Rolling Stone’s Matt Taibbi – the guy who famously referred to Goldman Sachs as “a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money” – has an interesting expose of how the wives of two Morgan Stanley hot shots, though they had no previous financial experience, set up their own investing initiative and got $220 million in bailout funds. [More]

wall street

Citigroup Still Selling Mortgages That Violate Quality Standards

15% of the mortgages Citigroup sold to government-owned Freddie Mac from the second half of 2009 and the first part of 2010 were riddled with flaws, according to an internal report obtained by Bloomberg. The error rate should be about 5%. The mistakes included missing insurance docs, missing appraisals and income miscalculations. [More]

Banks To Start Paying Dividends For First Time In 3 Years

After a 3-year hiatus, banks, plumped up by big profits thanks to a dizzying array of federal aid programs, are ready to stay paying dividends again to investors. Before they can be restored, the government will conduct a round of secret “stress tests” to evaluate the banks’ financial health. If all goes well, individual investors who had seen their dividends slashed to pennies, could start once again supping from the income stream. [More]

Should Economists Have A Code Of Ethics? They're About To Vote On It

Most professions, like lawyers, doctors, scientists, and sociologists adopted a code of ethics long ago but that could change soon for one of the lone holdouts, the curmudgeonly economists. Their big conference kicks off today in Denver. On the agenda is whether they should adopt such a code. A little movie called Inside Job might have something to do with it. [More]

Stocks Up After Fed Releases Minutes

The Federal Reserve Board, which sets US national monetary policy, released minutes from its latest meeting today, striking a tone of temperate growth. [More]

Markets Hit 2011 With A Jump

Markets held onto a rally Monday, spurred by news of continuing manufacturing sector growth. The Dow gained .98% in mid-morning trading, the S&P 1.24% and the Nasdaq 1.7%. But don’t start firing up your Scottrades and Etrades just yet unless you’ve got a fifth of Pepto in your desk drawer. 2011 is looking to be just as rocky as ever. [More]

Madoff's Son Hangs Himself

The son of convicted ponzi schemer Bernard Madoff was found dead this weekend hanging by his neck from a dog leash. Mark Madoff’s death was ruled a suicide. According to reports, he had been depressed because no one on Wall Street would give him a job. [More]

FBI Raids 3 Hedge Funds In Massive Insider Trading Probe

The FBI showed up with search warrants at the office of three different hedge funds today as part of a huge insider trading probe. Sources say it’s a prelude to the biggest insider trading bust of all time. [More]

Gold And Jewel-Encrusted Monopoly Game Heads To Wall Street

A gold and jewel bedazzled version of Monopoly worth $2 million is heading to Wall Street this Friday. That’s not a metaphor. [More]

How The Looming Mortgage Bond Scandal Could Dwarf The Foreclosure Fraud Crisis

If you thought the fake doc foreclosure fraud crisis is bad, wait till you get a load of what could happen once people start looking at the pending mortgage bond meltdown. Reuters blogger Felix Salmon dug into the documents and he says it looks like banks have been lying to investors about the quality all this time. [More]

SEC: Stock Market "Flash Crash" Caused By Single $4.1B Sale

Officials today announced they can trace May’s stock market flash crash to a single transaction. On May 6, 2010, at 2:32 pm, Waddell & Reed Financial of Kansas initiated the sale of 75,000 E-Mini Standard & Poor’s 500 futures contracts. A sale of this size, about $4.1 billion worth, would usually happen over five hours, but instead the trading algorithms sold them within 20 minutes “without regard to price or time.” At 2:42 pm, markets starting plunging 5% in five minutes. [More]

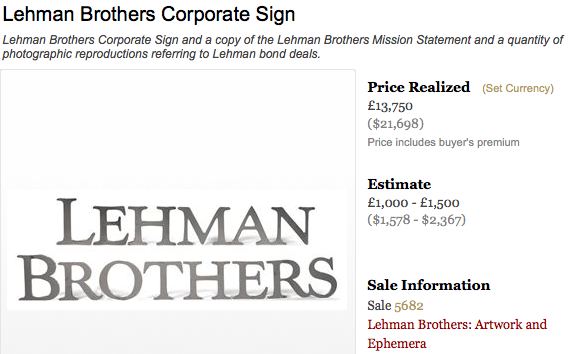

More Buyers Lined Up For Lehman Art Auction Than When Firm Sold

The art and ephemera of the failed Lehman Brothers firm fetched more interest at auction Wednesday than it itself could when it was put on the block, racking up $2.53 million in sales from over 200 participants. Of note was highest sale price item Gabriel Orozco’s “Atomists: Jump over” for $157,248, and a metal Lehman Brothers sign and a lot that included a sign of its mission statement that went for $21,744. The sign read, “We are one firm defined by our unwavering commitment to our clients, our shareholders and each other.” Ah, memories. [More]

Goldman Might Settle All SEC Probes With One Lump Sum

To avoid a costly and extended legal process and staunch further image degradation, Goldman Sachs is talking to the SEC about tying up their big probe and all their little probes in a little bow. [More]

Wall Street Threatens To Get Back At Politicians For Financial Reform

Bankers are planning to tighten the purse strings when it comes time to donate to political campaigns as a way of letting elected representatives know they’re not too happy about the whole financial reform thing. [More]

American Psycho: The Business Card Scene

Apropos of the blow dealt to Wall Street excess by the financial reform bill just passed by the Senate, here’s another piece of Wall Street excess that should probably get regulated. Business cards. They’ve gone totally off the rails. As my favorite scene from American Psycho shows, we must rein in these out-of-control practices before more kittens get stuffed into ATMS. [More]

10 Things You Don't Know About The Goldman Sachs Case

The media spin cycle is churning out its typically tepid hogwash about the SEC’s suit against Goldman Sachs. The Big Picture skewers 10 myths about the case and gets to the heart of the matter: Goldman is screwed. Here’s why: [More]

Obama To Bankers: Remember When Creating The FDIC Was Going To Ruin The Economy?

During the President’s address to Wall Street bankers today in New York City, he reminded them that their predecessors had completely flipped out about a bill that passed through Congress way back in 1933. It was, in their view, sure to “not only rob them of their pride of profession but would reduce all U.S. banking to its lowest level.” What was this reform bill? [More]

White House: Free Market Isn't "Free License To Take Whatever You Can Get"

The White House has released potions of a speech to be made by the president later today in NYC. In it Mr. Obama calls on banking industry lobbyists to halt their efforts to stop financial reforms that he feels are in the best interest of the market and the country. [More]