If you’re the type of person who already reflexively jiggles every card slot and looks for pinhole cameras whenever you go to swipe your card, despair. There is no 100% foolproof way to protect yourself, as proven by a pair of banditos who stole 3,600 card numbers after installing a credit card skimmer inside several gas pumps, reports the MountainView Voice. [More]

banks

Credit Cards Pitches Return To Campus

Despite being largely banned by the CARD act, credit card issuers have figured out how to get around its provisions and still reach college kids, reports WSJ. Here’s what they’re doing: [More]

BofA Loses Check That Would Have Saved House From Foreclosure

CBS 13 has the story of a man who fell behind on his mortgage payments who was told by Bank of America that unless he sent them $4,175 he would lose his house that he had spent years putting work into. So he managed to put together the money and sent it in as a cashier’s check. Then the bank lost his check. [More]

Banks Back In Business Of Lending Money, People Back To Borrowing

The New York Federal Reserve just issued its latest quarterly Household Debt & Credit report — which looks at the state of mortgages, home equity borrowing, auto loans and credit cars — and, for the first time in a few years, there are a number of not-so-bad things to say about things. [More]

Most Who Opted In To Overdraft Protection Were Wrong About How It Worked

One of the results of the regulatory overhaul was that banks couldn’t automatically enroll people in “overdraft protection.” This kicked off a mammoth effort by banks to try to convince customers it was in their best interest to sign up for a program that would let them get charged $35 for overdrafting a $1 candy bar rather than go through the pain and humiliating of having a card declined. But a new survey by the Center for Responsible Lending found that most of the people who did opt in either had a misconception about how the overdraft protection, or simply wanted the ceaseless onslaught of pitches from their bank about it to stop. [More]

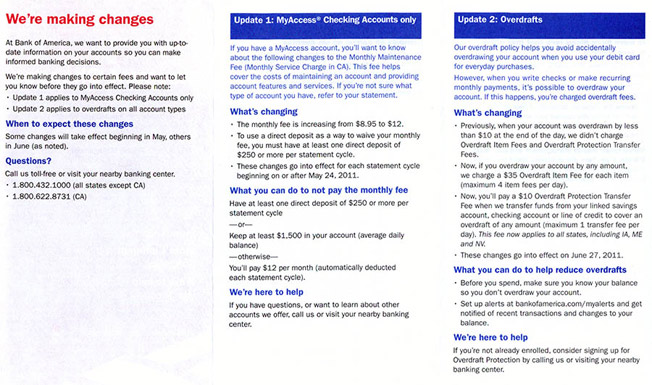

Bank Of America Adds New Checking Account Fees

Now that the regulatory heat is off on overdrafts, Bank of America is jumping back in with overdraft-related fees. They are also increasing the monthly fee and changing their requirements for avoiding it. [More]

Tricking Yourself Into Saving By Rounding Up Every Check In Ledger?

While trying to find an article in the Twin Cities Pioneer Press archive, I found a letter from one of their readers who had a unique way of tricking herself into saving money. Whenever she writes a check, she rounds it up in the check register. When she deposits a check, she rounds it down. At the end of the year she finds she has a cache of “ghost money” that she uses to buy new shoes, go to the movies, make donations and do home improvement projects. Depending on how you look at it, this is either the dumbest savings method ever, or an incredibly smart one. [More]

Call Every Time To Make Sure Extra Payments Go To Paying Down Principal

People trying to get ahead on their car and house payments are sometimes shocked to discover the default way that banks handle their extra payments. Instead of paying down the existing principal, they apply it to the future interest. Not only that, but you can’t just call them up one time and ask for them to change how they handle your payments. You need to call them every month you make a payment. Here’s a tale from reader Katherine: [More]

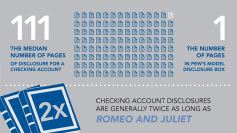

Checking Account Disclosure Documents Are Longer Than Romeo & Juliet, Contain Less Teen Sex

We recently wrote about the PIRG study showing how fewer than 40% of banks were willing to clearly disclose checking account fee schedules. Now a new report from the Pew Charitable Trust demonstrates just how far banks are willing to go to make it difficult for consumers to know what they are getting with their checking accounts. [More]

Why Are Financial Companies Forcing Us To Have Weak Passwords?

Your bank or credit card company is probably the last entity you would want forcing you to set an incredibly weak Web password. But it’s not just American Express that wants their customers to use really crappy, easily crackable passwords. Charlie recently discovered that Capital One and, to a lesser extent, Bank of America have limits on their customers’ passwords that force them to choose crappy ones. [More]

Regulators Hatch Plan To Pay Back Victims Of Bad And Illegal Foreclosures

It’s no secret that foreclosures in America have been a royal mess. Missing paperwork, faked documents, turbo-charged courts that just rubberstamp foreclosure orders, robosigners, the list goes on. Along the way, a number of homeowners have gotten foreclosed on improperly and, in some cases, even illegally. So regulators are putting together a plan for grand-scale recompense. They’ve laid down decrees that servicers have to start following the law, for really reals this time, banks need to hire outside firms to review their foreclosure actions between 2009 and 2010, and then pay back their victims. [More]

Bank Of America Posts 36% Drop In Profits

Perhaps hoping to garner sympathy votes in our Worst Company in America contest, Bank of America today reported a 36% drop in profits for the first quarter. One of the big drags on business continues to be the toxic landfill of mortgages the bank gobbled up when it bought Countrywide Home Loans. Never trust a man who is completely orange, I always say. [More]

Wells Fargo To Test Chip Embedded Cards With Travelers

Wells Fargo is going to send 15,000 EMV chip-embedded credit cards to frequent travelers this summer, the largest US bank to make a move towards these international-style credit cards. Consumers had complained about troubles using their credit card abroad with kiosks that only accept chip cards or with merchants who refused to take cards that only have the magnetic strip. [More]

Study: Less Than 40% Of Bank Branches Willing To Openly Disclose Account Fees To Customers

In spite of legislation requiring banks to disclose all fees associated with consumer deposit accounts, a new study from the Public Interest Research Group shows that only around four out of 10 bank branches don’t make it difficult or impossible for consumers to see the full schedule of fees.Additionally, banks are reluctant to let customers know about the availability of free checking accounts. [More]

BofA Charges Fee After 3 Withdrawals To Discourage You From Making More Than 6

Here’s a funny fee that I just found out about, even though it’s been in place for at least a year. So, Federal regulation, Regulation D, prohibits more than six withdrawals per month from a savings account (ATM withdrawals don’t count towards the 6). Most banks will just charge an “excess activity fee” if you go over that amount, but Bank of America charges a $3 fee if you have more than three withdrawals in a statement period. When Paul questioned why, customer service told him it was a “deterrent fee” to discourage him from hitting the Federal limit. “That’s like giving me a speeding ticket for going 27.5 miles per hour as a deterrent so I don’t go 55,” he writes. The rep was unmoved by his analogy. [More]

Citibank Pledges To Pay Small Checks First, Minimizing Overdraft Fees

Overdraft fees may be devious mechanisms that suck funds out of the customers who can least afford them, but their administration doesn’t have to be downright evil. [More]

Goldman Actually Borrowed From Fed Discount Window 5 Times, Contradicting Bank Claims

Looks like Goldman has been a more frequent visitor to the Federal trough than they’ve been letting on. Despite testifying before Congress that they had only accessed the Federal Reserve’s discount window, which lets banks borrow cash from the government quickly and on favorable terms, just once, Bloomberg reports that recently released data shows they actually took at least five overnight loans from the Fed between September 2008 and 2010. [More]