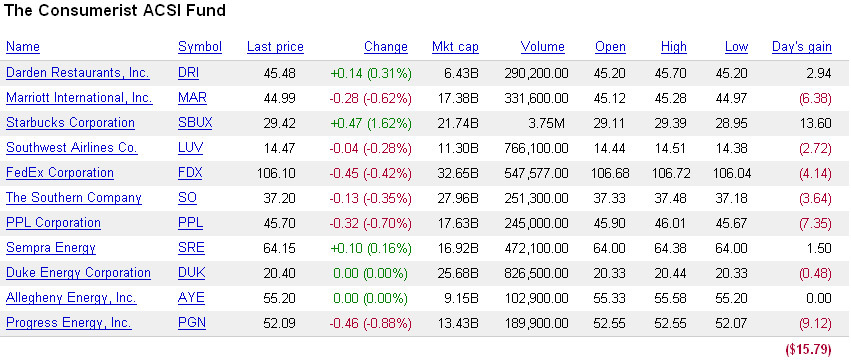

The Consumerist ACSI Fund v2.0

Based on your suggestions, we redid The Consumerist ACSI fund mock portfolio. We changed it from 100 shares to $1000 worth of each company, rounded down to whole shares. This way the highest stocks won’t have an undue influence on the portfolio’s performance.

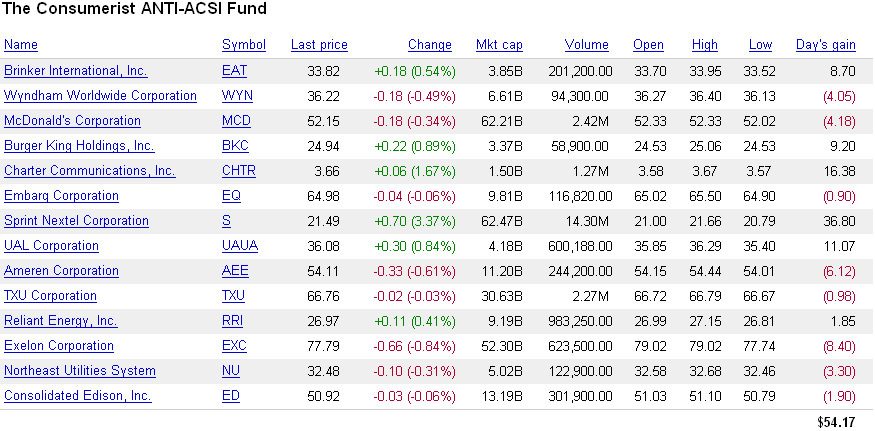

We also made the The Consumerist ANTI-ASCI fund, buying only companies performing in the bottom 20% on the ACSI relative to their competition and having ACSI scores below the national average.

Peek at our portfolios…

We know, ha ha, the ANTI-ACSI is outperforming the ACSI. Even if it was the other way around, you can’t tell anything from a mere 2 hours and 20 minutes of the market being open…

In that spirit, Correlation does not equal causation. To truly see the experiment’s hypothesis out, it will need to run for far longer than any of us will probably be writing this blog. Something like 10 years, ya know?

Even still, we’ll have fun tracking the funds’ progress, and seeing if it might be true that company’s with higher scores on the American Customer Satisfaction Index outperform the market indexes. — BEN POPKEN

NOTES:

* Made these charts with Google Finance’s portfolio function.

* It’s easier to find companies below the national ACSI average than above it.

* Samsung was excluded as they’re not public ally traded on the American stock market.

PREVIOUSLY: The Consumerist ACSI Fund

(Photo: Getty Images)

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.