People hate debt collectors, perhaps as much as, if not more than, they despise robocalls from telemarketers. And phantom debt collectors — those who attempt to collect debts that aren’t owed to them, if at all — are among the worst of the bunch. So when you combine the automated recorded messages of robocalls with the incessant harassment of phantom debt collectors, you create a particularly loathsome Frankenstein’s monster. [More]

cfpb

Will Congress Try To Kill The Consumer Financial Protection Bureau?

Since its creation as part of the 2010 Dodd-Frank financial reforms, the Consumer Financial Protection Bureau has been a target of pro-bank, anti-regulation lawmakers who contend that the agency lacks legislative oversight and puts too much authority in the hands of a single director. With the recent political power shift in the Senate and another presidential election on the horizon, some advocates are concerned that the anti-CFPB movement may take hold on Capitol Hill. [More]

In Wake Of Arbitration Report, Consumer Advocates Ask CFPB To Revoke Banks’ “License To Steal”

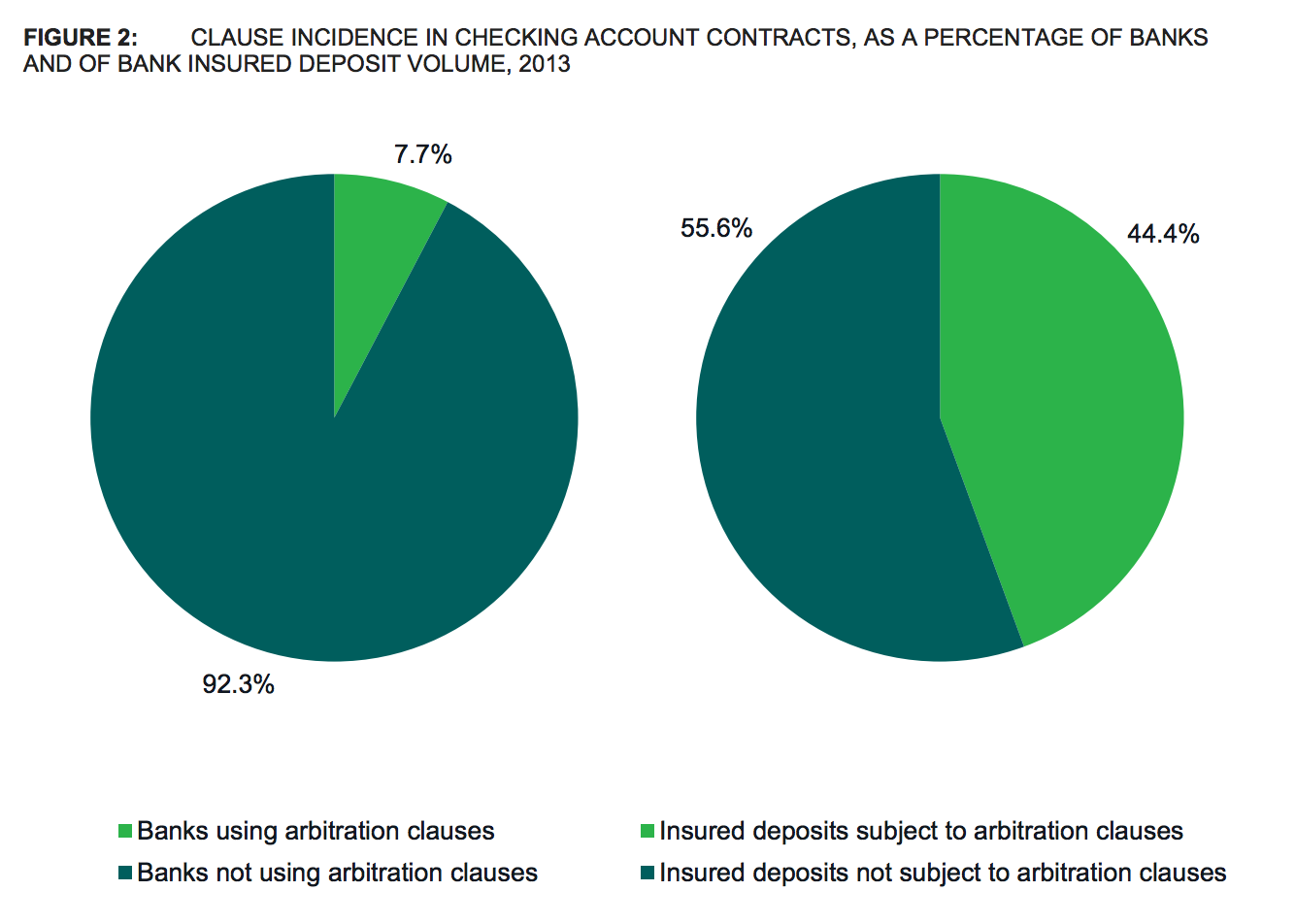

This morning, the Consumer Financial Protection Bureau released its final report on forced arbitration, showing how banks and credit card companies use contractual clauses to short-circuit class-action lawsuits from their customers. Now that the Bureau has done its research, consumer advocates are calling on regulators to use their authority to end the practice. [More]

Banks & Credit Card Companies Saving Millions By Taking Away Your Right To Sue

Tens of millions of American consumers have clauses in their credit card, checking account, student loan, and wireless phone contracts that take away their rights to sue those companies in a court of law, and more than 93% of these people have no idea they’ve had this right taken away from them. The companies involved are presumably quite happy about this lack of awareness, as it results in millions of dollars in savings that aren’t being passed on to you. [More]

CFPB Wants Better, Faster Database Of Credit Card Agreements

Much like a restaurant that has to shutter for a short time while installing new kitchen equipment, federal regulators occasionally have to press pause on an important process to fix things for the long haul. So in order to improve the Consumer Financial Protection Bureau’s public database of credit card agreements, the agency is planning to give banks a brief break from having to file those documents with the system. [More]

More Than 50M Consumers Have Free Access to Credit Scores, But Some Don’t Know What To Do With Them

Last year the Consumer Financial Protection Bureau began an initiative urging credit card issues to provide consumers with free credit scores on their monthly bills. Since then, a number of financial institutions have begun providing the information, leading more than 50 million consumers to have free and regular access to their scores. [More]

Wells Fargo, Chase To Pay $35.7M For Allowing Illegal Mortgage Kickbacks

Federal law prohibits giving or receiving kickbacks in exchange for a referral of business related to a real-estate-settlement service, but for four years a now-defunct title company in Maryland provide cash, marketing materials and consumer information in exchange for referrals. And now the banks have agreed to pay more than $35 million — including $11.1 million in redress to affected consumers — for their sins. [More]

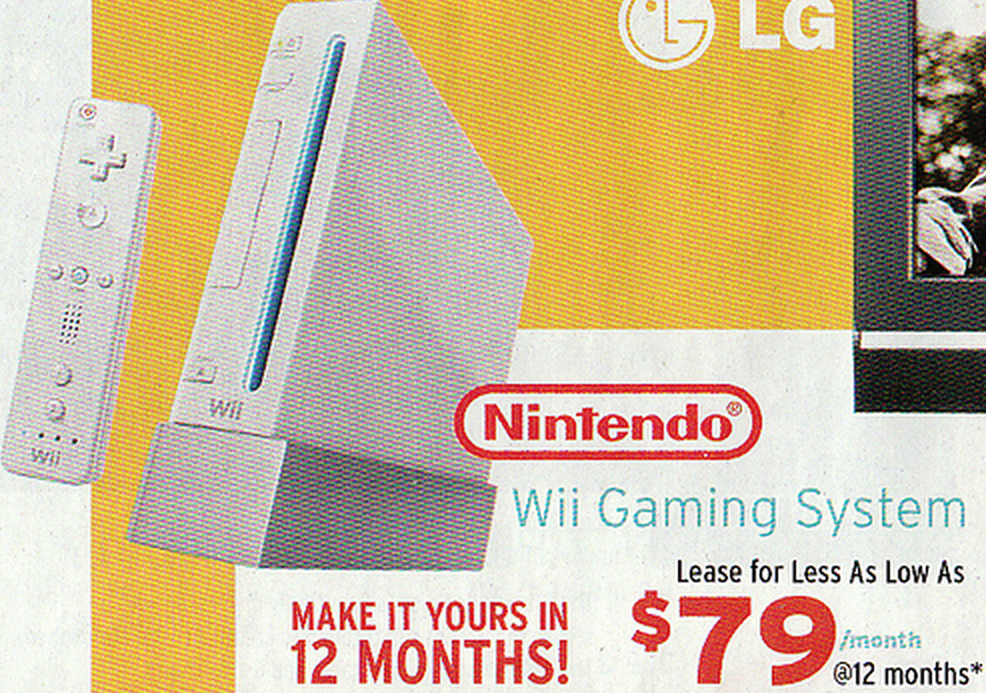

Senator Calls On Regulators To Take Closer Look At Rent-To-Own Stores

To people strapped for cash but looking to make a big-dollar purchase, the idea of financing that item through a rent-to-own store can be tempting. After all, most of us can afford $30/month, but not everyone has $900 on hand. But those monthly payments may go on for years, meaning you’ll pay double or triple the face-value of that purchase by the time you’re done. In the last decade, this rent-to-own model has become increasingly popular, especially among lower-income Americans. Now one U.S. Senator is asking federal regulators to keep a close eye on this retail industry. [More]

Protecting Military Servicemembers From Predatory Loans Is A National Security Issue

In recent years, we’ve written a number of stories about laws aimed at protecting active-duty servicemembers and their families from predatory loans and the businesses that try to take advantage of loopholes in these rules. Some readers have asked why members of our armed forces merit protections not available to civilians. But this isn’t about just doing something nice for our soldiers; it’s about removing a threat to national security. [More]

CFPB Lawsuit: Sprint Made Millions Off Consumers Acting As A “Breeding Ground” For Bill-Cramming

Just a day after rumors surfaced that Sprint could be facing a $105 million from the Federal Communications Commission for allegedly overcharging customers using a practice known as “bill-cramming,” the Consumer Financial Protection Bureau has filed a lawsuit against the carrier for the bogus charges placed on customer’s phone bills. [More]

New Requirement Aims To Curb Inaccurately Reported Medical Debt

Medical bills account for nearly half of all collections notices on consumers’ credit reports, affecting more than 43 million Americans. Meanwhile, it’s been shown that medical billing is fraught with errors and many consumers sent to collections for these debts are penalized too harshly. A new federal requirement hopes to reduce this overly negative impact of medical debt on credit reports. [More]

New Prepaid Debit Card Rules Would Add Protections, Curb Overdraft Abuse

A growing number of America’s unbanked and under-banked consumers have been turning to prepaid debit cards as an alternative to checking accounts. Between 2003 and 2012, the total amount of money deposited annually onto these cards increased from $1 billion to $65 billion, and that amount is expected to near $100 million for 2014. But those cards often come with hefty fees and lack protections of other financial products. The Consumer Financial Protection Bureau is looking to make prepaid cards safer and lest costly with a new slate of proposed rules. [More]

CFPB: Company Should Pay $7M For Processing Illegal Fees For Debt-Relief Services

Charging up front for debt-relief services without any actual results for the customer is illegal. But despite that, says the Consumer Financial Protection Bureau, a payment processing company processed millions of dollars worth of illegal fees from consumers. [More]

For-Profit Corinthian Colleges To Sell Off Campuses, Phase Out Programs

Corinthian Colleges, the company that operates for-profit education chains like WyoTech, Everest, Heald Colleges, and others has been the subject of both state and federal investigations that have kept it from opening up any new campuses. Today, Corinthian announced it’s working on a deal with the U.S. Dept. of Education that would keep its schools operating while it sells off a number of campuses and phases out others. [More]

GE Capital To Give Back $225 Million To Consumers For Bad Credit Card Practices

One of the nation’s largest credit card companies, GE Capital (which changed its name to Synchrony Bank a couple weeks back) has agreed to the largest credit card discrimination settlement in U.S. history and will fork over a total of $225 million in relief to around 750,000 consumers for illegal and discriminatory credit card practices. [More]

Bank Of America Ordered To Repay Consumers $727M For Sketchy Marketing Practices

Bank of America just received a hefty bill from the Consumer Financial Protection Bureau to repay $727 million to consumers wronged by the bank’s deceptive marketing practices regarding credit card add-on products. [More]

Bank Of America May Pay $800 Million For Questionable Credit Card Add-Ons

There’s another big legal bill on the horizon for Bank of America, as reports indicate the bank may soon agree to pay $800 million to settle allegations tied to sketchy add-on services for credit card customers. [More]