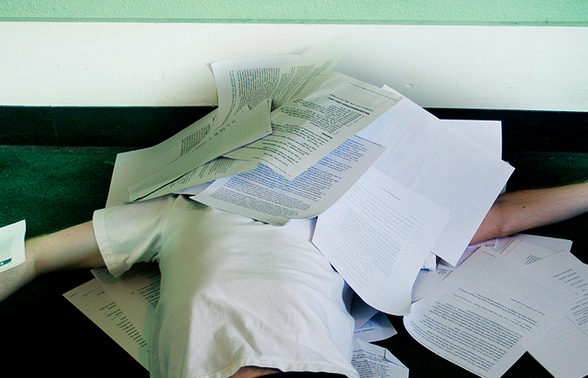

What Documents To Keep And Which To Pitch After Tax Season

(Klaus M)

Sure, we don’t all have endless amounts of file space to keep every little piece of paper we’ve accumulated over the years, but there are a number of important tax documents we’d be better off keeping on hand, Kiplinger reports.

WHAT YOU SHOULD KEEP

Actual Tax Returns: Tax returns can help you in a number of circumstances from applying for a mortgage to the always possible visit from the Internal Revenue Service.

The IRS has up to three years after the tax-filing deadline to initiate an audit, so Kiplinger suggests keeping supporting tax documents around for that long, as well. These documents include: credit-card statements, canceled checks, debit-card transactions and receipts showing deductions; letters from charities reporting gifts; and paperwork reporting mortgage interest, capital-gains distributions and income.

Records showing stock and mutual funds purchase dates and prices: When selling an investment you have to report the purchase date and price to establish a basis, Kiplinger reports.

While brokers are required to report the cost basis of stocks purchased in 2011 or later and mutual funds and ETFs purchased in 2012 and later, it’s a good idea to keep your own records.

Form 8606: This form, which reports nondeductible contributions to traditional IRAs, should be kept on hand until you withdraw all money from the IRA. By doing so you can assure that you can prove you’ve already paid taxes on the contributions so you won’t have to pay taxes again when you begin withdrawing the funds.

Records of home purchase cost and home improvements: There are circumstances, such as living in the home for less than two of the past five years or making a large profit from a home sale, that would cause a consumer to pay taxes on part of their profits. Homeowners can add the cost of major home improvements to reduce the taxable gain.

WHAT YOU CAN TOSS

Pay stubs: As soon as the information matches up to your W-2 for the year you can go ahead and pitch these.

Monthly brokerage statements: These can be tossed when the information matches your year-end report and your 1099s.

Credit card receipts: If they aren’t needed for tax purposes these can be disposed of once you check them against your monthly bill.

Utility, phone and cable bills: Toss these papers as soon as the next month’s bill arrives.

For more information and answers to tax season questions visit Consumerist’s Tax Dad:

Ask Tax Dad: Disabled Veterans, Commuting Actors, And Depreciating Dishwashers

Ask Tax Dad: Invasion Of The Dependent Relatives

Ask Tax Dad: How Do I E-File? What’s A Deduction, Anyway?

Ask Tax Dad: Micro-Business, Rental Home, Deadbeat Ex, And Government Shutdown

Ask Tax Dad: Send Us Your Questions For Consumerist’s Tax Columnist

Tax Records You Can Toss [Kiplinger]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.