It seems Wells Fargo has an employee whose actual name is “Dispute Representative.” Or at least so it would appear by the letter he received in his response to his request to have an erroneous item removed from his credit report. Guess the guy found his perfect job. [More]

banks

Strapped To A "Rocket Docket" Built For Max Foreclosure Speed

Florida has special high-velocity courts presided over by retired judges that process foreclosures at the rate of 25 per hour. That’s potentially one evicted family every 2.4 minutes. Rolling Stone reporter Matt Taibbi sat in on one of these “rocket dockets” to show what goes on, marveling at the shoddy and fraudulent paperwork the banks are cramming through the courts. [More]

Man Lets House Go Into Foreclosure Over $25 Fee

I think this qualifies as cutting off your face to spite your nose.

UPDATE: It seems our reader may have the last laugh, letting the house go into foreclosure, then buying it back at a discount.

TD Bank Charges Non-Customers 6% Fee For Coin Counting

Sad day. TD Bank’s coin counter machines used to be free to all, but within the past month they’ve changed it so now non-customers will get levied a 6% transaction fee. [More]

Banks Concocting New Ways To Spy On You

Feel the hair on your neck rising? Your bank is watching, with greater scrutiny then ever before. Banks are figuring out new scores and models to figure out your credit worthiness, using everything from how you deposit and withdraw money to how you pay your rent. [More]

Foreclosures Drop 9% Over Fudged Paperwork Fallout

For the first time in a long while, foreclosures actually dropped in October, falling 9%. The big drop came about as several big banks halted foreclosures across the board after news about the robo signers began to emerge. Foreclosures are expected to pick back up again November, albeit at a softened pace. It may be 3-4 months before the rate fully resumes. So take a gasp, homeowners behind on your mortgage, you just caught a temporary break. [More]

Squatters Spoil Dream Home With Fake Deed Claims

A Seattle couple were 10 days from closing on their new house when they discovered squatters had moved in who claimed they had seized “free land.” [More]

Landlord Says He Never Got My Rent, Can I Get My Money Order Back?

Marty sent his rent in by money order and the landlord says he never got it. Marty is trying to get his money from the money order back, but is finding out that it’s not the same thing as a check. [More]

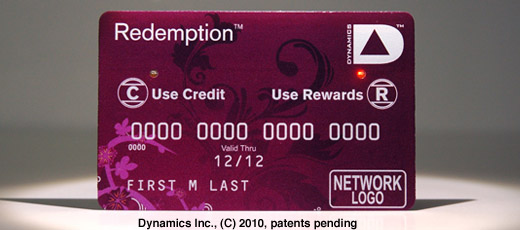

Credit Card Lets You Choose Paying By Credit Or Rewards Points

Would you like to pay with reward points, or credit? Just press the button on your credit card and a microcomputer rewrites the information on the magnetic strip, letting you switch payment types. A tiny light lets you know which one is active. That’s a new kind of credit card, the “2G,” Citibank is testing out starting next month. [More]

Oops We Lost Your Docs So You're Going To Foreclosure

After Alexis’s employer started making her and other workers taking mandatory furlough days, her income dropped so much that she had trouble making mortgage payments. So, like many others, she sought a loan mod. She followed all of Bank of America’s instructions and thought she was on the path to getting a mod. Then BoA told her they were going to foreclose on her house. [More]

Consumer Lawyers Drawn to Foreclosure-Fighting Bootcamp On Remote Farm

A growing band of consumer lawyers have been pilgrimaging to a farm located in the depths of the North Carolina mountains to learn the secrets of fighting foreclosures by exploiting lenders’ flawed document trail. [More]

Understand The Essential Players In The Foreclosure Scandal

Having trouble keeping track of all the different players and abbreviations and names in the latest foreclosure fraud mess? ProPublica offers a handy primer. [More]

Free Checking Accounts Heading The Way Of The Dodo

For much of the last decade, more and more banks had been offering checking accounts with no monthly fees or minimum balance requirements. But a new study from BankRate.com shows that this trend appears to have ended. [More]

Chase Sends Me Updates On Bank Account I Don't Have

Consumerist reader Jesse has recently started receiving account balances and deposit info via e-mail for a bank account with Chase. This would be wonderful and helpful — if Jesse had an account with Chase. [More]

Pick A Bank That Won't Screw You

Shopping for a bank but don’t want to get dinged with fees or unfair practices, but not totally sure you know what they all are? Those banks can be darn creative, after all. Here’s a great online guide that takes you step by step through all the practices you should watch out for. Complete the worksheet and you’ll have a good idea of whether you should stash your cash there or not. [More]

How The Looming Mortgage Bond Scandal Could Dwarf The Foreclosure Fraud Crisis

If you thought the fake doc foreclosure fraud crisis is bad, wait till you get a load of what could happen once people start looking at the pending mortgage bond meltdown. Reuters blogger Felix Salmon dug into the documents and he says it looks like banks have been lying to investors about the quality all this time. [More]

AGs In Every State Open Joint Foreclosure Investigations

On the heels of a massive fraudulent foreclosure document scandal, Attorneys General in all fifty states opened a joint investigation into home foreclosures, pledging to halt any and all wrongful practices at mortgage companies and banks. [More]

Delusional Thieves Caught Stealing Entire Mansions

A ring of confused folk in Georgia are stealing entire million-dollar homes, deeding themselves the property with bogus paperwork and squatting inside. [More]