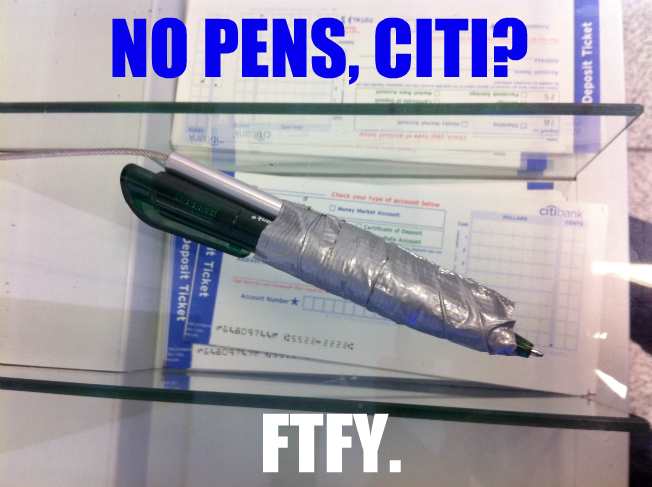

Reader Greg was sick of there never being any pens at the Citibank ATM at 8th ave and 16th st in NYC. They had those metal pens attached to wire like they always do, but people had stolen the pen innards and they were never replaced. (Probably because the bank got sick of replacing them.) So Greg came up with his own solution. He grabbed some free pens that are always in abundance at TD Bank and duct taped them to the empty Citibank pen barrels. [More]

atms

Woman With Hand Stuck In ATM Freed By Firemen

ATMs are no longer satisfied with just nipping fees from you. Now they want your flesh. [More]

Chase Tests Out $5 ATM Fees

Banks are continuing to amp up the threat of making consumers pay for the price of increased regulation. Chase is testing out charging non-customers in Illinois $5 for withdrawal fees. In Texas, they’re trying a $4 charge on for size. Consumer advocates say its a scare tactic meant to muddy up Congressional waters, but banking experts disagree. “I think customers have taken for granted the cost of banks’ infrastructure,” says Margaret Kane, president and CEO of Kane Bank Services told ABC News. “ATMs are very expensive to install and maintain.” [More]

TD Bank Charging Customers $2 To Get Cash From A Non-TD ATM

As Congress today debates over proposed caps on debit card swipe fees that would limit bank profits and lower costs for merchants, TD Bank has announced they’re going to start charging customers a $2 fee whenever they take cash out of a non-TD bank ATM. That’s going to be on top of any fee that you already pay the ATM. The only way to avoid the fee is to be in a higher-tier checking account. [More]

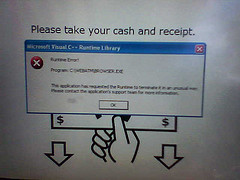

Wells Fargo ATMs Crash Across The Country

Most of Wells Fargo’s 12,000 ATMs crashed starting Monday afternoon and lasting several hours, reports the Star Tribune, and no one knows why. [More]

ATMs Are As Dirty As Toilets

You might want to wash your hands after the next time you take money out the cash machine. A new study shows that when bacteria harvested from both were compared, ATM keys were as dirty as the seat in a public bathroom. [More]

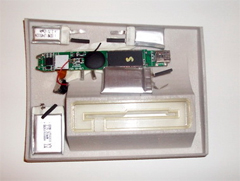

ATM Skim Scammers Steal Cards With Old Cassette Recorders

Fraudsters are cracking open old handheld cassette recorders and using their components to build ATM skimmers that steal your credit card numbers. [More]

Wells Fargo Wouldn't Accept My Deposit – So Where Is It Now?

Adrienne tells Consumerist that she did something very mundane: she deposited a payroll check that her fiancé had signed over to her in her Wells Fargo bank account using an ATM. Based on previous experience, and assuming that a payroll check from a Fortune 1000 company is a straightforward enough deposit, she then paid bills using the money that she thought was in her account. [More]

Mugging Alarms On ATMs Are Expensive And Useless

Anti-robbery systems at ATMs, like an alarm button button or a PIN code used to alert police you’re getting mugged, are rarely installed on the cash disgorgers, and with good reason. [More]

Cab Driver Locks Doors, Holds Passenger Hostage For Trying To Pay With Credit Card

There’s a driver for Pittsburgh Yellow Cab Company who doesn’t like it when you try to pay with a Discover card, even though the company’s website says they accept it. When Adam tried this, the driver accused him of trying to avoid paying, then locked the doors and initially refused to let him go to an ATM 15 feet away unless he left all of his belongings behind. While Adam called the cab company to complain (he was routed to a voicemail inbox), the driver called the police. Twice. [More]

At Chase, Depositing A $4,000 Check In An ATM Is "Unusual Activity"

Carol tells Consumerist that while in a financial pinch, she took out a title loan for $4,000, depositing it in her Chase bank account using an ATM. Instead of helping the situation, the deposit made her financial mess worse. Chase froze her out of her accounts and made her order a new debit card, but no one at her local branch or in the corporate “Risk Control” department has the power to tell her what the problem is. Her account remained locked after the check cleared. Bank staff also took the opportunity to attempt to sell her student loans and overdraft protection. Not a good time, Chase. [More]

Guy Hacks ATM To Spew Money, Play Music

Whether it’s a steel door or an encrypted network, thieves are always finding ways to break down the barriers that protect money. And the new technologies are also enabling bank robbers to invent new ways to jack cash with flair and razzle dazzle. Exhibit A, a security researcher at the Black Hat conference in Las Vegas demonstrates on-stage how one can remotely hack an ATM to make it spew money while playing a lively tune. [More]

Rejoice Penguins, Wells Fargo Has An ATM In Antarctica

Wells Fargo is the undisputed leader in Antarctic banking thanks to a pair of ATMs at McMurdo station. Despite the monopoly, the bank acts as a benevolent despot by allowing non-customers to draw cash without a surcharge. But who replenishes the stock of $20s? What happens when the ATMs break? Wells Fargo VP David Parker explained it all in a recent interview. [More]

California Welfare Recipients Spending Millions At Casinos

Following an L.A. Times report that revealed the California welfare debit card program allows benefits recipients to withdraw cash at ATMs at casinos, state officials disclosed that over $1.8 million in taxpayer cash had been withdrawn on the gaming floors of casinos in just the last eight months. [More]

Gold-Dispensing ATM Converts Pesky Cash To 24K Bars

Next time you’re in Abu Dhabi and have to get some gold in a hurry (and we’ve all been in that situation, right?), you can just drop in to the Emirates Palace hotel, pop a few bills into the ATM and walk out with gold bars. The machine, Gold To Go, monitors gold prices and automatically updates its pricing every 10 minutes. [More]

Bank Of America Technician Turned ATM Into Free Money Machine, Stole Over $200,000

A former BoA IT worker has agreed to plead guilty to installing malware on the bank’s ATM machines in order to withdraw money whenever he felt like it, reports Wired. According to the plea agreement, his total take from the crime was between $200-400k. The bank won’t disclose how he did it or what the malware was like, but earlier this month Visa announced that new malware has hit the U.S. that could not only capture customers’ PINs and card data, but also give the criminal the ability to empty the machine of any cash that was in it. [More]

Anonymous Protestor Leaves Pile Of Manure In Chase ATM Vestibule

Someone who was fed up at Chase made a special deposit on the floor of one of their ATM vestibules in NYC a couple of days ago. Fortunately for the clean-up crew, it looks like it was manure and not actual human poop. [More]