Only the capriciousness of youth or a devoted avoidance of the realities of life could explain why someone would decide against insuring a $430,000 vehicle. The 22-year-old driver of a Lamborghini Aventador apparently believed no harm could ever befall his precious vehicle, which is the only reason we can think why he would skip insuring it. Paying a high price for such a car is apparently no biggie, but a $568 ticket? That is ridiculous. [More]

car insurance

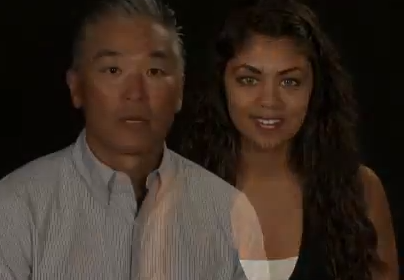

Ads For Controversial Car Insurance Initiative Feature “Real People” From PR Company Hired To Promote Measure

Voters in California will soon say yay or nay to Prop 33, a ballot measure that would change the way auto insurance rates are calculated. Ads for the initiative feature real consumers talking about the money they would save on car insurance if Prop 33 were to pass. But what’s not mentioned in those ads is the fact that some of these people work for the PR company hired to promote the measure. [More]

Progressive Provides More Details On Controversial Lawsuit

Earlier this week, the brother of a woman killed in a car crash made headlines around the world by claiming that his sister’s insurance company, Progressive, had actually come to the legal defense of the driver accused of causing the fatal accident. Since then, the insurance company has stated that it was not defending the other driver, but only defending itself in the lawsuit — a distinction the brother found wanting. Today, the insurer says it has reached a settlement with the family and is attempting to clarify matters further by explaining why its lawyers ended up on the other side of courtroom. [More]

Progressive Denies Defending Driver Who Killed Policyholder In Crash

UPDATE: The victim’s brother has issued a rebuttal to Progressive’s statement. It has been added to the bottom of the post.

—

Yesterday, the brother of a woman who died in a car crash made headlines when he wrote that lawyers for his late sister’s insurance company, Progressive, had acted as the defense counsel for the driver accused of causing the accident. At the time, we had asked the insurer to clarify its actual involvement in the case, but it only offered a vague “our hearts go out”-type statement. But now Progressive is flat-out denying it came to the defense of the at-fault driver. [More]

Why Would The Victim's Insurance Company Defend The Other Driver In A Fatal Car Accident?

After Woman Dies In Car Crash, Brother Says Her Insurance Company Defended Other Driver In Court

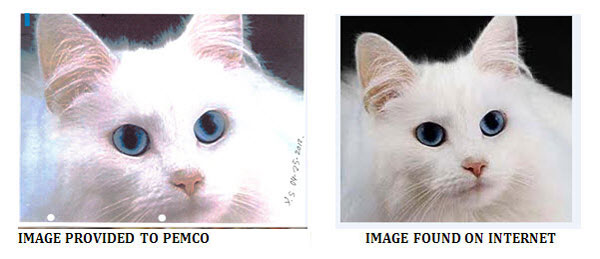

Man Allegedly Commits Insurance Fraud With Fake Dead Cat

Back in March 2009, a customer of PEMCO insurance was in a minor car accident, and the company paid out $3,452 for damages to the other driver’s car. Simple enough. No injuries were reported, and no pets in the car. Which is why it caught some PEMCO employees’ attention when the other driver filed a claim two and a half years later, seeking $20,000 for the death of his cat, Tom. The animal was “like a son” to him, he claimed. But “Tom” only existed as photos of someone else’s cats, readily available on the Internet. The state of Washington has charged the man with felony insurance fraud. [More]

State Farm Will Believe You Hit A Deer When You Serve Them Venison Steaks

Sean hit a deer with his car a few weeks ago. We believe him, but his insurer, State Farm, doesn’t. It’s not like the deer, which disappeared into the woods, is going to stop by his agent’s office and testify. So they were going to use his collision coverage, which would result in an increase in his premiums or even cancellation for daring to use the comprehensive policy that he was paying for. But Sean is a lawyer, and he fought back. [More]

Travelers Refuses To Believe Dad Is Dead, Sends Him Check For Mom’s Totaled Car

Charoo’s father is dead. Unfortunately, his name is still on the title of the car that he once owned, now driven by Charoo’s mom. She was in a car accident and the vehicle was totaled. Fine, just cut the lady a check so she can get a new car. Except the title was still in the name of both members of the couple, and the check has both of their names on it. Travelers refuses to issue a check to only Charoo’s mom, even with a death certificate and other documentation. Meanwhile, the bank refused to accept a check made out to a dead man. [More]

Beware "Vanishing Deductibles" In Car Insurance

Some insurance agencies are enticing customers by offering “vanishing deductibles” on car insurance policies. Purportedly meant to encourage safe driving, the plans take, say, $100 off customers’ deductibles for each year they don’t file a claim. For example, if a customer’s deductible starts off at $500 and five years pass without a claim being filed, the deductible vanishes completely and the customer doesn’t have to pay anything when he finally files a claim. [More]

Owning A Smaller, Cheaper Car Doesn't Necessarily Mean You'll Pay Less For Insurance

Thinking you’ve scored a great deal by buying a smaller, cheaper car might not be entirely correct, as one report indicates owners of such vehicles might end up paying more in insurance than some of their fellow drivers. [More]

Drive Through Hoops To Save Money On Insurance

Of all the regular costs that dog car owners, liability insurance is among the cruelest. You only get the best rates if you never file claims, so careful drivers end up subsidizing the costs incurred by reckless ones. The best drivers can hope for is to find the lowest rate by shopping around and taking advantage of every discount. [More]

How Removing Your Late Spouse From A Car Insurance Policy Raises Your Premiums

Statistically, married people are safer drivers than unmarried people, and car insurance premiums vary accordingly One of the things that Dan had to take care of after his wife died was taking her off the car insurance policy. While the GEICO employee he spoke to was very kind and helpful, his new premium caught him by surprise. Removing his wife from the policy didn’t cut it in half: it raised it by ten percent. [More]

Farmers Insurance 'Totals' Dog After Car Accident

Sasha, a 9-year-old Lab mix in Colorado, was hit by a minivan while walking her human last week. She survived the accident with damage to her liver, lungs, and diaphragm that may require surgery. While her person clearly considers her a family member, the law and the driver’s insurance company see things differently. Injuries to dogs are property damage, and the company “totaled” out the dog. They did not haul her off to a dog junkyard to be used for parts. [More]

Car Insurance Companies Keep Calling With Rate Quotes I Never Asked For

James thinks that he might be the victim of a scam. Or a prank. Something strange is going on, with fraudulent credit card charges and phone calls from car insurance companies that he never requested. He’s not sure whether the two things are even related, or what they could mean. [More]

Does The Hertz Claims Department Really Exist?

Have you ever tried to reach the “claims department” of Hertz? Mark was in a car accident with a Hertz customer, and isn’t able to get hold of anyone. Either this department is grossly understaffed, or it doesn’t exist. [More]

Insurance Companies Data Mine Your Death

Everything from what magazines you buy to how much television you watch could be used by insurance companies to determine whether you’re a risky client or not, and when you might die. [More]

How Is A Dump Truck Crashing Into My Parked Car My Fault?

Somewhere in upstate New York, a mysterious dump truck rolled down a hill, hitting Jennifer’s partner’s vehicle and one other car. While it’s wonderful that no one was hurt, now the incident has turned into a consumer issue. The truck owner’s insurance company doesn’t want to accept fault for the incident, leaving Jennifer’s partner to file a claim against his own meager insurance. How, she wonders, can they fight back? [More]