App That Promised To Pay Users For Fitness Trapped Some On Erroneous Payment Treadmill

The mobile app GymPact, later known as Pact, was a tool that gave users a financial incentive to exercise, eat fruits and vegetables, and to log what they ate. Only the Federal Trade Commission claims that Pact users were charged when they weren’t supposed to be, and some lost hundreds of dollars in a negative-option mess that they couldn’t cancel.

How it was supposed to work

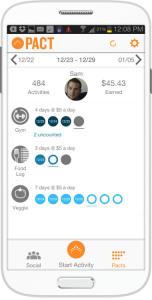

The idea behind the app was pretty simple: Users promised to exercise, eat plants, or log their food intake in the separate app MyFitnessPal a certain number of times per week. If they missed any tasks, they would automatically be charged between $5 and $50 from a credit card or PayPal account for each one.

The idea behind the app was pretty simple: Users promised to exercise, eat plants, or log their food intake in the separate app MyFitnessPal a certain number of times per week. If they missed any tasks, they would automatically be charged between $5 and $50 from a credit card or PayPal account for each one.

The penalty payments were divided up between the company itself and the users who did complete all of their tasks. This resulted in payouts of, for example, around $.25 for each workout, which users could withdraw once the total topped $10 or so.

Yet problems with those penalty payments, and charges for users who had completed their tasks or who had opted out, were the reason the FTC filed its complaint [PDF] against Pact.

Users filed an unusually high number of chargebacks against the company.

“A payment processor and a bank with which Defendants worked warned Defendants about the app’s high chargeback rate, and the company was fined by a financial institution for exceeding Visa’s permitted chargeback rate for six consecutive months,” the FTC notes in its complaint.

The app’s users were reversing those charges because they say they were being charged when they weren’t supposed to. Users claimed that the app racked up hundreds of dollars in charges when they thought that they had suspended or even closed their accounts, or when they had performed all of their activities for the week.

Negative option

Every week, pacts would automatically renew, and in some cases they would renew even if a user had taken a break. It was difficult to figure out how to quit the program, turning it into a negative-option fitness test. Think of a subscription box or the old Columbia Records business model where instead of choosing to buy an item, you have to take action and specifically opt out to not buy anything.

“Consumers who used this app expected the defendants to pay them rewards when they achieved their health-related goals, and to charge them only when they did not,” Tom Pahl, Acting Director of the Bureau of Consumer Protection, said in a statement. “Unfortunately, even when consumers held up their end of the deal, Pact failed to make good on its promises.” That’s not how a pact is supposed to work.

The end

The app abruptly shut down in July, with customer service closing down a month after that. Users can expect to receive an email about possible refunds if they still have a balance in their accounts, or if they made a complaint about erroneous charges.

The company has been ordered to pay almost $1 million back to users who filed complaints, and to distribute any funds left in users’ accounts to them immediately. The FTC’s total penalty against Pact is $1.5 million, but over $500,000 of that has been suspended because of the company’s financial situation.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.