Will Netflix Speeds Improve For Verizon, AT&T Internet Customers Anytime Soon?

Starting in the second half of 2013, Netflix speeds on several major Internet service providers began to sink drastically as the ISPs allowed Netflix downstream traffic to bottleneck, resulting in slow, fitful delivery to consumers who had paid Netflix for the service and the ISPs for broadband access. Earlier this year, Comcast speeds turned up out of their nosedive when the company made a profitable deal with Netflix, but what about everyone else?

Starting in the second half of 2013, Netflix speeds on several major Internet service providers began to sink drastically as the ISPs allowed Netflix downstream traffic to bottleneck, resulting in slow, fitful delivery to consumers who had paid Netflix for the service and the ISPs for broadband access. Earlier this year, Comcast speeds turned up out of their nosedive when the company made a profitable deal with Netflix, but what about everyone else?

A recent story from ArsTechnica looks at the possible cause for a delay in a paid-peering deal between Netflix and two major ISPs whose customers are currently lucky if they are able to access Netflix at all — Verizon FiOS and AT&T U-Verse.

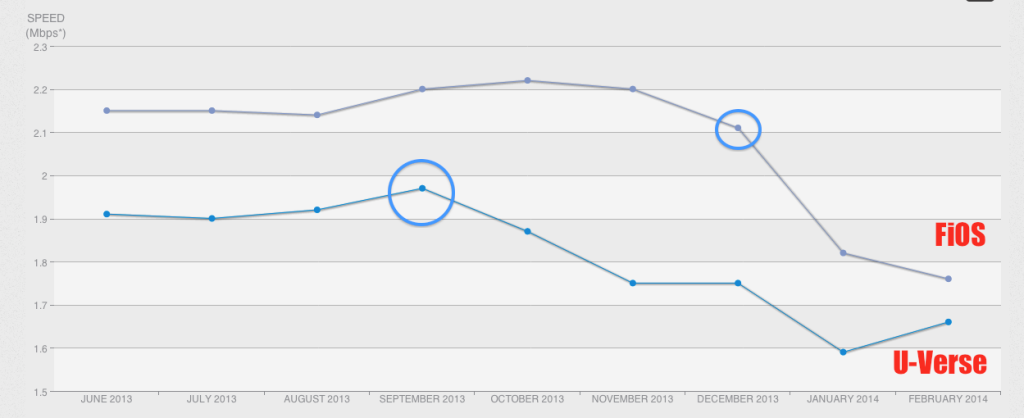

As you can see from the Netflix-supplied chart above, U-Verse speeds have been sinking last September, rebounding slightly in February, but still barely watchable at below 1.7 Mbps.

Verizon FiOS speeds were actually improving until the fall of 2013, when they began to drop. Then between December and January — a time period that just happens to coincide with a federal court’s gutting of the FCC’s net neutrality rules — they sank like a wily coyote with an Acme safe around his ankle, and have continued to slide.

It’s been reported that Netflix is in talks to make a Comcast-like deal with these two companies, one that would either put Netflix servers in the ISPs’ data centers or give it more direct access to the ISPs network. But why haven’t there been any deals made?

The better question might be why did the Comcast deal come together when it did?

Ars reports that Comcast had initially wanted a significant amount of money ($.01 per GB) from Netflix, but that it ultimately settled for less than that in order to get the deal done in time to help make the company’s “We’re pro-consumer” case to regulators.

Additionally, as part of its previous acquisition of NBC Universal, Comcast has agreed to abide by the net neutrality rules through 2018, regardless of the court’s trashing of the guidelines. While allowing the Netflix bottlenecks is not explicitly in violation of those rules, the last thing Comcast wants when it’s trying to buy Time Warner Cable is additional scrutiny from regulators.

But Verizon and AT&T aren’t in the process of trying to acquire a major competitor, so they lack that motivation to capitulate on pricing or other Netflix demands.

Likewise, neither Verizon nor AT&T have a customer base the size of Comcast, so Netflix may think it can play chicken as it can better handle losing angry FiOS and U-Verse subscribers than those companies can.

One final thing to consider is that FiOS and U-Verse often exist in the few markets where there is some sort of competition for cable and Internet service, so Netflix may be banking that disgruntled subscribers may flee Verizon or AT&T for another company.

Rest assured that, barring more strenuous net neutrality rules that ban bottlenecks, these deals will be made at some point. But Netflix will go as long as it can before having to shell out hundreds of millions of dollars for the access it once enjoyed without that toll, and the ISPs are going to try to get as much for access to their pipelines as possible.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.