Until Banks Settle On Single Way To Disclose Fees, It’s Hard To Compare Checking Accounts

Most banking services come with a laundry list of small-print, hard-to-read disclosures detailing how much one might expect to pay for things like depositing a check, talking to a teller or checking an account’s balance. Knowing that information before signing on the dotted line for a new checking account is paramount if you don’t want to be saddled with some of the billions of dollars consumers spend on checking account fees each year. However, as a new report continues to show, actually finding that information online can often be an exercise in futility.

Most banking services come with a laundry list of small-print, hard-to-read disclosures detailing how much one might expect to pay for things like depositing a check, talking to a teller or checking an account’s balance. Knowing that information before signing on the dotted line for a new checking account is paramount if you don’t want to be saddled with some of the billions of dollars consumers spend on checking account fees each year. However, as a new report continues to show, actually finding that information online can often be an exercise in futility.

A new study from WalletHub took a look at just how consumer-friendly banks are when it comes to providing information about their checking account fees online. The answer: not so great, but it’s getting better.

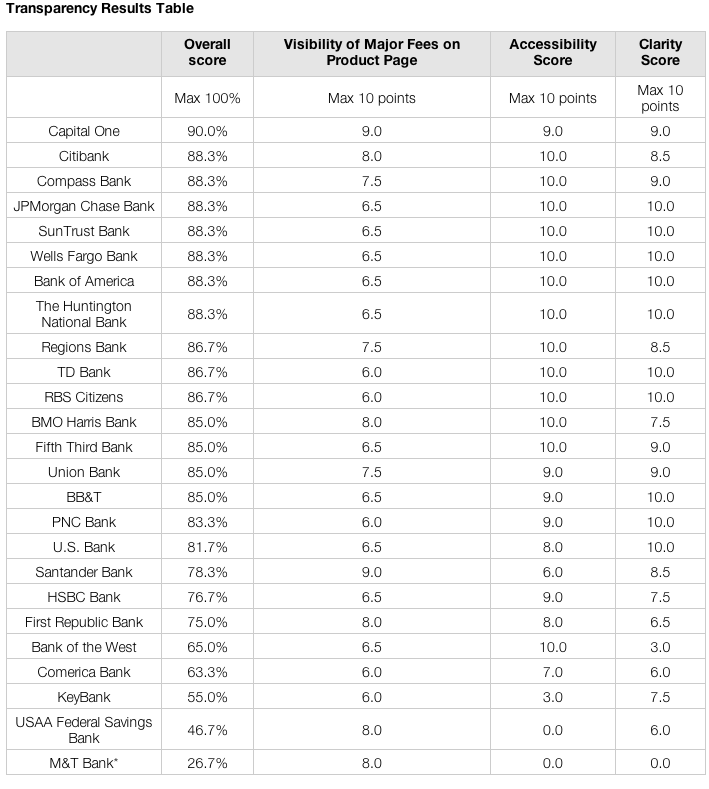

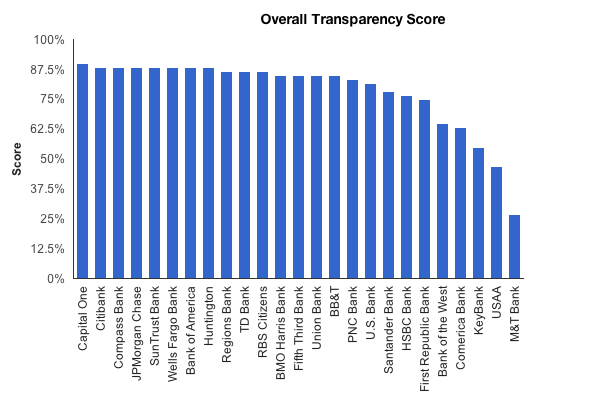

Of the 25 banks analyzed on the clarity, accessibility and visibility of fees for their checking products posted online, a majority were found to provide useful and sought-after information on their product’s webpages.

However, several banks provided little-to-no information online. M&T Bank, which scored just 26.7%, and USAA, which scored 46.7%, did not provide any fee schedule information to consumers on their checking account product pages.

Officials with M&T Bank tell WalletHub they plan to include fee information on their pages later this month.

On the flip side, Capital One topped the list for transparency with an overall score of 90%, followed by a seven-way tie for second place. Citbank, Compass Bank, JPMorgan Chase, SunTrust Bank, Wells Fargo Bank, Bank of America and The Huntington National Bank each scored 88.3%.

While those scores appear to be high, WalletHub contends that there’s still plenty of work for banks to do in terms of educating customers about the costs of their checking account products.

For years, consumer advocates and regulators have worked to create more consumer-friendly, and easily readable disclosures for checking accounts and other bank issued products.

Overall, the report found that banks continue to lack general uniformity in terms of checking account fee disclosure forms, format and content; making it increasingly difficult to for consumers to compare their checking account options across the marketplace.

While there are approximately 30 total fees associated with the average checking account, some banks charged as many as 50 fees for a range of actions related to checking accounts.

“The sheer number of different fees associated with checking accounts prevents effective product comparison and decreases the likelihood that consumers will find the best checking accounts for their needs,” the report states.

Back in 2011, Pew Charitable Trusts developed a model summary disclosure box that shows how banks can concisely list fees and terms of a checking account in an easy-to-understand format. Banks that currently use the box include JPMorgan Chase, Bank of America, Citibank, Wells Fargo, TD Bank, Capital One, Fifth Third Bank, Webster Bank.

WalletHub provided a list of helpful tips for consumers in the market for a new, or their first, checking account:

Read the fee schedule thoroughly – The number of checking account fees that banks disclose on their product pages varies greatly from one bank to another. Absence of a fee from the product page does not necessarily mean the fee is $0. Consumers should always review the fee schedule before opening an account to avoid any surprises in the future.

Don’t expect consistency in format – While many large banks have adopted a summary disclosure form designed by the Pew Charitable Trusts to make fee disclosure practices more uniform and straightforward, not all have adopted it. And of the ones who have, there are discrepancies among their disclosures.

Evaluate your practical needs – As evidenced by the number of fees that checking accounts charge, they offer a plethora of services ranging from straightforward ATM withdrawals to international wire transfers. You must therefore consider what exactly you’ll need from your checking account in practical terms.

Fewer disclosed fees doesn’t mean fewer actual fees – The number of fees listed by banks in disclosures varies from 20 to 40. Some banks disclose their fees only after a customer has opened an account. Others disclose their fees in inconspicuous sections of their websites. Consumers should be aware that there are banks that disclose only a part of their full list of fees initially, another part during the application process and the rest after the consumer has signed up for the account.

Cast a wide net – When you begin your search for a new checking account, start broad and refine as you go. That means you should avoid entering the search process with any preconceived notions, such as the particular institution you’ll get your account from, how large of a bank you wish to do business with, the necessity of in-person banking, etc.

Supplement with other accounts – A checking account will enable you to receive direct deposit of your monthly checking account, automatically pay monthly bills, and benefit from ad hoc access to cash. You can’t use a checking account for everything, though. You might therefore want to strategically supplement your checking account with an attractive savings account and/or credit card offer in order to make your financial management as efficient and rewarding as possible.

Checking Account Transparency Report: How Easily Can Consumers Shop for a Checking Account Online? [WalletHub]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.