Despite Threats Of Disaster, Investors In Comcast, Verizon, Etc. All Seem Totally Fine With FCC’s Plan To Reclassify Broadband

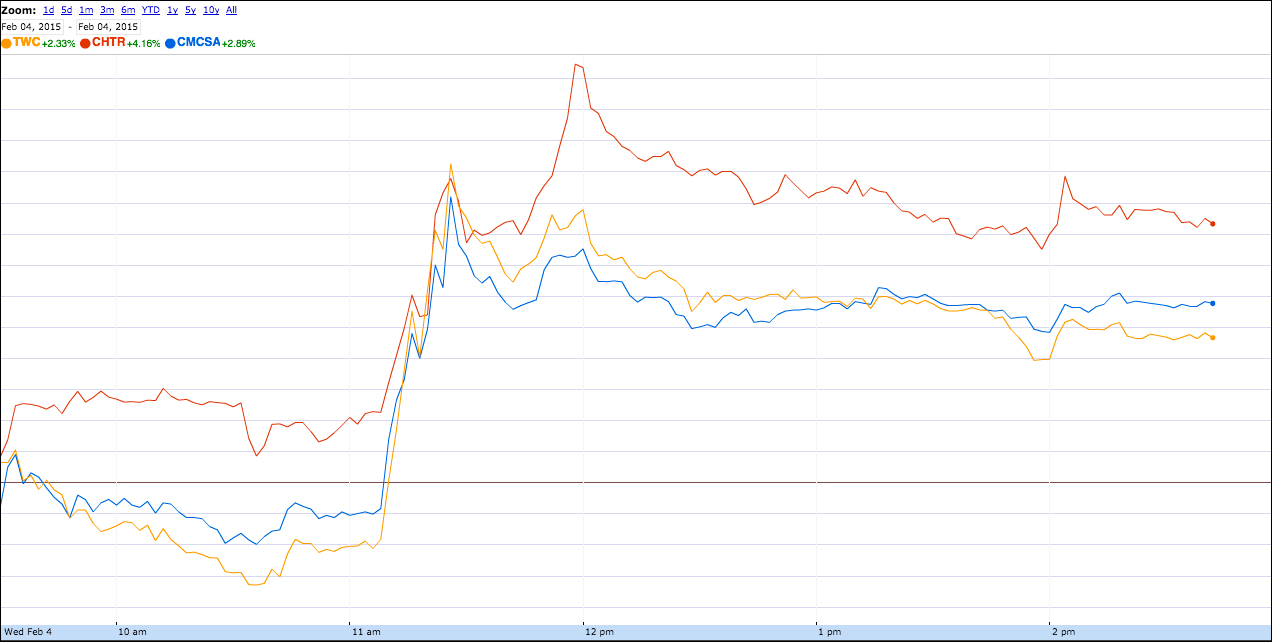

Stock price changes for Comcast, TWC, and Charter, as seen on Google Finance on February 4, 2015. All jumped significantly after FCC chair Tom Wheeler’s op-ed about net neutrality hit the internet at 11:00 a.m.

For a year now, the big ISPs have been having a series of public freakouts that stronger net neutrality rules would make for an uncertain regulatory future, leave them exposed, drive investment down, and hurt their businesses. And yet earlier today the chairman of the FCC dropped his bombshell that the agency is going to aim for the strongest possible regulation anyway. So how’d the market respond?

The stocks all went up.

Bloomberg reports today that pretty much all the major ISPs, including Comcast, Verizon, AT&T, Time Warner Cable, Charter, and Cablevision, all saw at least modest gains during the hours immediately following Wheeler’s announcement.

Comcast, TWC, and Charter all particularly benefited, seeing gains of as much as of 4.6%, 5.2%, and 6.9% respectively.

So if regulation in all its forms is supposed to be bad for business, what’s fueling these gains?

Bloomberg quotes an analyst who theorizes that forbearance is working its magic. Specifically: Title II could allow the FCC to impose rate controls on ISPs, and big business — and its investors — had been skittish about that possibility. But now with the outline (PDF) of the proposal available, investors can see that the FCC is steering well clear of rate regulation and changes in fees or taxes.

In other words, investors are happy because cable companies can continue to charge you as much as they darn well please. They just can’t throttle your content while they’re doing it.

Comcast, Cable Stocks Rise as FCC Won’t Try to Control Rates [Bloomberg Business]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.