Even though President Trump recently promised that your 401(k) retirement accounts would not be negatively affected by the ongoing effort to cut taxes, the folks in Congress who are actually deciding what tax laws will be changed say that putting limits on retirement plans is still a distinct possibility. [More]

401(k)

Trump Promises Tax Overhaul Will Not Include Cuts To 401(k) Plans

The Republican tax outline currently calls for large scale cuts to some taxes but has not yet provided much in the way of detail about how some of the government would offset some of those revenue losses. Recent reports said that the GOP was looking at lowering the maximum amount you can contribute to your 401(k) retirement savings — a proposal that chafed more than a few Americans. Now, President Trump is claiming that the tax plan will not touch your 401(k). [More]

Will Republican Tax Cuts Mean Lower Limit On 401(k) Contributions?

Some people with 401(k) retirement plans will put as much money into it as they can, but there are whispers that the tax cuts being drafted by Republicans in Congress could reduce the maximum amount of money you contribute to your retirement savings each year. [More]

Are Employee Student Loan Contributions The Next 401(K)?

Any help graduates can get when it comes to repaying their mountains of student loan debt is often welcome: from cities offering debt forgiveness to keep young adults in their areas to programs in which states will pay for portions of their education. Now, more employers are jumping on the assistance train by providing student loan payment contributions as part of their compensation plans. [More]

RadioShack Will Stop Matching Workers’ Retirement Contributions Next Year

RadioShack, the electronics retailer that once called itself “America’s Technology Store” and now wants to repair your cracked iPhone screen, is willing to try just about anything to stay in business. While they negotiate with lenders for permission to close more stores, the chain announced that it will end matching contributions to employees’ retirement plans as of February 1, 2015. [More]

AOL CEO Regrets Blaming Benefits Change On “Distressed Babies,” Reverses Unpopular Move

Late last week AOL’s CEO Tim Armstrong announced that the company would be delaying company contributions to employee retirement accounts. That was enough to make workers grumble already, but then he added that the shift was partly due to two specific employees who had “distressed babies.” That didn’t go over so well, and the company has now reversed the benefits shift. [More]

How To Not Suck… At Picking A Retirement Plan

Taxes now or taxes later? Unfortunately, “No taxes at all” isn’t an option. But when it comes to your retirement savings, you do have some control over when you pay Uncle Sam. [More]

Americans Racking Up Debt Faster Than We Save For Retirement

This seems to be the week for sad news about Americans and our retirement-saving behavior. A new study shows that while we might be sticking money in our 401(k) plan like dutiful money squirrels, in general, Americans aren’t doing ourselves any favors for retirement as we rack up debt at a higher rate than we sock away money. [More]

Ask Tax Dad: Overfunded 401(k), Living In My Rental Property, And More Tax Returns For Dead People

Usually, our staff Certified Tax Cat handles readers’ questions about taxes, but he’s currently at a Warby Parker showroom shopping for some even less fashionable glasses. Filling in for him is Laura’s dad, a retired accountant and real live independent tax preparer. Exclusively on Consumerist this spring, Tax Dad answers your questions. [More]

Your 401(k) May Actually Be Worth Something Again

We know a lot of people simply stopped looking at their quarterly 401(k) account statements a few years ago, hoping and praying the market would eventually recover and they would someday see all that money lost when the economy went SPLLLAATTT!!. Well, it may be time to take a peek at your next statement, as the latest numbers show very positive signs of recovery. [More]

How To Roll Over A 401(k) To An IRA

When you leave a job, it’s important to make sure the cash you stashed in your 401(k) follows along. Some are tempted to cash out the account and suffer the penalty, but the savvy choice is to roll it over into a new account. [More]

One Man Explains Why He Stopped Contributing To His 401(k)

Just about every financial expert tells you not only to contribute to a company 401(k), but make sure you pay in enough to receive the company match. We can’t argue any differently, but tough times and changing priorities can make compelling arguments for dropping contributions. [More]

Avoid These 3 Retirement Plan Mistakes

You’ll be excused for worrying more about your day-to-day financials than those of your future, 65-year-old self. But it’s important not to let your 401(k) or other long-term investments become afterthoughts. One reason to think big-picture is that decisions you make in retirement investments now will have ripple effects that turn into tidal waves in your golden years. [More]

More People Using 401(K) Funds As Piggy Banks

Even though the economy has begun to demonstrate occasional signs of life, many Americans are still feeling the sting of those darkest days. Millions of homeowners are struggling to pay mortgages they can’t afford and those that have walked away from underwater loans now have battle-scarred credit reports. So in order to stay afloat, more consumers are taking loans from their own retirement savings. [More]

Bill Aims To Stop People From Using 401(K) As A Piggy Bank

A recent study found that a record number of people (around 28%) with 401(k) retirement funds had loans (averaging $7,860) outstanding on them in 2010, meaning that these same folks will not have as much money set aside when it does come time to retire. That’s why a pair of Senators have introduced legislation that would make it more difficult for people to tap their 401(k)s. [More]

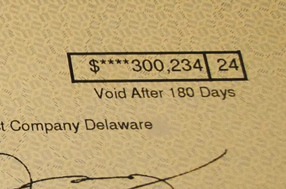

Fidelity Sent Me Someone Else's $300,000 Retirement Savings

Douglas received an unexpected delivery from UPS last week: a check from Fidelity Investments made out to Vanguard Fiduciary Trust Company for over $300,000, along with a bunch of 401(k) rollover paperwork that included the real account holder’s address, date of birth, SSN, and phone number. [More]

An Argument For 401(k) Minimizing

Just about every financial adviser demands you max out your 401(k) contributions, at least to the percentage your employer matches, which is why it’s refreshing to see a rare counter-argument. [More]

Common 401(k) Mistakes To Avoid

Christian personanl finance blog Redeeming Riches offers four revelations on how you may be mistreating your 401(k).