Residential Credit Solutions is a mortgage servicer specializing in delinquent loans and “credit-sensitive” (read: high-risk for default) residential mortgages. But after allegedly screwing over homeowners by, among other things, not honoring loan modifications on mortgages transferred from other servicers, RCS is on the hook to pay $1.5 million in restitution and a $100,000 penalty to federal regulators. [More]

cfpb

Western Union-Owned Mortgage Company Must Return $33.4M To Customers

A mortgage payment company owned by Western Union has agreed to return $33.4 million to consumers following allegations that it misled customers into thinking they could save thousands of dollars on their home loans. [More]

Appeals Court Revives Texas Bank’s Lawsuit Challenging Constitutionality Of CFPB

This week, the Consumer Financial Protection Bureau celebrates its fourth anniversary of protecting consumers from harmful practices and shady characters in the financial sector. But instead of buying the regulatory arm a big ol’ birthday cake, a federal appeals court is gifting the Bureau with a revived lawsuit challenging its constitutionality. [More]

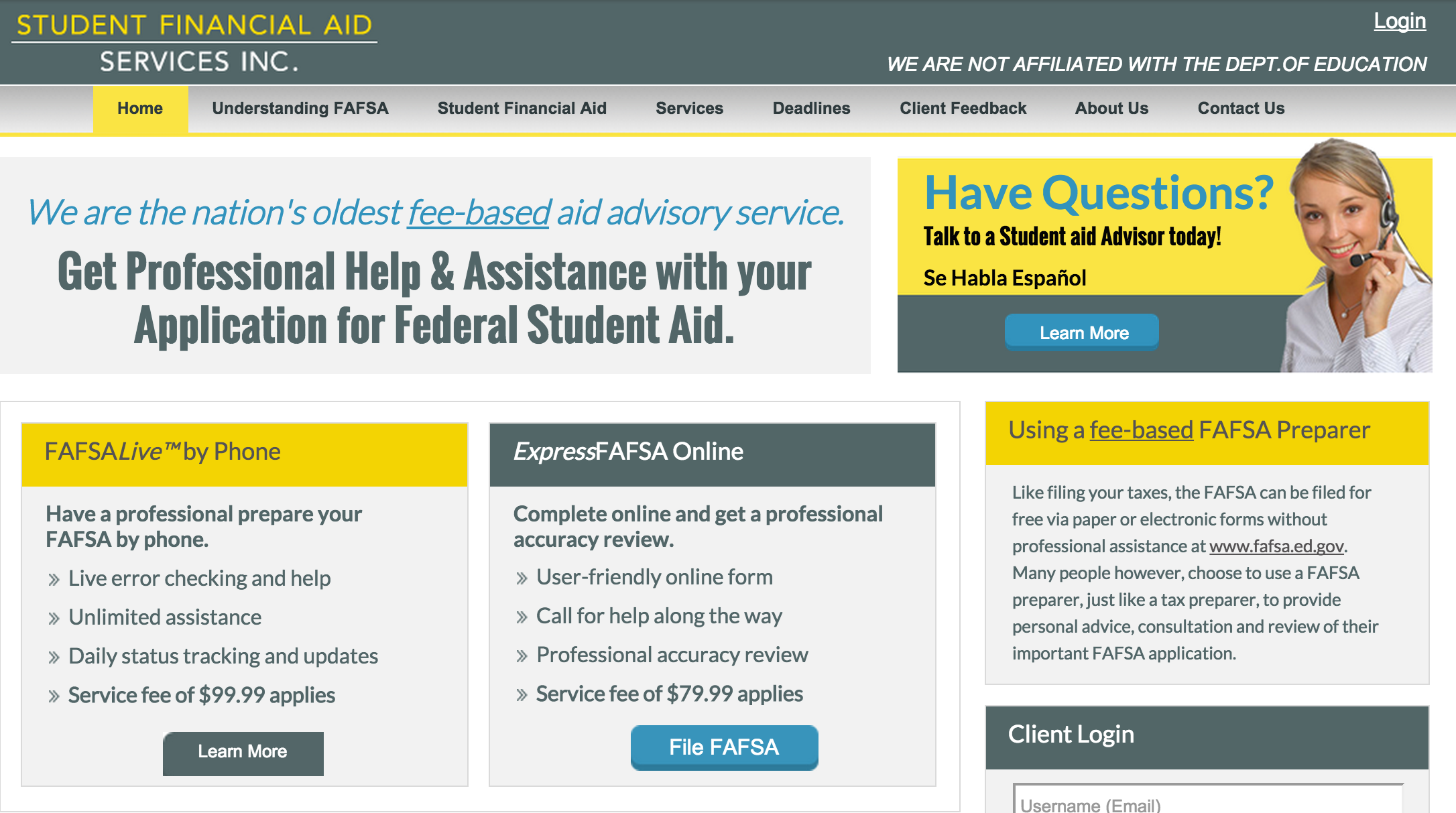

Former Operator Of FAFSA.com Penalized $5.2M For Illegal Billing

Five years ago, we told readers looking to fill out the Free Application for Federal Student Aid (FAFSA) to steer clear of FAFSA.com, as it was not the official Dept. of Education site for the FAFSA. Today, federal regulators announced a $5.2 million settlement with the company behind the now-defunct website for illegal billing practices. [More]

Citibank Must Pay $700M Over Illegal Marketing, Collection Practices

The Consumer Financial Protection Bureau ordered Citibank and one of its subsidiaries to pay $700 million in relief to more than 8.8 million consumers for engaging in a string of illegal credit card practices, including deceptively marketing and billing for debt protection and credit monitoring services, and misrepresenting fees related to debt collection actions. [More]

Chase Credit Card Settlement Halts Collections On 528,000 Accounts

Earlier today, we told you of reports that JPMorgan Chase had agreed to pay at least $125 million to close the books on state and federal investigations into its credit card collections practices. Now that the details of the deal have been made public, we know exactly how much the bank will pay and how many credit card accounts are affected. [More]

![JPMorgan Chase To Pay $136M To Close Credit Card Debt Collection Probes [UPDATED]](../../../../consumermediallc.files.wordpress.com/2014/09/chasecard.png)

JPMorgan Chase To Pay $136M To Close Credit Card Debt Collection Probes [UPDATED]

UPDATE: The Consumer Financial Protection Bureau has released the details of the settlement, which put the total value at $136 million, $106 million of which will go to the 47 states (and Washington, D.C.) involved in the investigations. [More]

Military Personnel Face Student Loan Issues Despite Required Protections

The Servicemembers Civil Relief Act (SCRA) provides a number of protections for military personnel and their families when it comes to private and federal student loans. While these benefits aim to alleviate the burden servicemembers face when paying back their educational debts, a new report from the Consumer Financial Protection Bureau shows that many student loan servicers continuously fail to uphold their end of the SCRA requirements. [More]

CFPB Asks Google, Bing & Yahoo To Help Stop Student Loan Debt Scams That Imply Affiliation With Feds

The Internet is teeming with scammers, fraudsters, and hustlers determined to part consumers from their money, and as a $1.2 trillion venture, student loans often present an attractive avenue for these ne’er-do-wells. In order to better protect individuals from such schemes, the Consumer Financial Protection Bureau is enlisting the help of the country’s major search engines. [More]

CFPB To Oversee Non-Bank Auto Financing Companies

While some folks get their car loans from the bank or credit union, many Americans finance their vehicle purchases through non-bank entities, including auto dealers. But until now, the federal Consumer Financial Protection Bureau only had regulatory authority on car loans issued by financial institutions. A new rule from the CFPB will soon give the agency oversight of the nation’s largest non-bank auto finance operations. [More]

CFPB Fines Mortgage Company $20M For Pushing Customers Into Spending More Than They Had To

While a report earlier this year suggested that consumers don’t spend nearly enough time shopping for the right mortgage, that doesn’t mean lenders are off the hook for purposefully steering potential homeowners into costlier mortgages. Because doing so will land a company in hot water with federal regulators. Just ask RPM Mortgage and its top executive, who must now pay $20 million for their allegedly deceptive practices. [More]

Forcing McDonald’s Workers To Accept Wages On Debit Cards Not Okay In PA, Says Judge

Two years ago, a Pennsylvania woman sued her former employers at McDonald’s because they forced her and other workers to accept their wages on fee-laden prepaid debit cards. Though the fast food franchisee, who runs 16 McDonald’s, later changed this policy, the lawsuit continued to move forward, and last week a judge ruled against the franchisee’s claims that the debit card requirement was completely legal. [More]

CFPB Wants To Hear Your Comments On Student Loan Servicing Practices

Outstanding student loan debt now totals more than $1.2 trillion in the U.S., and it’s only going to grow as college tuitions continue to outpace inflation. Meanwhile, student loan servicers aren’t exactly making it easy for borrowers to pay down that debt with confusing and inconsistent policies and an apparent reluctance to work with troubled borrowers. In an effort to see if the repayment process can be made less byzantine, the Consumer Financial Protection Bureau is asking for you to share your thoughts on the state of student loan servicing. [More]

Legislators Once Again Trying To Delay New Lending Protections For Military Personnel

The Department of Defense is trying to do something good for servicemembers by closing loopholes in the Military Lending Act that can leave military personnel vulnerable to predatory lenders. But these safeguards are now the target of a Congressman who has received substantial campaign contributions from payday lenders. [More]

Verizon, Sprint To Pay $158 Million To Settle Wireless Bill-Cramming Allegations

Several months after AT&T and T-Mobile reached multimillion-dollar settlements with federal regulators to close the books on allegations of bill-cramming — illegal, unauthorized third-party charges for services like premium text message subscriptions — both Sprint and Verizon have also decided to pay the regulatory piper. Combined, the two wireless companies will pay $158 million to settle cramming claims with the FCC and the Consumer Financial Protection Bureau. [More]

House Panel Strikes Provision That Would Delay Added Military Lending Act Protections

Yesterday we reported that Congress would make a decision whether or not it would intervene to slow the Department of Defense’s work to create new rules aimed at closing loopholes in the Military Lending Act that often leave military personnel vulnerable to predatory financial operations. Thankfully, legislators saw the need for more protections regarding military lending and determined the rules could go into effect as planned. [More]

Congress May Delay Predatory Lending Protection For Military Personnel

The Military Lending Act prevents military personnel from being caught in revolving debt traps of triple-digit interest loans from predatory financing operations like payday and auto-title lenders, but there are loopholes that allow some lenders to get around the MLA’s 36% APR interest rate cap, resulting in the loss of millions of dollars to servicemembers each year and raising issues of national security. The Dept. of Defense is currently working toward new rules that would add protections for military personnel, but Congress may intervene to slow the DoD from making progress. [More]