Fannie Mae Smacked by New Report

New evidence surfaced that Fannie Mae molested its accounting in the 90’s so top execs could harvest $25 million plus in bonuses.

Much of the blame for the fiduciary inaccuracies was laid on CFO J. Timothy Howard, and Leanne G. Spencer, former controller.

A schedule prepared by Ms. Spencer “set out different earnings projections based on different types of expense deferrals that described a plan, ultimately accepted by senior management, to defer nearly $200 million in expenses in order to meet earnings projections, and, as a consequence, meet the target for awarding the largest amount in executive bonuses,” reported the New York Times.

Something to check out while boning up for Round 7 of the Worst Company Poll.

How does Fannie Mae make its money in the first place?

Pretty pictures after the jump…

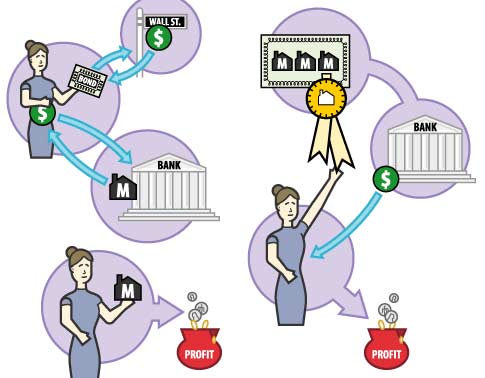

“On the left, Fannie issues bonds on Wall Street and has to pay interest on that money. With the money they buy mortgages from banks and collect the interest on the mortgage. The difference between the two interest rates is Fannie’s profit.

On the right, they guarantee mortgages. The fee they get by guaranteeing the mortgage (minus the cost of any defaults) is their profit.” (Chart and explainer courtesy of L-dopa).

And yes, Fannie Mae is an actual person, lacking legs, seeing only through two slits. To see her disembodied form floating down Wall Street is a sight to send shivers down to your soles.

Report on Fannie Mae Cites Manipulation to Secure Bonuses [New York Times]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.