Comcast Officially Files for TWC Merger, Claims Broadband Competition Is Fine Because You Have A Smartphone

It’s a big day for Comcast: not only did they win a big old golden poo this morning, but also they formally took the first step in the regulatory dance that stands between them and their purchase of Time Warner Cable by filing a mountain of paperwork with the FCC. The massive document contains all of Comcast’s explanations for why the merger is the best idea ever… and it’s a doozy. Let’s take a closer look at their arguments, shall we?

It’s a big day for Comcast: not only did they win a big old golden poo this morning, but also they formally took the first step in the regulatory dance that stands between them and their purchase of Time Warner Cable by filing a mountain of paperwork with the FCC. The massive document contains all of Comcast’s explanations for why the merger is the best idea ever… and it’s a doozy. Let’s take a closer look at their arguments, shall we?

Formally called the “Applications and Public Interest Statement,” the filing [180-page PDF] explains who the parties are, what their business is, and why their merger would be for, and not against, the public interest. It’s basically a deep expansion of Comcast PR’s greatest hits: “Applicants compete in a dynamic, expanding, and highly competitive marketplace” is one we’ve heard before, as is, “Because the parties do not compete for consumers, there is no plausible theory of competitive harm arising” from the merger. In fact, the vast bulk of the filing is spent explaining why and how the marketplace is currently competitive and will remain so post-merger.

Wouldn’t it be great if all that active competition was actually real? Consumers sure would benefit! But it’s not, and we don’t. Competition in the TV and broadband space is minimal at best, and Comcast’s legal masterwork of window-dressing doesn’t change that. No matter how they frame the arguments — geographically, financially, or technologically — the fact remains that competition, already minimal at best, will not increase with this deal.

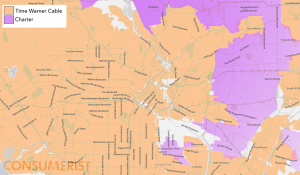

The Geography Argument

“The transaction presents no competitive concerns because … Comcast’s and TWC’s service areas are distinct and the companies do not compete in any relevant market.” — p. 127

It’s true that Comcast and Time Warner Cable don’t actually compete against each other directly in any areas. Comcast has been waving that flag since the first day the merger was announced, and it’s a true fact. It just also doesn’t matter.

We’ve been through this before: TWC and Comcast might not compete with each other but unfortunately, nobody else really competes against them in many markets, either.

As Comcast bigwig David L. Cohen pushed hard in both a media call and in a blog post, post merger there would be “no reduction in consumer choice” anywhere. “Customers will still have the same number of video, broadband, or phone options before the deal as after it.” And that is indeed true.

But anything times zero is still zero, and Comcast’s stance isn’t useful. There already is no competition for huge numbers of consumers, and making the biggest company bigger is really not going to help on that front.

Comcast’s argument about overlapping coverage areas is, at this point, mostly important for their response to challenges of it. According to Comcast, the reason we don’t see high levels of broadband access competition is really because we’re not counting right. If we’re just looking at the cable and fiber companies, Comcast says, we’re doing it wrong.

The Technology Arguments

Contrary to the picture some have painted of DSL as a defunct service, between December 2008 and December 2012, DSL-based broadband connections grew at an average annual rate of 25 percent, exceeding cable broadband’s pace of growth at an average annual rate of 18 percent.” — p. 48

“Competitive forces are also present – increasingly and robustly so – via mobile wireless services offered by well-capitalized and aggressive national wireless providers. For a large number of Americans, wireless is already a meaningful broadband alternative.” — p. 51

If David L. Cohen has any buddies running DSL companies, surely they are right now thanking him for doing them a solid. Today Comcast is absolutely singing the praises of DSL, apparently the nation’s greatest broadband technology. The “new DSL,” as Cohen continuously proclaimed, is a worthy competitor to cable.

In their filing, Comcast asks us to consider AT&T in particular: “AT&T’s DSL and FTTN [fiber] U-verse services significantly overlap both Comcast and TWC … and AT&T has affirmed its plans to continue to enhance and expand these services.”

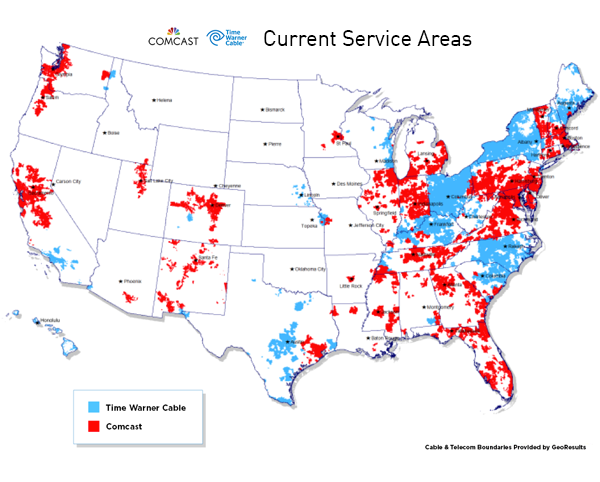

Here’s where Comcast and Time Warner Cable are available, according to Comcast:

Comcast’s “no, really, we don’t compete with TWC” coverage map, via their website.

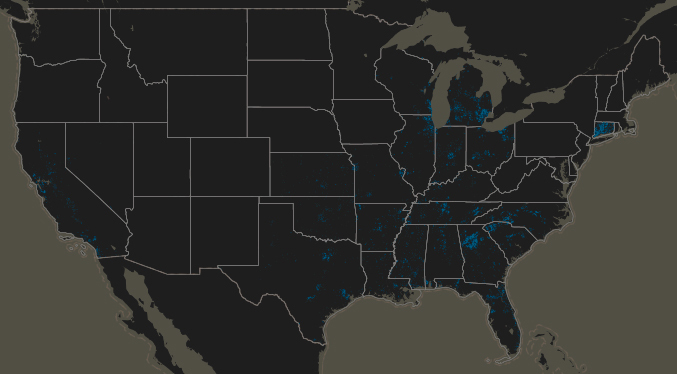

Now here’s where AT&T provides wired broadband services, according to the National Broadband Map:

The parts of the country where AT&T provides broadband access, via the National Broadband Map.

Even if AT&T’s service is every bit as splendid as Comcast insists, it’s still a complete non-factor for millions of broadband consumers in tons of cities and states, including the densely populated urban corridors of both the northeast and the West Coast. Meanwhile Verizon FiOS isn’t expanding, Google Fiber is still only in three cities even if it might expand, and both Verizon and AT&T are trying to cut back on what land line service they offer.

So much for wire-line competition. But there’s still 4G LTE, as Comcast stresses. So what about wireless competition?

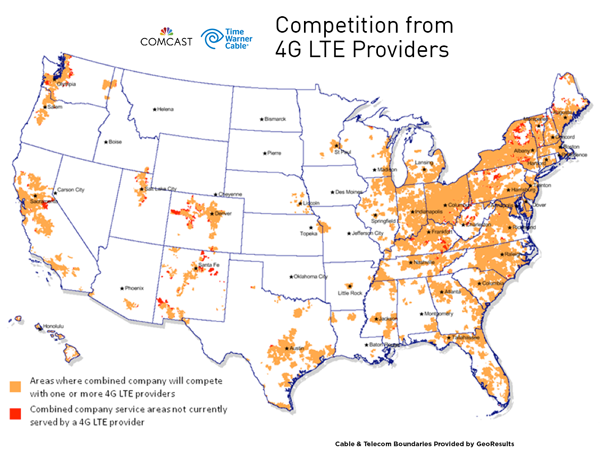

The 4G Fallacy

The cable industry is well aware of the possibility of material mobile broadband substitution for cable broadband within the next few years. With the increasing ubiquity of 4G wireless connectivity and the multitude of enabled devices including smartphones and tablets, these predictions are increasingly becoming a reality. … 4G wireless broadband technology can deliver speeds that rival those of wireline cable and telco companies — well over 50 Mbps downstream.” — p. 54-55

Comcast is trying their hardest to sell the idea that mobile broadband is viable competition to wired broadband service. Your phone, they say, is every bit as connected as your house. Therefore, competition already exists and is robust.

Where Comcast/TWC coverage overlaps with 4G LTE coverage, according to Comcast.

To give credit where it’s due, Comcast is indeed partially right about 4G. Wireless broadband really is a huge and growing factor to consider in the internet landscape. We’ve looked at the numbers before: more than half of the country does use their phones for internet access, and about a third of people who own smartphones use them almost exclusively for their internet access.

But although mobile broadband may be a truly competitive option five or ten years from now, it certainly isn’t yet. Cohen reluctantly admitted that “wireless pricing today for some consumers is not competitive,” but implied that those consumers are the minority.

They aren’t.

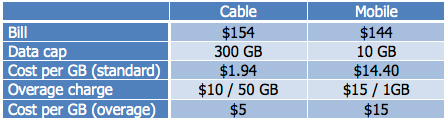

The average monthly mobile bill these days runs about $144 per month, give or take. Verizon Wireless is the largest mobile phone carrier in the country, and under their newest pricing plan, introduced in February, a bill of approximately $140 per month will get a user 10 GB of data use. Users who go over their threshold pay $15 per 1GB of extra data.

Meanwhile, your average family pays about $150 per month for their home TV and broadband service. If that service is with Comcast, then it has a 300 GB “data threshold” and the overage charge, when it’s enforced, is $10 per 50 GB.

The numbers are only rough averages, and comparing two very different services is handling the proverbial apples and oranges. But the overall message is still clear: mobile, wireless broadband is still a much more expensive way to move data than a traditional broadband connection is.

The numbers are only rough averages, and comparing two very different services is handling the proverbial apples and oranges. But the overall message is still clear: mobile, wireless broadband is still a much more expensive way to move data than a traditional broadband connection is.

Of course, we don’t all necessarily need that much data. For someone who never does anything more complicated than check their e-mail, perhaps mobile-only is already a viable alternative. Most of us aren’t such low-volume users, though. Use Netflix or Hulu at all? HD video uses roughly 2 GB of data per hour streamed. 10 GB would get you a couple of movies, or about half a season of prestige TV. But not both. And nothing else on top of it, either.

Mobile wireless is not only limited and pricey; it’s also unreliable. If you live in an area (like Manhattan) with too many users trying to connect to a fancypants 4G LTE network, you may get kicked down to much slower 3G connectivity. And that’s if your carrier even offers LTE service where you live. And although LTE network connections can offer download and upload speeds on par with their traditional broadband brethren, on average they don’t yet.

What Happens Next

With today’s filing, Comcast has drawn up their battle lines. As predicted, they’re pushing back hard on the idea of broadband competition. They insist that they’ll make TWC customers’ lives better, get more poor families using the internet, and keep being the best at net neutrality.

The reality, though, is a lot hazier. Comcast’s behavior has a decidedly spotty record, and the company already has an outsized amount of clout.

Head executives from both Comcast and Time Warner Cable, along with a handful of other pro-business and pro-consumer witnesses, will testify before the Senate Judiciary Committee tomorrow. From there, the process rolls on.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.