Last year, banks made $11.16 billion from customers who overdrew their accounts with a majority of those overdraft fees going into the pockets of the three largest banks: Wells Fargo, Bank of America, and JPMorgan Chase. There could be more fees headed Chase’s way soon if customers don’t pay heed to the company’s changing overdraft policy. [More]

Checking Account

Chase Raising Fees On Some Checking & Savings Accounts In 16 States

Chase customers in more than a dozen states will be seeing a slight change to some of their account statements next month, as the bank announced it would increase service charges for both checking and savings accounts. [More]

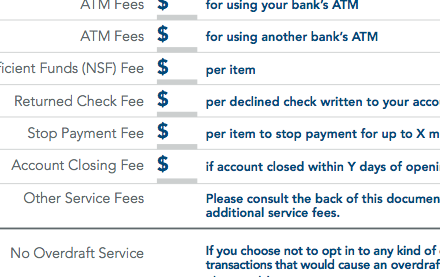

Chase To Cut Checking Account Fee Disclosures From 100+ Pages To One

When the charitable folks at the Pew Charitable Trusts first suggested that banks could condense their overly complicated fee schedules from over 100 pages to one simple page, it seemed unlikely that any major bank would follow suit. But this morning, JPMorgan Chase announced it would do just that. [More]

Bank Of America: A Stop-Payment Isn't A Guarantee We Won't Process The Check Anyway

There’s a funny little thing about putting a “stop payment” order on a check that most banks don’t tell you about until it’s too late: They often only last six months and the only way to guarantee that check never gets deposited is to close the associated checking account. This is a lesson being learned the hard way by a Bank of America customer who saw her account drained of its last few dollars after an old landlord cashed a 16-month-old check. [More]

Bank of America Mistakenly Shuts Down Access To Your Account, Charges You For The Pleasure

Poor Jacob. He only wanted to deposit a $2,019 check with Bank of America. Apparently, this was enough to provoke the bank into shutting down his account, leading to overdraft fees whenever Jacob tried to access his money.