Just in time for the fourth anniversary of its creation, the Consumer Financial Protection Bureau announced its expanding the type of consumer complaints it accepts to include prepaid cards and other nonbank products. [More]

debt settlement

Illinois Files Suits Against Debt Settlement Companies That Allegedly Scammed Student Loan Borrowers

We already know that some debt settlement programs provide little relief for debtors, and consumers who contributed to the $1.2 trillion student loan debt tab appear to be the top target for these companies. Today, the Illinois Attorney General announced lawsuits against a pair of debt-settlement companies that targeted, and allegedly misled, student loan borrowers. [More]

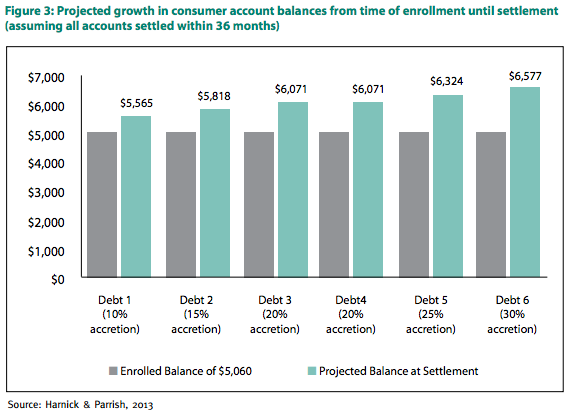

Debt Settlement Programs Often Do More Harm Than Good For Consumers

In the past we’ve told readers about the a number of bogus debt-relief operations that scammed already vulnerable consumers. But a new report from the Center for Responsible Lending points out that it’s not just shady companies that hurt consumers. Sometimes legitimate debt settlement programs can leave consumers in more debt than they started out with. [More]

Citibank Screws Up Money Transfers, Admits Fault, Calls Us 20 Times A Day

Henry and his wife went broke, then worked out a payment plan with Citibank to settle their debt. The idea was to be proactive in order to avoid harassment about bills they couldn’t afford. [More]

Don't Use A Debt Settlement Agency

Steer clear of debt settlement agencies. A good deal charge unnecessary fees and there’s really nothing they can do legally that you can’t do on your own. Some of them are even outright fraudsters. [More]

3 Reasons To Avoid Using A Debt Settlement Company

As the economy has weakened and unemployment has caused debt to become unmanageable for many people — one type of company has flourished — debt-settlement services. [More]

Worst Week Ever For Debt Settlement Industry

It may have been a rough week for Comcast and Goldman Sachs, but the debt settlement industry arguably faced even worse luck. [More]

Confessions Of A Debt Settlement Company Worker

After spending a year (one of the worst of my life) working at a debt settlement company, I feel that I am obligated to warn as many consumers as possible about how badly you can ruin your financial situation by using one of these companies. My new job is at an all natural bakery, I no longer wish to swerve my truck into a tree on the way to work. Debt settlement is the process of eliminating your debt by ceasing payment to the creditor, and then negotiating with the card companies or collection agency to pay less than the balance owed. The debt settlement company charges a rather hefty fee for this service; however, the consumer should be saving money on the deal because they are paying significantly reduced balances to clear their debt. This is how it is supposed to work. This is not how it usually works.