App Developer Settles Charges It Hijacked Consumers’ Phones To Mine Virtual Currency

The FTC and New Jersey AG’s office allege that the makers of the Prized app used the program to infect customers’ phones with malware for their own use.

Some reward programs aren’t really rewarding. In fact, some are downright harmful to consumers. That was apparently the case with an Ohio-based smartphone app developer that recently agreed to settle charges that it hijacked consumers’ phones through a seemingly innocuous gaming app.

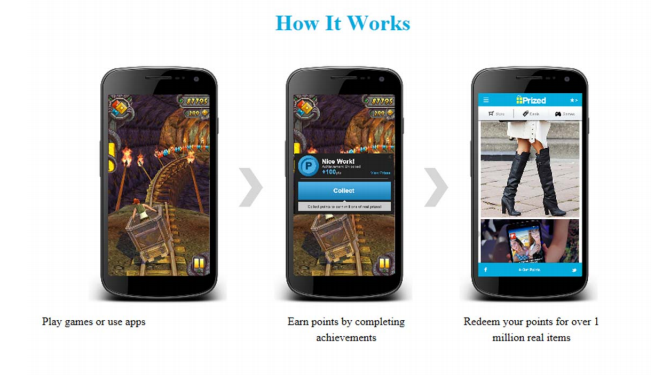

Smartphone app developer Equiliv Investments advertised its Prized app as a way for users to earn points for clothing, gift cards and other prizes by downloading affiliated apps, playing video games embedded with advertisements, or taking online surveys.

But the Federal Trade Commission and New Jersey Attorney General’s office say the app was actually used as an entryway to mine virtual currency like Litecoin, Dogecoin, and Quarkcoin.

According to a complaint [PDF] filed by the FTC and AG’s office, Equiliv and director Ryan Ramminger began marketing the Prized app in February 2014 through the Google Play Store, Amazon App Store and other third-party sites.

The company promised users that the downloaded app would be free from malicious software and viruses.

However, shortly after users download the app, it took control of the device’s computing resource to mine for virtual currencies.

The complaint alleges that the app developers then used consumers’ devices to attempt to solve equations that create virtual currencies, thus lining their own virtual wallets.

As a result of this mining, the infected devices quickly burnt through their monthly data plans, lost battery power rapidly and recharged more slowly.

“Consumers downloaded this app thinking that at the very worst it would not be as useful or entertaining as advertised,” said Acting New Jersey Attorney General John J. Hoffman. “Instead, the app allegedly turned out to be a Trojan horse for intrusive, invasive malware that was potentially damaging to expensive smartphones and other mobile devices.”

In all, the complaint alleges that Equiliv and Ramminger violated the FTC Act and the New Jersey Consumer Fraud Act.

To resolve the allegations, the company has agreed to a proposed settlement banning it from creating and distributing malicious software.

Additionally, the company is required to pay a suspended monetary judgement of $50,000 to the state of New Jersey.

The case is part of the FTC’s ongoing work to protect consumers taking advantage of new and emerging financial technology, also known as FinTech. As technological advances expand the ways consumers can store, share, and spend money, the FTC is working to keep consumers protected while encouraging innovation for consumers’ benefit.

App Developer Settles FTC and New Jersey Charges It Hijacked Consumers’ Phones to Mine Cryptocurrency [Federal Trade Commission]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.