If you listen to trend pieces in the news and online commenters, cash is on its way out. There are coffee shops and restaurants that don’t accept it, and most people don’t carry very much cash at any given time. Yet it turns out that retailers still generally prefer cash, since it’s the cheapest way to accept payments. [More]

unbanked

Feds Accuse NetSpend Of Misleading Customers About Prepaid Debit Cards

NetSpend, one of the nation’s largest providers of prepaid debit cards, has been accused of violating federal law for allegedly misleading users into believing that funds loaded onto these cards will be available immediately, while some users say they had to wait weeks or were never able to access their funds. [More]

Households Are Using Prepaid Cards More Than Ever Before

Weeks after federal regulators finalized rules aimed at making prepaid cards safer and less costly for consumers, a new report from the Federal Deposit Insurance Corp. finds that more households are relying on the financial products than ever before. [More]

Next Year, You Can Buy Pay-As-You-Go Cable From Comcast If You Want

We’re used to there being two kinds of cell phone plans. There’s the post-paid, where you get a bill every month that may go up or down depending on your usage. And there’s the pre-paid, where you pay your $40 and get your flat amount of data and airtime, and use it until it’s used up. But prepaid cable? That’s a new one. [More]

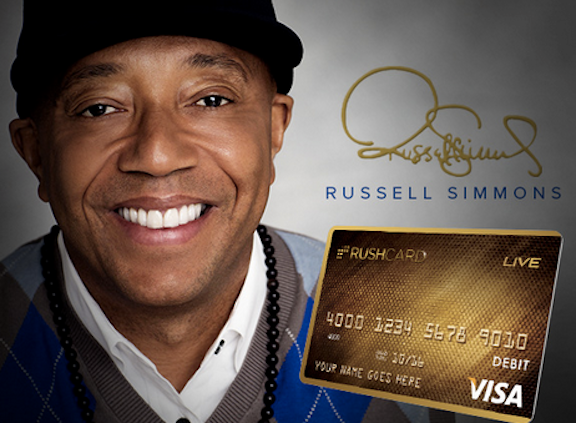

RushCard To Pay $19M To Customers After Weeks-Long Glitch Last year

Last October, thousands of unbanked consumers who rely on prepaid RushCards were unable to access their funds because of a technical glitch. After toying with the idea of creating a compensation fund for those customers, RushCard announced Thursday that it will pay at least $19 million to card users affected by the weeks-long outage. [More]

Prepaid Debit Cards Are Not Quite As Terrible As They Used To Be

There are contexts where prepaid debit cards are useful. Consumers without bank accounts who would otherwise deal all in cash use them, and they’re also useful for distributing allowances. The problem with prepaid cards is that they impose high fees for functions like reloading, using out-of-network ATMs, or monthly fees for simply having the card. However, they’re better than they used to be, largely because at least they disclose those fees. [More]

RushCard To Create Reimbursement Fund For Customers Unable To Access Money

The thousands of unbanked consumers who rely on prepaid RushCards but have been unable to access their funds because of a technical glitch, may receive compensation for the issue. [More]

After RushCard Fiasco, Consumer Advocates Urge More Oversight Of Prepaid Cards

For the better part of two weeks, thousands of unbanked consumers who rely on prepaid RushCards have been unable to access their funds because of a technical glitch. While the company run by Russell Simmons continues to fix the issue, consumer advocates are pointing at the incident as evidence that federal regulators need to do more to protect prepaid cardholders. [More]

Technical Glitch Locked Customers Out Of Prepaid RushCard System For The Past Week

While prepaid credit cards can serve as a lifeline for millions of unbanked Americans in need of an alternative to traditional banking, Russell Simmons’ RushCard recently left thousands of consumers stranded without their funds because of a technical glitch. [More]

Choosing The Wrong Prepaid Debit Card Can Cost You Up To $500/Year In Fees

While prepaid debit cards have long been criticized for having too many fees (and for being less than transparent about those fees), the impact of those fees will largely depend on how you use a particular prepaid card. Choosing one that’s ill-suited to your needs could cost you hundreds of dollars a year in fees that you didn’t need to spend. [More]

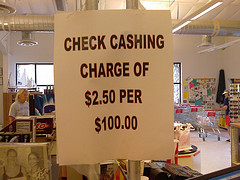

1-In-4 Americans Turn To Payday Loans & Other High-Cost Financial Products

When discussing the topic of payday loans — or other high-cost, short-term financial products like auto-title loans and check-cashing — there can be a tendency to treat them like something that only a small percentage of Americans use. But a new report from the FDIC confirms that 25% of us have turned to one of these potentially predatory services in the past year, and that this rate has not been going down. [More]

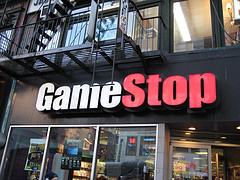

Bank Of GameStop Is The Best Or Worst Idea Ever

When you need a place to stash your money that isn’t a shoebox under the bed, it can be hard to find a good option. Minimum balance requirements, fees for the privilege of having an account…it’s all very complicated, especially if you don’t have a lot of money to deposit. Simplify things by joining the First National Bank of GameStop. [More]

Reporter Lives For Month Without A Bank, Fee Orgy Ensues

As an experiment, an AP reporter tried to live for a month without using a bank so she could get a taste of how people who can’t get an account, or choose not to, live. She discovered fees and confusion galore, and found that it would end up costing her $1,100 a year just to spend her own money. That’s not even counting the cost of standing in “Soviet-style” lines in grungy check-cashing places to cash her paycheck alongside the great unwashed, and unbanked. Overall, depressing, anxious, and time-consuming experience [More]

Your Cash Is No Good At The Apple Store

If you’re saving up to buy an iPad, don’t do it by sticking your spare cash into an envelope. (Or a sock, for that matter.) As a woman in Palo Alto, Calif. learned, the same “credit or debit cards only” policy that Apple put in place to prevent rampant reselling of iPhones exists for iPads, and no stack of bills can be exchanged for the shiny gadget. [More]

Revealing The Hidden Cost Of PrePaid Debit Cards

With credit cards harder to come by and more annoying to use, the prepaid debit card market is projected to explode from $8.7 billion loaded on the cards to $119 billion in 2012, but a good chunk of that is going to be eaten up by hidden fees and gotchas. This sexy graphic visualization shows how.

Walmart: No More Paycheck Here's Your Pre-Paid Debit Card

Walmart, our nation’s largest employer, has eliminated paper paychecks. Now employees can choose to sign up for direct deposit or have their wages added to a pre-paid debit card. ABCNews says that only about half of Walmart’s employees use direct deposit — the rest either prefer a paper paycheck or, in some cases, don’t have a bank account.