The New York Times says that the FBI has begun an investigation that includes almost the entire mortgage industry—from the lenders to the brokers to the Wall Street banks who packaged the loans as securities. They’re cooperating with the SEC and wouldn’t name which firms they’re targeting, but the Times said that it includes 14 companies.

banking

../../../..//2008/01/22/wachovias-4q-earnings-get-hammered/

Wachovia’s 4Q earnings get hammered by the subprime meltdown. [Bloomberg]

Say Goodbye To Your Free Student Checking Account

Banks love graduation almost as much as parents. You’re finally on your own, able to afford food, rent, and beer, so why shouldn’t the banks—the kind, selfless banks that let you save while you slaved for knowledge—now sink their teeth into your anorexic accounts for a hearty bite of their own? FiLife compiled an excellent list of bank policies so students know how their institution plans to celebrate their impending graduation.

Wachovia Hands $100,000 To Fake Armored Car Driver

Lt. William Farr, the head of the D.C. police bank robbery unit, told the Washington Post that investigators are playing catchup.

../../../..//2008/01/10/tony-blair-will-join/

Tony Blair will join JPMorgan Chase & Co Inc, the third largest bank in the U.S., as a senior advisor. We wonder if Countrywide is courting President Bush for a similar position in 2009.

86,000 Mortgage Related Jobs Cut In 2007

A new study says that 86,000 mortgage related jobs were cut due to the weakening housing market, says CNNMoney. Diabolical mustache-twirling evidence-forging lender Countrywide unburdened itself of the most workers, cutting 11,665.

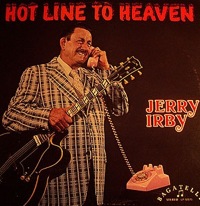

Consumer Groups Support National Banking Complaint Hotline

Consumers Union and Consumer Federation of America both threw their support behind Rep. Carolyn Maloney [D-NY]’s “Financial Consumer Hotline Act of 2007,” a proposal to establish a single national hotline where consumers can file complaints against any financial institution. Currently there are five different federal agencies who regulate the banking industry, each with its own system for collecting and addressing complaints.

Stockton, California Shows Us How Bad The Mortgage Meltdown Can Get

Steve Carrigan is in charge of economic development for Stockton. He says bank loans made it a party every day.

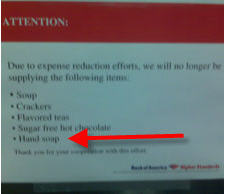

WaMu No Longer Provides Plastic Cutlery, Hot Chocolate, Keeps Tea

We had an email go out to employees here at WaMu. They’re going to stop providing us plastic cutlery, hot chocolate, creamer, and anything but regular tea.

Will Car Loans Be The Next Credit Meltdown?

Gone are the days of the three-year car loan. The length of the average automobile loan hit five years, four months in October, up more than six months from 2002, according to the Federal Reserve. And nearly 45% of loans written today are for longer than six years. Even some staid lenders owned by the carmakers, such as Toyota Financial Services and Ford Credit, are offering seven-year financing. And a few credit unions, particularly in the West, are tinkering with the eight-year note.

Bank Of America Can't Afford Soap For Employee's Break Room

After waving good-bye to billions in the subprime mortgage market and bailing out nefarious mustache-twirling mortgage lender Countrywide, Bank of America says it can no longer afford soap for its employee’s break rooms.

"Courtesy Overdraft Fees" Are Bad For Consumers

Bankrate has an extensive article on “courtesy overdraft” services tied to debit cards. These services prevent your debit card transactions from being denied, but have the unpleasant effect of charging you anywhere from $20-$35 for this “courtesy.”

Foreclosures Up 68% From Last Year

Foreclosure tracking firm RealtyTrac has announced November’s foreclosure numbers and, while foreclosure activity is down 10% from last month’s number, the news isn’t happy. Foreclosures are up 68% from November 2006, with 201,950 foreclosure filings—up from 120,334 this time last year. Also worth mentioning, last year’s numbers weren’t exactly low—they were up 68% from 2005.

Fed Approves Plan To Curb Irresponsible Lending

The Fed has unanimously approved a new plan to tighten provisions designed to prevent predatory mortgage lending, as well as help to decrease the number of consumers who irresponsibly take on debt that they cannot afford to repay.

Hotline Proposed For Banking Complaints

Consumers with banking complaints reflexively complain to the FDIC or their state Attorney General, even though five federal agencies regulate the banking industry. A bill introduced by Carolyn Maloney (D-NY) wants to connect aggrieved consumers to the right agency by establishing a hotline to handle all banking complaints.