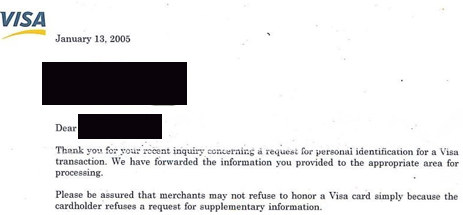

Stores are violating their contract with the credit card companies if they set minimum or maximum charges, or force you to show ID in addition to your credit card (with the obvious exception being for age-limited purchases). Depending on your state and your card issuer, surcharges or “convenience fees” may be banned as well. The best way to straighten these guys out is to report them to the credit card company. People who have done so on the Credit Boards message board say that when they report a merchant, they get a letter from the credit card company and when they go back to the store, the shenanigans have stopped. Here’s all the contact infos for the credit card companies to file a merchant complaint, as well as links to merchant agreements, in case you feel like standing up for your consumer rights. Someone better warn Amy’s Ice Cream!

visa

Stores Can't Force You To Show ID With Your Credit Card

Here’s an interesting fact in this Red Tape Chronicles post about how to protect your private data bits from retailers who don’t know any better: by the terms of their merchant agreement with credit card issuers, stores are not allowed to force you to present ID in addition to your credit card.

The "Green" Credit Card

Here’s a different kind of rewards card, instead furthering more material consumption, the Brighter Planet Visa card lets you earn “EarthSmart” points. These points are automatically used every month to fund renewable energy projects. Every 1,000 points funds about 1 ton of carbon offsets. (Carbon offsets are a way of breaking the cost of planting trees, reclaiming methane, building windmills, etc, into purchasable units). There’s a 0% introductory APR for the first 12 months, 9.99% or 15.99% APR thereafter, depending on your credit score. You get to feel good, renewable energy gets funded, and Visa and Bank of America get good PR –win-win-win-win. Gotta wonder, if you default on your payments, will they pull the trees out of the ground?

National Retail Federation: Credit Card Companies Don't Care About Data Security

Last Sunday’s 60 minutes had a report by Lesley Stahl about the now-infamous TJX data breach.

That $3000 Was Fraud? Chase Doesn't Care, It Only Wants Money

Brandon writes:“In January 2007, I was traveling in Mexico and was mugged, having my wallet and passport stolen. By the time I got back to the hotel and began calling my credit card companies to cancel, the criminal had charged close to $3,000 on my CHASE Circuit City Visa card. I explained to CHASE that the charges were fraud, and they sent me a fraudulent charge affidavit to complete and have notarized. As I couldn’t take care of this until I returned from my trip, and had more important things like a passport to worry about, I waited a few weeks before completing the paperwork and during those weeks received about 2 calls a day from CHASE urging me to send the documents.”

Credit Card Companies Say TJ Maxx Breach Affected 94 Million Accounts

According to new court papers, Visa and Mastercard are saying that the TJ Maxx security breach actually affected 94 million accounts—more than double the amount that TJ Maxx reported.

Another Good Reason To Hate The "Life Takes Visa" Campaign

Credit Slips points out another reason we loathe the Life Takes Visa campaign. You know, the one where everyone moves in blissful synchronicity, swiping their debit cards for small items, then the party stops and everyone glowers at the tardbucket who pays for stuff with cash.

Make Credit Card Companies Your Bitch

Blueprint for Financial Prosperity reminds us that savvy consumers can take advantage of credit card companies hellbent on turning a profit. Most credit card companies will go to great lengths to keep their customers happily spending away. Use these tips to make them cater to your every financial desire:

Visa Tap-N-Go Ads Piss Us Off

We loathe these Visa commercials. They show commerce going along like clockwork. People paying with their tap-and-go Visa card. Getting their donuts. Until one guy pay with cash. Everything screeches to a halt. He gets looks from the cashier and other customers.

Hasbro And Visa Pervert LIFE Board Game To Train Children In Racking Up Credit Card Debt

As if credit card-related debt wasn’t a big enough problem in the U.S., Hasbro and Visa want to fuel the fire. Hasbro is launching a new edition of The Game of Life called Twists and Turns that will replace play money with a Visa-branded card. Matt Collins, Hasbro’s vice president of marketing, said of the switch, “When we started to design a completely new edition of the popular game, we knew it was also time to reflect the way people choose to pay and be paid – and replacing cash with Visa was an obvious choice.”

Reclaim Unnecessary Credit Cards' Unnecessary Foreign Transaction Fees

Several major credit card companies were successfully and recently class-actioned for charging unnecessary fees for overseas transactions.

Discounts Just For Using Your Credit Card

Blueprint for Financial Prosperity reminds us that credit cards carry more discounts than we realize. Visa, MasterCard, and American Express all offer discounts for cardholders. Discover’s discounts are limited to business accounts.

“Millions” Of Visa & MasterCard Accounts Breached?

Reader S. got a call this morning from Citibank. They said her card had been compromised and she needed a new card. When she asked for details, Citibank could only say that an unspecified business had their system compromised, affecting “millions” of Visa and MasterCards

Gift Cards Are The Most Popular Gift

The 2006 Deloitte report on gift cards is out, and it’s official. Gift cards are the single most popular gift this holiday season. But are they a good buy? Sort of. It seems that due to consumer pressure, and FTC pressure, stores are improving their customer service/disclosure of fees when it comes to gift cards. But that doesn’t meant there aren’t still a lot of problems. The Montgomery County, Maryland, Office of Consumer Protection which assesses dozens of cards annually, has released their 2006 report. The report evaluates 40 different gift cards, looking for things like whether or not the card can be replaced if lost or stolen, whether the cards have an expiration date, and whether fees are assessed to the card’s balance. Basically, you want to avoid the following cards:

Wells Fargo VISA Gift Card’s Hidden Fees

Wells Fargo touts its prepaid VISA gift cards as “the perfect gift” and has sold over a million, but perhaps they would sell a little less if people knew about these terms and conditions, flushed out by Mouse Print:

Hot Consumerist Forums Threads

• Amazon.com offers $30 credit if you get their Visa card. Are there reasons not to get it?