We already know that student loan debt can have adverse effects on borrowers; from not being able to purchase a home to dinging credit reports. But a new study claims there’s also a link between the piles of debt and poor mental and psychological functioning among young adults. [More]

Education

ECMC Completes Purchase Of Everest University, WyoTech Campuses

Shortly after the Consumer Financial Protection Bureau reported that it secured $480 million in student loan relief for current and former students of embattled Corinthian Colleges Inc., Education Credit Management Corporation – the company seeking to purchase more than 50 campuses from the for-profit giant – announced it had completed the controversial $24 million transaction. [More]

Deal Provides $480 Million In Debt Relief To Current & Former Corinthian Colleges Students

When student-loan servicing company Educational Credit Management Corporation revealed it would purchase 56 campuses belonging to embattled for-profit college chain Corinthian Colleges, regulators and consumer advocates began working to ensure that students affected by CCI’s collapse would be protected under the deal. Today, the Consumer Financial Protection Bureau and the U.S. Department of Education announced some students would receive the help they deserve in the way of $480 million in debt relief. [More]

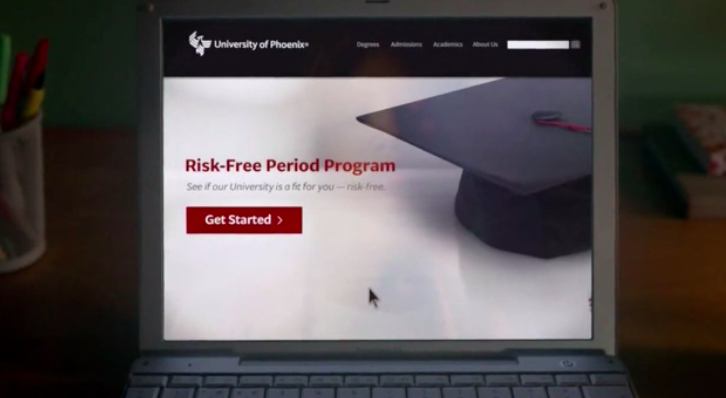

University Of Phoenix’s Risk-Free Trial Might Not Cost You, But Is It An Accurate Taste Of College?

From diet pills to dating websites, it’s not hard to find someone offering a “risk-free” trial membership, and thanks to the University of Phoenix, that “try before you buy” model now applies to college courses. But while one might admire the idea of giving potential students a taste of the school before committing to an expensive education at the for-profit online university, consumer advocates are concerned about the program’s benefits. [More]

Couple Used Stolen Identities To Obtain $270,000 In Federal Student Loan Funds

There’s no doubt that student loans are a big business. While that business is meant to assist students in attending college, two con artists used the system to line their own pockets, all at the expense of unknowing consumers and the federal government. [More]

Will New Owner Of Everest University, WyoTech Continue With Old Owner’s Sketchy Practice?

When students apply to one of the for-profit schools owned by Corinthian Colleges Inc., they sign away their right to seek any legal action against the company if they’re wronged. Now that CCI is selling off 56 of its Everest and WyoTech campuses, the new owners have a chance to end this anti-consumer practice, but will they? [More]

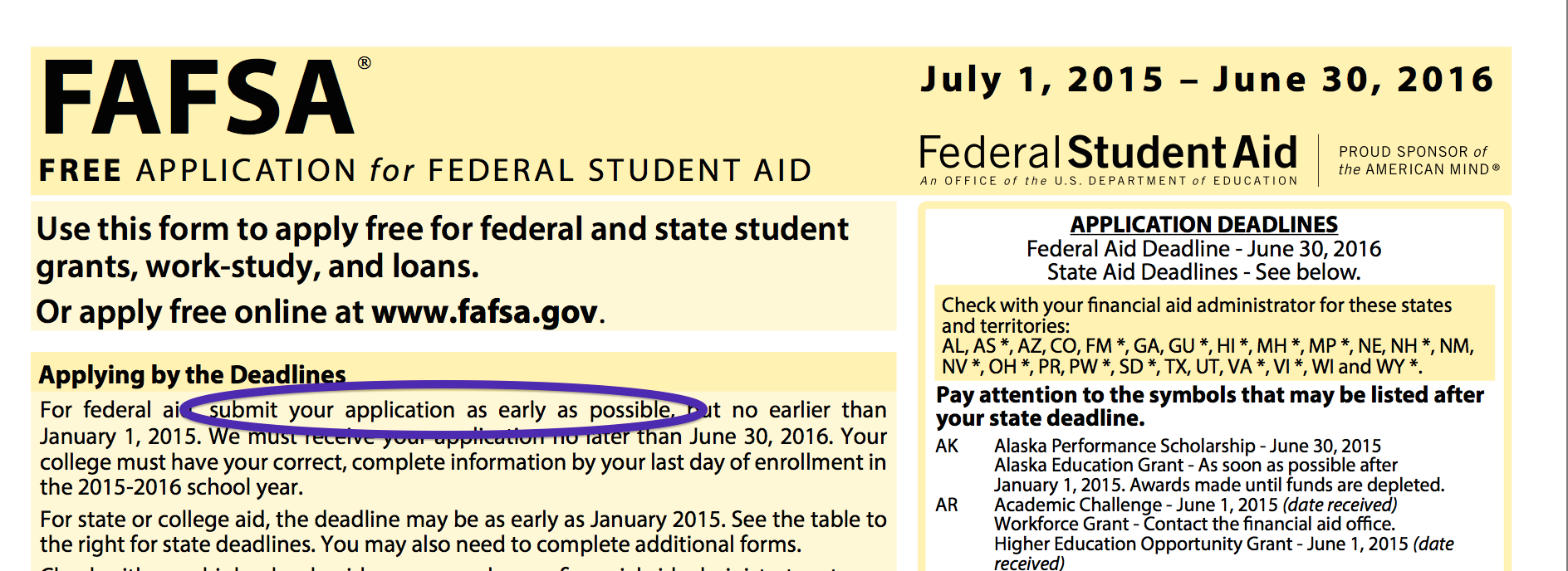

College Students Leaving $3B In Grant Money Unclaimed By Not Filing FAFSA

College students and financial supporters of college students: Remember when we told you at the end of the year that you needed to get your Free Application for Federal Student Aid in ASAP? Maybe you pinned it on the cork board in the kitchen or made a mental note that disappeared as soon as you had to remember the finer points of the infield fly rule. It’s because people didn’t get around to filing their FAFSA that there are billions of dollars in unclaimed grant money just sitting around gathering dust like that post-it note on which you wrote “File FAFSA. Buy bread.” [More]

Proposed Program Would Pay First Two Years Of Recent New York Graduates’ Student Loans

With the average graduate now leaving college with more than $28,000 in student loans, it can be difficult to envision just how one might manage to land on their feet. If you happen to be a resident of New York and attended an instite of higher education within the state’s borders, repaying those debts could be a bit easier under a recently proposed student loan repayment program.

White House Proposes Free Community College For Dedicated Students

The cost of a college education has outpaced inflation for the last few decades, making school less affordable for millions of Americans and driving student loan debt past the $1 trillion mark. And in the last decade, the for-profit education industry has taken in many billions of dollars in federal student aid for schools with high dropout rates. Today, President Obama offered a suggestion: Free community college educations for those willing to stick to it. [More]

Michigan College Guarantees Graduates Make $37,000 A Year, Or It Will Help Pay Off Their Student Loans

A small, private college in Michigan is giving new meaning to the idea of “gainful employment.” While the government’s recent rule was implemented to protect students from predatory for-profit colleges, non-profit institution Adrian College is making a guarantee to students aimed at helping them weather the high cost of student loans: make more than $37,000 a year after college or get some or all of your student loans reimbursed. [More]

To Anyone Paying For College: Start Your Year Off By Filling Out Your FAFSA

Among all the resolutions you should make for the new year — saving money, losing weight, quitting black tar heroin — there’s an easy one that gets left off that list by parents of college students or anyone else paying for a higher education: Filling out that Free Application for Federal Student Aid Form as soon as possible. [More]

Consumer Advocates Warn Sale Of Corinthian Campuses To Loan Servicer Company Could Further Hurt Students

Nearly a month ago embattled for profit-college group Corinthian Colleges Inc. announced it had found a buyer for 56 of its campuses under the Everest and WyoTech brands. But the proposed $24 million sale to Educational Credit Management Corporation has drawn the ire of consumer advocates for its lack of protections to students and the possibility that all liabilities related to litigation or private student loans carried by CCI would be waived. [More]

Man Allegedly Takes Out $262,000 In Student Loans Under Stepdaughter’s Name, Doesn’t Use It For Tuition

Here’s the thing, when you take out student loans you sign a promissory note saying you’ll use the funds to pay for tuition related costs. If you don’t, then you’re committing something called student loan fraud. That’s apparently the case for a Pennsylvania man who must now stand trial for taking out hundreds of thousands of dollars worth of student loans in his stepdaughter’s name only to use the money himself. [More]

CFPB Takes Action Against Two Alleged Student Debt Relief Scams

Student loan borrowers have enough to worry about, so they shouldn’t have to deal with being hounded by so-called debt relief companies promising to provide consumers with repayment benefits that actually come free of charge with federal loans. Today, the Consumer Financial Protection Bureau took action to put a stop to two such relief scams that reaped millions of dollars from thousands of consumers. [More]

Deal To Keep The Government Running Cuts $303M From Pell Grant Program

Congress’ deal to keep the federal government up and running may be coming at the expense of some of the nation’s poorest prospective college students. The spending package is poised to cut $303 million from the Pell Grant program. [More]

Senators Ask Dept. Of Education To Discharge Student Loans For Everest, WyoTech, Heald Students

While Corinthian Colleges — the failing for-profit educator behind schools like Everest University, WyoTech, and Heald College — sorts out new owners for most of its properties, several thousand of the schools’ students are left in limbo, unsure of who is responsible for their education — and unsure if that pricey education is worth the huge loans they’ve taken out to pay for it. Yesterday, a group of a dozen U.S. Senators asked the Dept. of Education to consider giving these students a way out of their federal student loans. [More]

For-Profit College Hired Exotic Dancers As Admissions Reps

The operators of a now-defunct for-profit college in Florida allegedly told its admissions directors to do whatever it took to sell the school to potential students. Among the tactics used by the school is one straight out of a wacky, low-budget, late-night college movie you might see on Cinemax. [More]