VISA is blanketing Argentina with a new ad in which a shopper named Hernan is turned into “HER-NAN,” like HE-MAN, imbued with the powers of Castle Greyskull. You don’t need to know Spanish to experience the awesomeness, but we also have a translation. [More]

banks

Old-School Personal Loans Make A Comeback

Out of the soil of the post-apocalyptic credit graveyard shoots the skeletal hand of a forgotten lending practice. Banks are once again busting out “personal loans” to help finance what might otherwise be just out of reach for consumers. Here’s how they work: [More]

When Automatic Payments Won't Stop

Here’s what you need to do when a vendor won’t stop billing your bank account automatically after you ask them to quit it. [More]

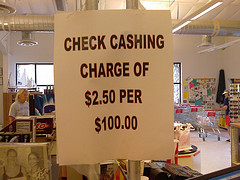

Reporter Lives For Month Without A Bank, Fee Orgy Ensues

As an experiment, an AP reporter tried to live for a month without using a bank so she could get a taste of how people who can’t get an account, or choose not to, live. She discovered fees and confusion galore, and found that it would end up costing her $1,100 a year just to spend her own money. That’s not even counting the cost of standing in “Soviet-style” lines in grungy check-cashing places to cash her paycheck alongside the great unwashed, and unbanked. Overall, depressing, anxious, and time-consuming experience [More]

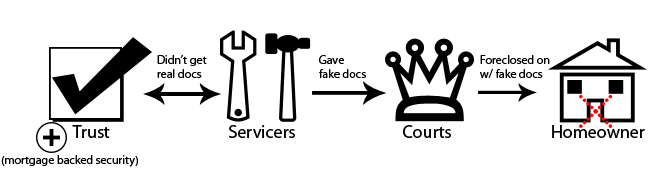

How The Current Foreclosure Fraud Crisis Works

A simplified way to understand how the current foreclosure fraud crisis got started. It all became unwound when a foreclosure mill “robo signer” admitted in a deposition to signing more than 10,000 affidavits in one day, little lies on slips of paper that got people thrown out of their houses. [More]

Check Fraud Leads To Kafkaesque Nightmare For Wachovia Customer

What do you do when you have tried every possible tactic you can think of to resolve a situation, and you can still make no progress? Michael, a 20-year Wachovia customer, now finds himself in just this situation with the bank. No one at Wachovia has the power to straighten out his customer service nightmare that began when someone forged a check on his account back in June. [More]

"Rogue Trader" Gets 3 Years, $6.7B Fine

The “rogue trader” who cost his former employer, French bank Société Générale, $7.1 billion through a series of high-stakes bets that leveraged fictitious transactions outside his trading limit was sentenced today to 3 years in prison and a “symbolic” $6.7 billion fine. [More]

Bank Of America Freezes All Foreclosures In 23 States

Bank of America announced Friday that it was halting foreclosures in each and every case that hadn’t gone to judgement. They became the third major bank to put the brakes on foreclosures after revelations that document processing firms were allegedly forging papers and signatures on a massive scale. [More]

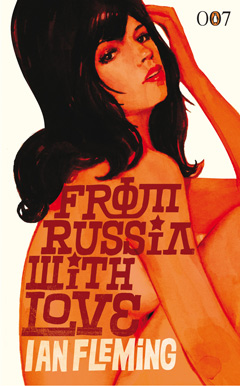

Russian Hotties Collared In $3M Bank Hack Scam

Several comely young Russian woman were snagged by the feds in New York yesterday for allegedly working as money mules for hackers who stole over $3 mil from American bank accounts using trojan viruses. [More]

JPMorgan Chase Suspends 56,000 Foreclosures

JPMorgan became the second major lender after GMAC/Ally Bank to halt pending foreclosures, halting proceedings on 56,000 homes. This follows revelations that “robo-signer” “foreclosure mills” were filing paperwork that would be gracious to call “sloppy,” at the rate of 10,000 a day. [More]

Interactive Graph Of Bank Failures Like Watching Nuclear Impact Zones

The one joy of WSJ’s otherwise mirthless interactive graph showing bank failures across the country from Jan ’08 to present is that when you slide the time scroller back and forth, it looks like, as Marketplace’s Paddy Hirsch just tweeted, looks like a series of nuclear impact zones. [More]

Chase Forecloses On Family With Son Crippled By Rare Genetic Disorder

A family whose son has debilitating cerebral adrenoleukodystrophy got foreclosed on by Chase, just days after they were told their loan modification was approved. [More]

Chase Approves Transaction Anyway After Customer Declines Overdraft Protection

Paul opted not to sign up for Chase’s overdraft fee trap–oh wait, they call it “protection”–but Chase happily ignored this fact and approved a transaction anyway, which led to a $34 overdraft fee that they refuse to reverse. The loophole they’re using to get around Paul’s opt-out is that the vendor was someone he’d authorized in the past, and therefore this new transaction isn’t protected from the bank’s “protection” fee. [More]

Colleges Reap Big Bucks Selling Student Addresses To Credit Card Companies

Colleges are making bucket-loads of cash selling their alumni mailing lists to credit card companies. In some cases, they’re even getting a cut on every credit-card purchase or debit-card transaction a student makes. [More]

SmartyPig Slices Interest Rate To 1.75%

SmartyPig just cut the interest rate on its online savings accounts from an ahead of the pack 2.15% to 1.75%, unless you have $50,000 or more in your account. [More]

BofA Forecloses On Man's House, Even Though He Has No Mortgage

Bank of America stole Jason’s house from him, putting it through foreclosure even though he has no mortgage, with them or anyone, and he paid for it in cash. [More]

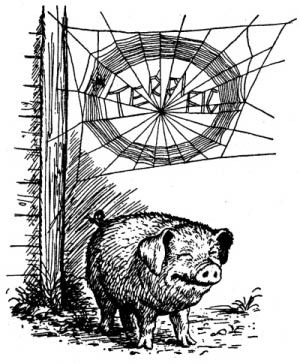

North Dakota Court Says Bank Can Rob Customer Of $12K In Overdraft Fees

If you live in North Dakota and find yourself buried in overdraft fees, don’t go crying to the state’s Supreme Court. Judges ruled that a bank was within its rights to stick a hog farmer with $12,000 in overdraft charges. [More]