We know we should do this. We try to do this. We never do! This is one we’re going to work on for next month.—MEGHANN MARCO

banking

Turn An Old Computer Into A Dedicated, Secure, Banking Terminal

Here’s an idea for a spare computer you have lying around: make it into a secure banking device.

Banks Target The Wealthy To The Detriment Of Minorities And The Poor

According to a report by the National Community Reinvestment Coalition (NCRC,) banks are predominantly concentrated in wealthy neighborhoods, leaving poor and minority communities without access to basic financial tools such as checking and savings accounts. The NCRC compared bank locations to minority and income data provided by the census. The findings suggest that banks are redlining with devastating consequences.

This report shows in 24 out of 25 MSAs [Metropolitan Statistical Areas], urban areas that have dense populations have fewer bank branches — therefore fewer mainstream banking opportunities — than the less populated suburbs. Without the ability to build relationships with the regulated banking community, working class and minority neighborhoods are more likely to use “fringe” services, such as payday lenders and pawnshops, for small loans. They are also more likely to have their home loans originated with mortgage brokers and subprime lenders, which often led to foreclosures and unmanageable monthly payments.

Houston, Philadelphia, and Los Angeles showed the greatest disparities, compared to the relatively equitable distribution of banks in San Francisco, Seattle, and Boston.

Cingular: More Banks On The Mobile Banking Bandwagon

AT&T Inc. said on Tuesday it has taken a step toward the long-promised notion of phones replacing credit cards, checks and cash by signing agreements with Wachovia Corp. (WB.N: Quote, Profile, Research) and several other banks.

Which Mortgage Is Right For You?

So many lifestyles, so many loans…which one goes with which? Bankrate has a tool that matches your lifestyle to one of 8 different types of mortgages. You’re bound to match one of them, right? —MEGHANN MARCO

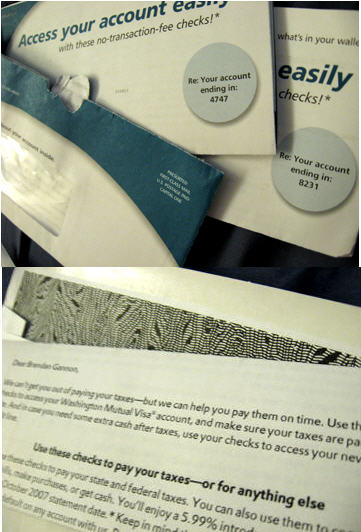

CapitalOne Sends Blank Checks From Someone Else's Account

So, I wrote in recently to mention that WaMu had sent me blank “checks” in an open, unsealed envelope. I complained, of course, and got a generic reply. Today I got another unsealed envelope of blank checks from Washington Mutual. Hmm.

Which Online High-Yield Savings Account Is Best?

There’s been a raging “online savings account” debate going on at Get Rich Slowly, resulting in a valuable discussion in the comments.

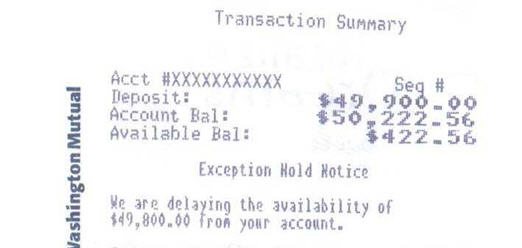

WaMu Holds Large Deposits For 2 Weeks, Doesn't Warn You First

How long should a bank be allowed to hold your money to “verify” it? A week? 5 days? 2 weeks?

Now Home Depot Wants To Be A Bank

Atlanta-based The Home Depot Inc. (NYSE: HD) also has applied to run its own bank…The bank would allow Home Depot to enable contractors to offer home improvement loans to their own remodeling customers.

Walmart Abandons Plan To Become A Bank

“Since the approval process is now likely to take years rather than months, we decided to withdraw our application to better focus on other ways to serve customers,” said Wal-Mart Financial Services President Jane Thompson in a statement.

Is Walmart Becoming A Bank?

UPDATE: Walmart has responded. They are abandoning their plan to become a bank. Caught!

Phishing Scams More Costly Than Bank Robbery

The amount of money taken typically is fairly small and will not dent a bank’s bottom line. Further, bank robbers are apprehended in almost 58 percent of cases, according to Federal Bureau of Investigation statistics. Only murder has a higher rate of clearance by arrest.

So what do banks worry about? Phishing scams.

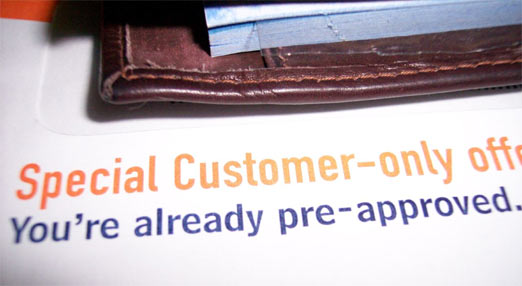

Is Anyone In America NOT Pre-Approved?

Elizabeth Warren over at the intellectually rigorous Credit Slips blog points out the correlation between tightened bankruptcy laws and credit card offers increasingly inundating the American consumer.

Bank of America To Begin Cell Phone Banking

Bank of America Introduces Leading-Edge Mobile Banking for More Than 21 Million Online Banking Customers (Press Release) [PRNewswire]

Bank of America: Major Credit Cards with No SSN

In the latest sign of the U.S. banking industry’s aggressive pursuit of the Hispanic market, Bank of America Corp. has quietly begun offering credit cards to customers without Social Security numbers — typically illegal immigrants.

Watch Sexy Webcam of Senate Predatory Lending Hearings

The Senate Banking Committee held a hearing Wednesday on predatory lending practices titled: “Preserving the American Dream: Predatory Lending Practices and Home Foreclosures.”