Now that free checking is dead at each of the four major retail banks, is there any where you can go to just have a simple checking account without paying a bunch of fees? Yup, look at your smaller local bank or credit union, or think about an online checking account, reports American Banker. Unlike the big banks that have such dominant market presence that they don’t need to compete on price, just who has more ATMs, the scrappier outfits are going to to use free checking as a competitive advantage and a way to get people in the door so they can try to upsell them to other banking products and services. [More]

banks

17.45% Of Florida Homes Are Vacant

The latest Census Bureau results show that 17.45% of homes in Florida are vacant. That’s 1.558 million houses sitting there soaking up the sun. Florida’s housing bubble was one of the hottest and now their vacancy rate is the highest. [More]

Visa Letting People Send Money By Credit Card Could Be Boon For Scammers

Visa is launching a new service that will let people send each other money from their Visa or bank account to each other’s Visa debit, credit or prepaid card, as we noted yesterday. But while this will open up new vistas of convenience, and offer a way for people who are sick of scammers exploiting Paypal’s refund system to conduct transactions, I would at the same time expect to see new kinds of advance fee fraud using the service. [More]

Crooks Rob ATM Users With Glue Guns

No, they’re not pointing them into people’s backs and saying, “gimmie all your money,” but The San Francisco Examiner reports thieves using glue guns to rob ATM users are pulling off a “stickup” of another sort. [More]

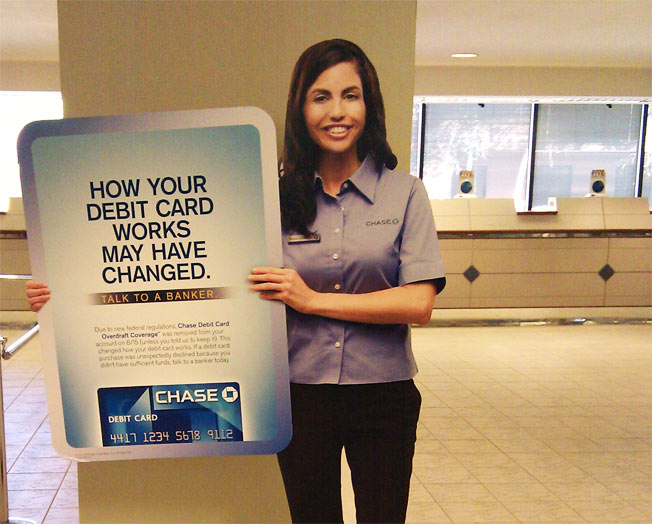

Chase Tests Out $5 ATM Fees

Banks are continuing to amp up the threat of making consumers pay for the price of increased regulation. Chase is testing out charging non-customers in Illinois $5 for withdrawal fees. In Texas, they’re trying a $4 charge on for size. Consumer advocates say its a scare tactic meant to muddy up Congressional waters, but banking experts disagree. “I think customers have taken for granted the cost of banks’ infrastructure,” says Margaret Kane, president and CEO of Kane Bank Services told ABC News. “ATMs are very expensive to install and maintain.” [More]

Homeowner Turns SUV Into Anti-BofA Collage

A homeowner has affixed their SUV with a creative anti-Bank of America collage and slogans on posterboard and parked it outside a BofA branch in Austin, Texas. Reader Jeff is at the SXSW festival and sent in this picture he snapped of the scene. The driver of the car apparently has a loan with Bank of America and is accusing them of “fraud” though I can’t decipher from the medley of images what kind they had in mind. Nice pirate flag, though. [More]

Europeans Guillotine Credit Card Magnetic Strips

The credit card magnetic strip might be on the path to becoming the 8-track of our times, and this time, it’s all the Europeans fault. The European Payments Council recently passed a resolution that declares that magnetic strips should only be allowed in “exceptional cases” and lets banks refuse magnetic strips if they feel like it. [More]

Clergy Perform Exorcism On Chase Bank

A group of clergy gathered together on the steps of JP Morgan Chase on Park Ave in New York City to perform an exorcism on the bank. They said that the bank was possessed by the demons of “selfishness and avarice” because according to the group’s new study, only 6% of New York homeowners seeking a loan mod have gotten it in the past year. The exorcism happens at 0:57. No satanic spirits fly out of the banks, but money does fly out when the clergy closes down their bank accounts. [More]

Bank CD Opened In 1974, Mysteriously Eaten By Bank Of America

Laura (no, not me) is trying to track down a 37-year-old certificate of deposit that belonged to her grandparents. This is more difficult than it sounds, since their original bank was gobbled up by progressively larger and larger banks until it became part of…Bank of America. Laura’s grandmother passed away recently, and it bothers her that this situation isn’t resolved. She’s determined to find this lost CD: even though Bank of America alternately claims that there are no records of it, or that her grandfather cashed it in after he died. [More]

HSBC Joins List Of Banks Warning It Will Probably Get Fined For Improper Foreclosure Practices

HSBC is the latest in a string of banks who warned investors via their SEC filing that they expect to get fined after getting a letter from regulators chastising their improper foreclosure practices. On Friday, Wells Fargo, Ally Financial (formerly GMAC) and SunTrust banks made similar announcements. [More]

Why Banks Threatening To Limit Debit Card Swipes To $50 Is Horrible, And Hooey

As I mentioned on Friday, because the banks are pissed off, pretty soon you might not be able to pay for a restaurant meal or pay for groceries on your debit card. The banks are considering putting a $50-$100 cap on how much you can buy per transaction with a debit card. First, I think they’re bluffing. But, if they really followed through on it, this would seriously disrupt commerce across America. Let me paint you a picture of hypothetical supermarket checkout line. [More]

Banks Shutting Down Branches In Poorer Hoods While Opening In Richer

The New York Times combed through the data and found that when the banks close branches, they’re doing it in poorer neighborhoods. And when they open a new branch, it’s more likely to be in a well-off area. While that makes business sense, it could violate the spirit of the Community Reinvestment Act which was passed to curb “redlining,” where lower-income neighborhoods are discriminated against by the financial services industry. [More]

Banks Might Limit Amount You Can Buy On Debit Card

Grumbling over proposed limits to debit card swipe fees, banks are hinting they’re considering putting a cap on how much you can buy with a debit card. It could even be something like $50 or $100, forcing consumers to either pay with credit card or cash. [More]

Wells Fargo Meeting Today With Philly Homeowner Who "Foreclosed" On Them (Here's How He Did It)

Wells Fargo is meeting today at noon with the Philadelphia homeowner who “foreclosed” on them, The Consumerist has exclusively learned. Patrick says he “received a call from upon high” late yesterday and that he now has an appointment, “with a very senior Wells Fargo person.” It will be interesting to see how this plays out. But how did Patrick go from embattled and ignored homeowner to seated across the negotiating table with leverage? I spoke with him to find out more about both how and why he did what he did. His story is an inspiration to anyone who’s dreamed of going toe-to-toe with the big banks and winning. Turns out that armed with persistence, and a little legal know-how, Davids can take down Goliaths. [More]

TD Bank Charging Customers $2 To Get Cash From A Non-TD ATM

As Congress today debates over proposed caps on debit card swipe fees that would limit bank profits and lower costs for merchants, TD Bank has announced they’re going to start charging customers a $2 fee whenever they take cash out of a non-TD bank ATM. That’s going to be on top of any fee that you already pay the ATM. The only way to avoid the fee is to be in a higher-tier checking account. [More]

Watch Out For Bank Of America's 'Check Image Service Fee'

Joseph is a longtime customer of Bank of America who has always had a fee-free banking experience. Then he noticed an unfamiliar $3 fee on his account called a “Check Image Service Fee.” He hadn’t heard anything about this, so he signed on customer service chat to find out what it was all about. It turns out to be a fee for having printed images of your canceled checks on a paper statement. Really, the fee is intended to encourage customers to stop receiving paper statements in the mail. [More]