WaMu Holds Large Deposits For 2 Weeks, Doesn't Warn You First

How long should a bank be allowed to hold your money to “verify” it? A week? 5 days? 2 weeks?

Paul and his wife are buying their first home and, as a result, are making some large transactions between their various financial institutions. Paul writes:

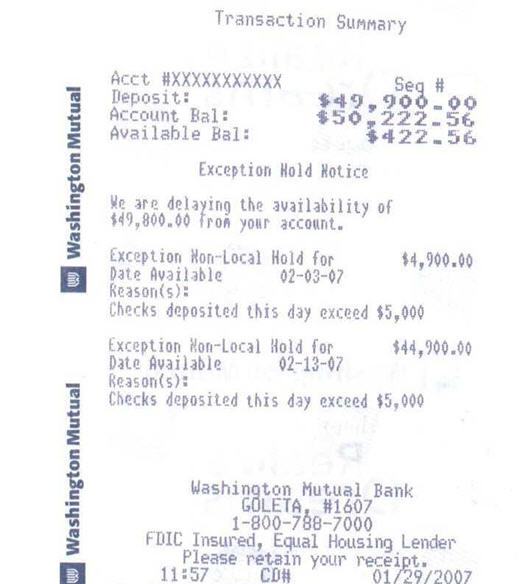

My wife and I were in the process of buying our first home. Our escrow was to close on February 9th, and our loan people wanted our down payment to show up in escrow on February 7th. We had money spread around in a few financial institutions, so we started early to gather the money in our WAMU joint checking account to wire the down payment to escrow. On Monday, January 29th I went to a WAMU branch to deposit a check for $49,900 which was from my Schwab account. This was 7 business days before I needed to wire the money. I saw a sign at the “teller window” that said they may hold checks up to 5 days to verify the funds. I asked the “teller” before I gave him the check when he thought the funds would be available, and he said “The receipt will tell you.” I didn’t really like that answer, but I figured it wouldn’t be longer than 5 days.

It was much longer than 5 days. Read the rest of Paul’s email inside.

Paul continues:

I gave him the check, he deposited it, and then he gave me the receipt. As I walked away and read the receipt it told me that $100 was available now, $4,900 would be available on February 3rd (5 days), and the remaining $44,900 would be available on February 13th, over two weeks after the deposit, and well after our escrow was to close. This was not good.

I talked to the manager who was more helpful than the kid at the teller window, but he said since the check was so large compared to what we kept in the account they had to hold it. I understood that we don’t keep much in that account (trying to keep cash in high yield savings accounts) and understood the check wouldn’t be available right away. However I thought as soon as the money cleared Schwab, the money should be available for us. He said to come back in a couple of days and he’d see what he could do.

So I ended up hounding Schwab to see when it cleared that account. Once it did, on Wednesday January 31st, I called the WAMU manager and gave him the name and number of who I talked to at Schwab. He then called them and then called me back and said he manually released the hold on our funds. So it ended up working out, after some panic and diligent following up. However if I hadn’t had the manager manually release the funds I’m afraid they would have been sitting on the bulk of my money for two weeks. Needless to say, we didn’t move any of our other money into WAMU. Instead we moved the rest of our down payment funds into a local account we have (Santa Barbara Bank and Trust) where the teller actually checked with her manger BEFORE depositing the check. She told me 2-3 days to clear and sure enough it was available in two days.

We’ve since closed our accounts at WAMU and moved all of our cash to the local bank.

For all their nice “customer friendly” advertising, we’ve been getting a heck of a lot of complaints about WaMu lately. What’s up with them? Growing too fast for their own good? —MEGHANN MARCO

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.