Comcast Keeps Claiming Competition Abounds, Despite Mountains Of Evidence From Planet Reality

The chairman of the FCC has recently said several times that broadband competition is sparse, not plentiful, but Comcast seems to know better. In their response filing (258-page PDF), Comcast repeats their argument that the existing broadband market, as-is, will prevent them from behaving badly. Why? because they’ll hemorrhage subscribers if they do:

“Comcast has significant disincentives to harm edge providers for many reasons, foremost among them that blocking or degrading access to streaming video, applications, or other online content likely would cause significant numbers of customers to switch providers and thus compromise Comcast’s broadband business.”

But as we’ve seen in maps and in data from the FCC, most of us don’t really have any place to jump ship to. And yet Comcast seems to think all its deeply dissatisfied subscribers can flee at will to the same old scapegoats: DSL, mobile, satellite, and Google.

Here’s what Comcast’s saying, and why it’s misleading.

1.) “Telephone companies appear well-positioned to offer highly competitive broadband speeds well into the future.”

To hear Comcast tell it, the telco market — DSL, mainly, but also fiber — is in tip-top shape. With Verizon, AT&T, and CenturyLink all expanding, everything is coming up roses for consumers nationwide.

Those companies don’t want the FCC to require them to offer actual high-speed broadband connections, but it is true that they’re slowly expanding to offer more of them anyway. The key word there, though, is “slowly.”

While companies like AT&T and CenturyLink are gradually expanding into gigabit service, those services right now are very small-scale and reach only a comparative handful of consumers. AT&T offers “GigaPower” service in three cities, with 11 more scheduled, and CenturyLink has just started a rollout of gigabit fiber in 11 cities. Hopefully in five or ten years’ time the telecom carriers will indeed prove to be seriously competitive services, but in 2014 they’re still more like sideshow curiosities.

In fact, in their public comment on the merger, CenturyLink expressed strong concerns that letting Comcast merge with TWC would harm their own business and reduce competition even further:.”CenturyLink’s ability to offer competitive video choices to new customers and in new markets – and to offer a viable product to consumers in its existing markets – depends fundamentally on the existence of a fair (if not level) competitive playing field,” they wrote. “This transaction threatens to tilt the playing field decisively against small providers such as CenturyLink in a number of significant ways, and thus to limit or prevent competitive facilities-based entry, much to the detriment of consumers.”

So that’s DSL. What about everyone else?

2.) “Cable overbuilders, new entrants like Google fiber, municipal providers, fixed wireless providers, and satellite broadband providers also are competing vigorously. And well-capitalized and aggressive nationwide mobile broadband providers now offer services that provide speeds comparable to many of the fixed broadband services that consumers purchase.”

Let’s tackle these one at a time.

Those cable overbuilders, like small company RCN, are already being heavily squeezed out of the market by pressure from Comcast. They, like CenturyLink, deeply fear for their ability to keep competing even in a small way against Comcast as it grows. RCN wrote in their anti-merger comment to the FCC that, “With its monopsony power in programming acquisition unchecked, the combined company would have a natural incentive to … engage in predatory conduct.” They added that letting Comcast and TWC merge would have a deleterious effect on small overbuilders like them, and that, “if other small providers are driven out of the market, others cannot and will not enter to replace them.”

Of course, one new major company is trying to enter to replace them, which brings us to Google. Google Fiber seems to be doing very well so far, but the product only exists in three cities currently (or two-and-a-half, really; customers in Austin cannot yet register for service). There are nine more metro areas in the running eventually to become the fourth Google Fiber city, but no plans have yet been made. Even if Google undertook an extremely aggressive plan for expansion, it would be many, many years — if not decades — before Google Fiber became a national provider.

Municipal providers, on the other hand, are indeed desperately trying to expand. But it’s a challenge for them exactly because of Comcast and other incumbent companies, which together have spent a lot of time and money making muni broadband illegal in as many states as possible.

The FCC may yet override those state-level blocks, but the outcome of that proceeding is still very much up in the air. And even if the FCC did manage to overrule all those state laws tomorrow, it would, again, take years if not decades for municipal broadband to become a factor in the majority of cities or counties out there — and state-level governments are not suddenly going to become responsive to spending on new projects just because there are no longer laws blocking them.

What of fixed wireless? That’s the technology that AT&T is promising to bring to rural customers if their mega-merger with DirecTV gets approved. There’s some exciting potential there, especially for folks far-flung from cities, but it’s not widely available just yet.

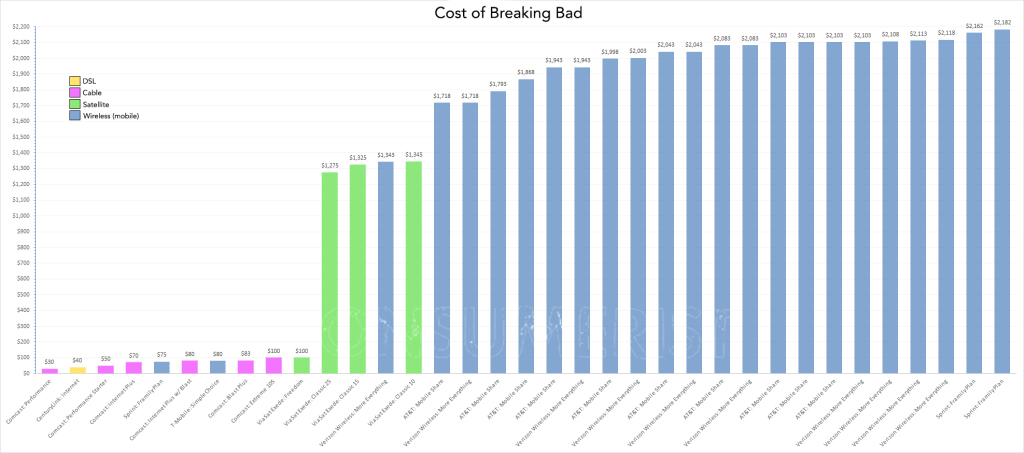

That, then, leaves mobile broadband and satellite as the last two likely competitors to Comcast. But as we’ve already covered at length, no matter how much Comcast wants to sing the praises of those technologies, for most consumers they are realistically no competition at all. High prices and low data caps make them simply not feasible for most home use.

Saying a thing a whole bunch of times doesn’t make it true.

Comcast keeps trying to have it both ways: they say they need to buy Time Warner Cable to remain competitive against all these other really rough players in the room. But meanwhile every other company, even some very big ones, is desperately trying to claw back any space to compete in a world where Comcast is the clear heavyweight.

Starting a new company, or even expanding an existing smaller one, is a prohibitively costly and complex undertaking. Barring some unforeseen corporate and regulatory miracle, the players we have in the field now are the only ones we’re going to have for quite some time. And those players keep buying each other out, leaving us with fewer than ever before.

In ten or twenty years, we probably will have a much more robust fiber network, and faster, more reliable, cheaper mobile data, available to individual consumers. But Comcast wants to buy Time Warner Cable now, not in some rose-colored best-case 2025. And in the here and now, most consumers’ choice is still limited to “slim” or “none.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.