service-specific loan forgiveness programs out there. Here, he gets into more detail and responds to questions about the one topic no one ever hopes to face: default. [More]

The CFPB Answers Your Student Loan Questions, Part 2: Repaying, Consolidating, Refinancing

Earlier today, Rohit Chopra, Student Loan Ombudsman for the Consumer Financial Protection Bureau, responded to questions from readers about applying for schools and comparing financial aid packages. In this second part, he deals with the many issues involved with repaying your student loans. [More]

The CFPB Answers Your Student Loan Questions, Part 1: For Prospective Students

A little while back, we asked Consumerist readers to send in their student loan-related questions to Rohit Chopra, the Consumer Financial Protection Bureau’s Student Loan Ombudsman. Today, we’re bringing you his answers in three parts, each dealing with a different aspect of the topic. Since it’s about time for next year’s freshman class to decide on schools and financial aid packages, we’re starting with answers for prospective students. [More]

Senate Panel Gives Thumbs-Up To Confirming CFPB Director Cordray

Consumer Financial Protection Bureau director Richard Cordray moved one step closer to sticking around as the young agency’s head this morning, with the Senate Banking Committee narrowly giving its approval to his confirmation. [More]

One Complaint To CFPB Fixes Mortgage Snafu That 9 Months Of Dealing With The Bank Couldn’t

As Consumer Financial Protection Bureau director Richard Cordray pointed out in his testimony before the Senate Banking Committee this morning, more than 130,000 American consumers have used the agency’s numerous complaint portals to help resolve their problems with financial institutions. Consumerist reader Charles is just one of those people who still has a house because the CFPB was able to accomplish in a few days what no one else could in almost a year. [More]

CFPB Director Cordray To Make His Case For Another Term Tomorrow

A little more than a year after taking the reins as the first Director of the Consumer Financial Protection Bureau, Richard Cordray will be appearing tomorrow before the Senate Banking Committee to answer questions and make his case for another term at the Bureau’s helm. [More]

Sen. Warren Asks Bank Regulators If “Too Big To Fail” Has Become “Too Big For Trial”

In her first hearing as a member of the Senate Banking Committee, Massachusetts Senator and longtime Consumerist favorite Elizabeth Warren grilled a panel of regulators on their tendency to settle with law-breaking banks rather than go to trial. [More]

This Valentine’s Day, Tell Congress You’d Really Love Access To A Free, Reliable Credit Score

While the three major credit bureaus each allow you to access your credit report once a year at no charge through annualcreditreport.com, getting your actual credit score will likely cost you some money. [More]

Send Us Your Questions For The CFPB’s Student Loan Ombudsman

In addition to the masses of consumers currently paying down their student loans, there are millions of Americans who are either about to pick a financial aid package for college or are just being hit with their first post-college loan payments. So we figured it was a good time to take some questions on the subject. [More]

Regulators Looking To Rein In Debt Collectors Who Use Facebook To Contact Consumers

Even though there’s a lengthy “no-no” list of things debt collectors can’t do, it makes no mention of how collections agencies can use social media. But that may be about to change as the Consumer Financial Protection Bureau gains oversight control over the largest members of the collections industry. [More]