The FBI has opened an investigation into Countrywide for suspected securities fraud, reports the New York Times. The Justice Department and FBI “are looking at whether officials at Countrywide, the nation’s largest mortgage lender, misrepresented its financial condition and the soundness of its loans in security filings.” So far everything is unofficial because nobody has been authorized to discuss the case, and a Countrywide spokeswoman says, “”We are not aware of any such investigation.”

banking

../../../..//2008/03/08/heres-a-free-idea-for/

Here’s a free idea for the taking: why doesn’t a bank (cough HSBC cough) offer the option to have text message alerts sent to a registered phone number any time a withdrawal is made from a specific account via ATM? “$120 was withdrawn at 2:51pm EST in Palo Verde, CA. Reference #293005” See how easy that was? Such exception-based reporting would drastically cut down on fraud (we’re guessing) by enlisting the help of customers to report unauthorized transactions immediately.

You'd Better Know Your Balance, Because WaMu Certainly Doesn't

“Keep track of your bank balances!”—pretty much every week on Consumerist either we or our readers say something like this.

Foreclosures Hit An All Time High As Many Homeowners Simply Give Up

The Mortgage Bankers Association says that foreclosures have hit an all-time high as more and more borrowers with adjustable rate mortgages walk away from their homes before their payments increase.

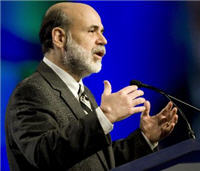

Fed Chairman Asks Banks To Forgive Mortgage Debt

Fed Chairman Ben Bernanke is urging lenders to “forgive portions of mortgage debt held by homeowners at risk of defaulting,” says Bloomberg.

U.S. Banking Profits Plunge To Lowest Levels In 16 Years

Banks just aren’t making the same profits they used to says the Federal Deposit Insurance Commission.

Is HSBC Straining Under An "Unprecedented" Wave Of Fraud Activity?

If you’re an HSBC customer, check your account, as there may be a wave of fraudulent activity hitting your bank. Two days ago we wrote about the guy in the U.S. who discovered his account had been drained by someone in Bulgaria. Later that day we received an email from Emily in NYC who was having similar problems, only her fraud-buddy was in California and Canada making withdrawals on her account.

Emily’s fiancé wrote back to us today with an update, and according to Emily, the HBSC Fraud Investigator who spoke to her “said that their fraud department was so overwhelmed, it was ‘still in the developing stage of how we’re going to handle’ it. I asked if she knew how many customers were affected and she stated ‘We don’t even know.'”

WaMu Doesn't Know How To Deal With Potentially Fraudulent Account?

A reader writes in to tell us about “the world of suck I encountered at WaMu” over some wrong personal data. A year and a half ago, she started receiving Washington Mutual account mail—including overdraft and collection notices—for someone named Ly Ly V____ at her address. “I’ve lived at my home for 11 years, and have no neighbors with that name.”

36 Confessions Of A WaMu Banker

– About the WaMu Free Checking, yes it is a different “free” checking account. We just came out with the “WaMu” part about a couple of years ago, so if you have any “free” checking account older than that I suggest you change it to the newer one.

New Hampshire Gives Payday Lenders The Boot

New Hampshire will become the latest state to keep payday lenders from gouging their patrons. A measure passed by the legislature will cap interest rates on payday loans at 36%, a drastic change for an industry used to bludgeoning underbanked consumers with interest rates exceeding 500%. Payday borrowers spend an average of $793 trying to repay a $325 loan. Let’s see how the economic leeches spin this as a loss for consumers.

NY Governor On The Mortgage Meltdown: "The Bush Administration Will Not Be Judged Favorably"

What did the Bush administration do in response? Did it reverse course and decide to take action to halt this burgeoning scourge? As Americans are now painfully aware, with hundreds of thousands of homeowners facing foreclosure and our markets reeling, the answer is a resounding no.

Goldman Sachs: By 2009 You May Owe More Than Your Home Is Worth

Home prices experienced the steepest drop on record for a single quarter says the National Association of Realtors:

The national median price drop of 5.8%, to $206,200 from $219,300, was the steepest ever recorded by the National Association of Realtors (NAR), which has been compiling the report since 1979.

Don't Be Ashamed To Ask Friends Or Family For A Loan

Taking a private loan from friends or family can be a win-win proposition, not necessarily a shame-filled dish with a side order of failure. Private loans are an ideal way to reduce the amount you need to borrow from a bank—instead of paying loan application fees, processing fees and higher rates, you can save money while offering attractive yields to your friends and family.

USAA Customer? Make Sure Your Checks Haven't Been Cashed Twice

This morning, Mary logged onto her USAA bank account to check her balance and was surprised to find that her rent check had been cashed twice while she was asleep. She was eventually able to get through to a human and get the problem addressed, but it wasn’t easy. And she may not have been the only one affected.

Online Bank Cancels Cards On "Risky" Customers

Egg, a Citibank-owned online bank in the UK, announced this past weekend that it’s canceling the accounts of 161,000 of its customers after “conducting a one-off, extensive risk review.”