Reuters wandered around a few Walmarts in Illinois and California and asked shoppers how they were feeling about the groceries they were buying:

budgets

Surviving On 99-Cent-Store Food For A Week In NYC

Henry Alford of the New York Times writes that sometimes he will “plop a can of chicken broth down on the checkout counter and think, ‘$2.19? For someone to boil chicken bones? I want that job,'” so he decided to try going a week with food from 99 cent stores in New York City.

../../../..//2008/03/21/laundry-detergent-is-expensive/

Laundry detergent is expensive. One “debt free” blogger has taken the time to mark up a detergent cap to show you how much product you’re probably wasting with every load. [No Credit Needed] (Thanks to J.C.!)

Break The PayDay Loan Death Cycle

Are you trapped in a payday loan death cycle, or have a friend or family member who is? See, the problem with a payday loan is that some people aren’t able to pay the first one off (if you don’t have money in the first place, you’re not going to be any better off two weeks later!), and then have to take out more and more loans to cover each loan they couldn’t pay off. Not only is there high interest, there’s fees. A former PayDay loan lender on personalbudgettraining.com shares his advice for breaking out of the debt trap.

If you can’t get out of this right now, start by advancing $50 less per pay period. Take the difference of what you were paying us in fees and start paying it into an emergency fund. Grab a job delivering pizzas, babysitting, whatever, and pay it into an emergency fund. Borrow less and less from us. Use the EF for actual emergencies. Once you are out of this, don’t get back into it.

Earn more, borrow less, and pay off more.

6 Ways To Save Money When Dining Out

RacerX at “Life, Liberty and the Pursuit of Money” has posted the 6 ways he and his wife save money when they go out to eat. Following all of them would make for a noticeably different experience at your favorite restaurant—perhaps more than you’d like. But even adopting a couple of these tips could knock 10% or more off your next fancy meal with the significant other.

Dell Closing All U.S. Dell Direct Kiosks, Effective Immediately

There was a rumor going around since last night that Dell was shuttering its 140 mall kiosks nationwide in another wave of belt-tightening. Now it’s official: “Dell Inc. will close its 140 kiosks in the U.S. as the computer maker is changing its retail strategy to sales in partnering stores.

Supermarket Trick: Wait One Month Before Using Coupons

Trent at the Simple Dollar describes the “one month coupon strategy”—a cool trick that lets you line up coupons with in-store sales for massive discounts. Set aside grocery coupons for a month, then go through and select the ones you’re interested in. Bring them to the store and you’ll find that many of them are for products that are now on sale. On Trent’s last visit to the supermarket, approximately 40% of the coupons matched on-sale products—in the most extreme example, he was able to purchase some ice cream for 19 cents.

Recession Fears Bring "Mass Luxury Movement" To An End

The aspirational upper-middle-class customer who helped companies like Coach and Saks post double-digit growth in the past few years has disappeared due to the current rotten economy, writes BusinessWeek. The result: luxury goods companies that expanded their product lines to appeal to the not-quite-rich now have $150 purses and nobody to buy them. Coach went so far as to offer coupons recently “to drum up sales.”

Create A Virtual Piggy Bank For "Spare Change" From Debit Card Transactions

Consumerism Commentary wants you to “put your savings in hyperdrive.” Funny, we thought that’s what we already did, which is why our savings raced light years away from our bank account. But Flexo, in his series of posts this week on how to save, uses a more grounded definition of “hyperdrive” and offers suggestions like opening a high yield savings account, saving your spare change (or the contemporary equivalent of spare change if you pay with a debit card), and automating your savings. Yes, these are simple suggestions, but that’s what makes them easy to remember and easy to implement.

Are The New Apple Products Worth Buying?

The dirty-sounding finance blog “Make Your Nut” works through the pros and cons of the latest Apple products, so that you can “make sure you enter into your purchases with eyes wide open.”

2 More Stupid Financial Mistakes Sasha Made In 2007

Here they are, the final two mistakes in Sasha’s top-five screw-ups over at Consumerism Commentary. Mistake #4, “Failing to Balance Rental Property Income with Deductible Expenses,” is a bit specialized, although it contains a good lesson that can be applied to other situations. It’s the final entry, however, that applies to pretty much everyone (we’ve suffered from it ourselves in the past): “Failing to Remain Competitive Within My Field.”

3 Stupid Financial Mistakes Sasha Made In 2007

Sasha over at Consumerism Commentary is actually working on a list of five stupid mistakes from last year, but she’s uploading them one at a time and we’re getting tired of waiting. We’ll post a quicklink or something to the remaining two in a few days. Anyway, here are mistakes one through three, another person’s financial self-flogging in public for your edification, or grim enjoyment.

Finance Website Buxfer Lets You Store Sensitive Data On Your Own Computer

With its new Google Gears functionality, Buxfer might finally be the answer for people who want the bells and whistles of an online personal finance website (hello Mint!)—charts, pretty colors, and general infoporn goodness—without having to blindly trust an unknown company with sensitive data such as bank account or credit card numbers (goodbye Mint!). The service uses Google Gears to store account login information and credentials on your own computer, then syncs the data collected with the Buxfer servers, writes VentureBeat.

The Best Personal Finance Ideas Of The Year

Nothing say Christmas like a list, so here’s another one. Here are some of the best personal finance ideas blogged this year, chosen by Mrs. Micah: Finance for a Freelance Life. Her top pick is the “debt snowflake” from the blog PaidTwice—it describes the act of finding lots of little ways to supplement your standard income, so that you can add mass to your “debt snowball” to make it more effective.

Save So You Can Splurge

Here’s how reader Andy Alt saves his money while still rewarding himself:

Roughly 65% of the money I make goes directly to a savings account (the other 35% goes to rent, health insurance, cell phone bills, gas, auto insurance & food). After I take care of the necessities, I tell myself that for every $10,000 I save (usually takes 2-3 months) I allow myself to buy something cool that I want around the $1000 range. Since summer, I bought a Macbook with 4GB ram, a 1966 Fender Pro Reverb amp and am ready to make another purchase (perhaps a scooter or used motorcycle) once I hit my mark again.

../../../..//2007/12/06/how-to-calculate-compound-growth/

How to calculate compound growth in Excel using the RATE function. [AllFinancialMatters]

Saving Money The Lazy Way

If you’re like approximately 25% of the writers at The Consumerist, then prolonged talk of budgeting makes your eyes glaze over with boredom as you imagine yourself somewhere else doing something fun, like playing a video game or looking at pornography. Here, then, is a list of 10 so-called “easy” ways to save money, none of which require that you read a book or finally open that Quicken box your parents bought you two years ago. Many (or most) of the ideas may be of dubious value, but nobody said being lazy was profitable.

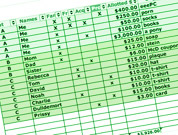

Use A Spreadsheet To Plan Your Gifts

This professor of finance proposes you take all the fun out of wildly overspending on last-minute gifts for friends and family, and replace it with the measured, predictable joy of a spreadsheet. However, if you follow his advice, the odds will be much better that you’ll end the year with healthier checking and credit card accounts.