If at first you don’t succeed try again… and again, and again. That appears to be the approach members of Congress are taking when it comes to a bill that would allow student loan borrowers to refinance their private and federal student loans. [More]

Education

You Can’t Discharge Your Student Loans In Bankruptcy Because Of Panicked 1970s Legislation

Although bankruptcy should only be viewed as the last option for consumers drowning in a sea of debt, even this final-straw course of action won’t help Americans with getting out from under hefty student loans — but it wasn’t always this way. [More]

Legislation Would Require Private Student Loans Be Forgiven If Borrower Dies

Shortly after the death of their daughter, a New York couple’s grief was interrupted by a battle with an entity they never imagined: her private student loan lender. Inheriting a dead child’s student loan debt is a problem too many parents have had to face, and one that a new piece of legislation aims to eliminate. [More]

Senators Introduce Legislation To Make Private Student Loans Dischargeable In Bankruptcy

Since 2005, student borrowers have been unable to discharge their private student loans through the process of bankruptcy. But that could soon change after a group of 12 senators introduced a bill aimed at addressing the current student debt crisis by restoring the bankruptcy code to hold private student loans in the same regard as other private unsecured debts. [More]

Student Aid Bill Of Rights Aims To Overhaul Federal Student Loan Repayment, Servicing Process

The way in which borrowers pay back their federal student loans – from checking the balance to filing complaints against servicers – is set to change with the signing of a presidential memorandum Tuesday. [More]

Banks & Credit Card Companies Saving Millions By Taking Away Your Right To Sue

Tens of millions of American consumers have clauses in their credit card, checking account, student loan, and wireless phone contracts that take away their rights to sue those companies in a court of law, and more than 93% of these people have no idea they’ve had this right taken away from them. The companies involved are presumably quite happy about this lack of awareness, as it results in millions of dollars in savings that aren’t being passed on to you. [More]

Report: Taking For-Profit Colleges Nonprofit Can Generate Hefty Profits For Owners

Earlier this year Education Credit Management Corporation bought 56 campuses from embattled for-profit chain Corinthian Colleges Inc. and took the schools to the nonprofit sector. While that conversion was initiated because of the ongoing collapse and financial problems facing CCI, other college chains have dropped the for-profit status seemingly to pick up hefty profits. [More]

U.S. Department Of Education Cuts Ties With Five Debt Collection Agencies To Protect Borrowers

Consumer advocates applauded the Department of Education’s announcement last week to end contracts with five private collection agencies that provided inaccurate information to borrowers. [More]

Senators Chastise Govt. For Making Money Off Struggling Student Loan Borrowers, Not Offering Enough Relief

For several years now the government has offered federal student loan forgiveness programs aimed at helping borrowers to avoid defaulting on their debts. While recent reports have shown that the popularity of the programs has exceeded expectations, a group of six senators say the Department of Education could do more given the billions of dollars in payments it receives from federal loans each year. [More]

Corinthian College’s Canadian Subsidiary Files For Bankruptcy A Week After Campuses Shut Down

Less than a week after the Ontario Education Ministry closed 14 Everest College campuses in the province, the Canadian subsidiary of for-profit college operator Corinthian Colleges Inc. announced it had filed for bankruptcy. [More]

Current, Former Corinthian College Students Go On “Debt Strike,” Refuse To Pay Private & Federal Loans

With for-profit educator Corinthian Colleges Inc. selling off campuses and closing schools, thousands of Everest, WyoTech, and Heald College students are waiting to learn the fate of the more than $1 billion in private and federal student loan debt used to finance their education. While the Department of Education and the Consumer Financial Protection Bureau have worked to secure deals in which some of that debt will be forgiven, some students are increasing the pressure on such deals by staging a “debt strike.” [More]

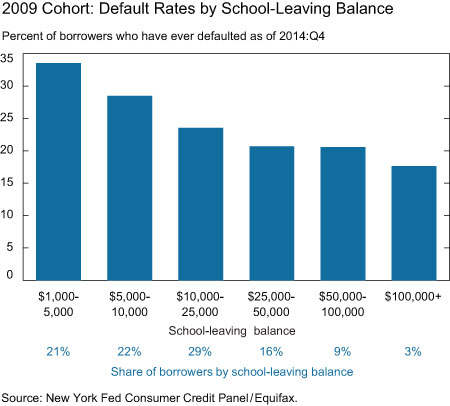

Why Are Borrowers With Less Student Loan Debt More Likely To Default?

Just days after the Federal Reserve Bank of New York showed that student loan delinquency rates were once again on the rise, a new Fed report finds it’s student loan borrowers with the lowest levels of debt who typically are the most delinquent.

[More]

Ontario Education Officials Close 14 Everest Campuses Amid Corinthian Colleges’ Downfall

If you thought the issues plaguing beleaguered for-profit college operator Corinthian Colleges Inc. didn’t extend beyond the borders of the United States, then you were wrong. Some 2,400 students in Canada are now left to pick up the pieces after the Ministry of Education in Ontario announced it would shut down CCI-operated Everest College campuses in the province. [More]

Student Loan Debt Increased $77B In 2014, One In Nine Loans Now Past Due

Student loan debt reached an all-time high and delinquency rates continued to rise last year, according to a new report from the Federal Reserve Bank of New York found. [More]

California Halts Grants For Students At Corinthian’s Heald College Campuses

Nearly 4,500 students at California campuses of the for-profit Heald College chain — operated by the beleaguered Corinthian Colleges, Inc. — have been notified they won’t be receiving state grants to help finance their education because school administrators failed to provide financial statements to state regulators.

[More]

Corinthian Colleges Inc. Expected To Be Delisted From Nasdaq Tuesday

Embattled for-profit college operator Corinthian Colleges Inc. — the company behind the Everest, WyoTech, and Heald College chains — is set to be delisted from the Nasdaq stock exchange Tuesday after it failed to meet a deadline to file quarterly earnings reports.

Federal Student Loan Forgiveness Plans Cost Govt. Nearly $22B More Than Expected

Last spring, legislators and researchers began voicing concerns that federal student loan forgiveness plans could become a victim of their own success. This week, we learned just how successful – and costly – such program are; information that once again created a chorus of concerns regarding the sustainability of such programs. [More]

Should For-Profit Colleges Be Allowed To Spend Taxpayers’ Money To Put Their Names On NFL Stadiums?

This past Sunday — and for the second time in seven years — the Super Bowl was played at a stadium carrying the University of Phoenix name. The for-profit online school paid more than $150 million to slap its brand on the stadium, with much of that money coming from taxpayers. Some groups say that for-profit schools should not be allowed to make such splashy marketing investments at a time when there are so many questions about the quality of education provided by for-profit institutions. [More]