Earlier this year, the Consumer Financial Protection Bureau launched a public probe into potentially anti-consumer practices of the student loan servicing industry. More than 30,000 people responded, leading the Bureau, along with the Departments of Education and Treasury, to release a framework they hope will curb these questionable practices, promote borrower success, and minimize defaults. [More]

Education

Legislation Once Again Takes Stab At Allowing Borrowers To Refinance Student Loans

Lawmakers have renewed their support for students buried under piles of educational debt by — yet again – introducing a bill that would allow borrowers to refinance their student loans. [More]

ITT Educational Services Target Of Federal Fraud Investigation

Things don’t appear to have gotten better for for-profit college operator ITT Educational Services since it announced in September 2014 that it was under increased scrutiny from federal regulators, as the owner of the ITT Technical Institute chain revealed on Monday that the Department of Justice is looking into whether the company defrauded the federal government. [More]

White House Unveils New “College Score Card” To Help Students Select Schools

With student loan debt now well past the $1.2 trillion mark — due in no small part to students that paid top-shelf tuition prices but ended up with bottom-shelf educations and job prospects — there’s a need to provide American students and their families with all the relevant information they need when it comes to picking the right school for their goals and their wallets. [More]

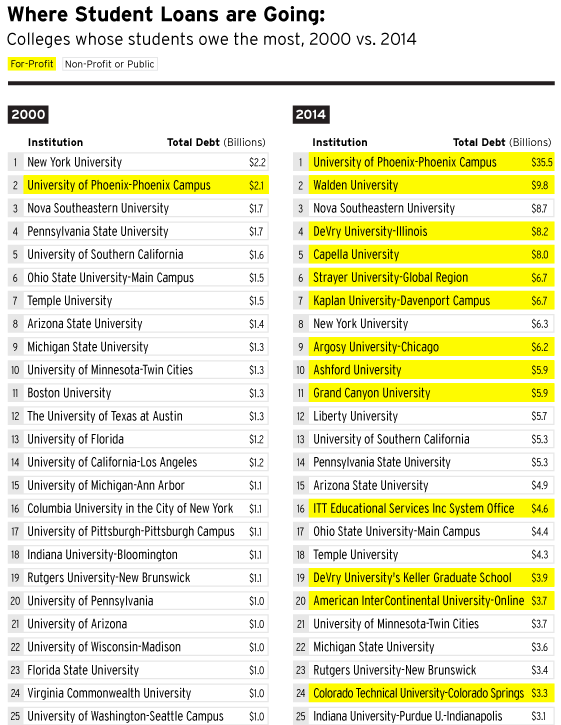

For-Profit Colleges Lead The Way On Loan Defaults: Report

During the Great Recession, the growing industry of for-profit colleges promised millions of Americans a path to a higher education. But the high tuitions charged by many schools sent U.S. student loan debt soaring to more than $1.2 trillion. A new report claims that while for-profit schools charged top-dollar, many students were getting a cut-rate education, making it difficult to obtain jobs that will allow them to pay down this debt.

[More]

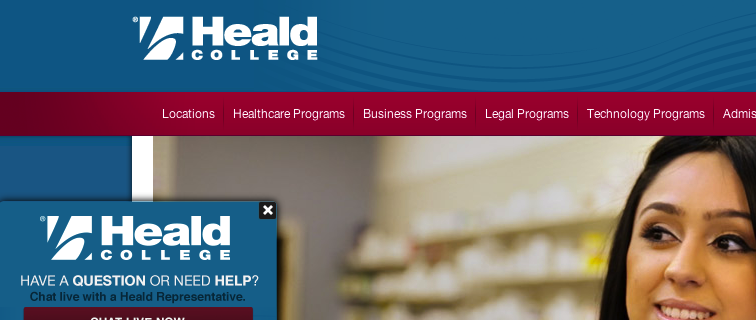

Corinthian Students Continue To Wait For Debt Relief As Department Of Ed. Reviews More Than 7,800 Claims

The tens of thousands of students seeking debt relief from the federal government after for-profit education chain Corinthian Colleges Inc. closed its Everest University, WyoTech and Heald College campuses, will have to wait a little longer, the Department of Education said Thursday as it provided an update on the number of federal student loans it has discharged and that are currently under consideration. [More]

Mass. AG, Lawmakers Call For More Assistance For Former Corinthian College Students

Ever since for-profit education chain Corinthian Colleges Inc. closed its Everest University, WyoTech and Heald College campuses, leaving tens of thousands of students with millions of dollars in loans, consumers advocates, legislators and others have urged the Department of Education to relieve former students of their debt burdens. Those calls for help continued on Tuesday with renewed pressure from Massachusetts Attorney General Marua Healey and Sen. Elizabeth Warren calling on the Dept. to rid victims of the defunct for-profit college of unsustainable loan payments. [More]

Sallie Mae Spinoff Navient Could Face CFPB Lawsuit Over Student Loans

In the short time since Navient – the nation’s largest student loan servicing company – spun off from Sallie Mae, the company has come under scrutiny for it allegedly unfair practices of overcharging and imposing excessive fees on consumers’ loans. While those practices resulted in a $97 million settlement with the Depts. of Education and Justice, and the Federal Deposit Insurance Corp, they could soon lead to a lawsuit from the Consumer Financial Protection Bureau. [More]

Dept. Of Education Plans To Overhaul Loan Forgiveness Program For Students Defrauded By Schools

As thousands of former Corinthian College students continue to wait to learn whether or not they’re on the hook to repay billions of dollars in student loans they took out to attend the now defunct for-profit college, the Department of Education announced plans to overhaul the loan forgiveness process for students who believe they have been defrauded by their colleges. [More]

Are Student Loan Forgiveness Programs Just A Free Pass For Grad Students With More Than $100K In Debt?

Just two years ago, the Consumer Financial Protection Bureau estimated that nearly 33 million American workers eligible for student loan forgiveness weren’t taking advantage of the programs. Times have certainly changed, as the federal government earlier this year revealed that these program were now so popular they cost nearly $22 billion more than they anticipated. But it doesn’t appear the increase in use for such plans is by those who might benefit the most. [More]

Servicemembers At Failing For-Profit Schools Not Protected By Veterans Affairs

When a for-profit college closes its doors, students are often left with hefty student loan tabs and little recourse. Some of those borrowers may be eligible for a discharge of their debts through the Dept. of Education, but others – like the thousands of veterans who used their GI Bill benefits to finance their education – are simply out of luck, often losing their chance to obtain a degree, thanks in part to failures within the Department of Veterans Affairs. [More]

Auto Loan Debt Tops $1 Trillion For First Time; All Consumer Debt Nearing $12 Trillion

Now that the Great Recession has gone from “is it really over?” to “remember when?” more Americans are buying cars, pushing auto loan debt beyond the $1 trillion mark for the first time in U.S. history. [More]

University Of Phoenix Stops New Enrollment At 14 Campuses, 10 Learning Centers

The country’s largest for-profit college chain is about to get a bit smaller, as a new report reveals that The University of Phoenix is no longer accepting new enrollments at two dozen campuses and learning centers across the country. [More]

Groups Say Proposed Student Loan Plan Doesn’t Provide Enough Assistance

The Dept. of Education recently proposed regulations intended to make the student loan repayment process less burdensome and drawn-out. Nearly two dozen consumer advocacy groups say that while these rules should help borrowers, more could be done to ensure that all students benefit. [More]

University Of Phoenix Faces Probe Into Military Recruiting Practices

A little more than a week after federal regulators set their sights on the University of Phoenix for possible deceptive and unfair business practices, the California Attorney General’s office is joining the investigation party by opening a probe into the for-profit college’s military recruitment practices. [More]