The secret of the $23 quadrillion VISA debit errors looks like a specific and not uncommon programming error. Take the insanely large number, if you convert 2314885530818450000 to hexadecimal, you end up with 20 20 20 20 20 20 12 50. In programming, hex20 is a space. Where a binary zero should have been, there were spaces instead. What made this instance special is that it wasn’t caught in time. A Slashdot commenter identifying himself as working in the industry explains more about what very likely happened:

visa

Shortchanged By Verizon's Rebate Card

Late last year Verizon started replacing its rebate checks with Visa debit cards. You use them as you would debit cards, only without having to tap in a PIN. Long story short — after using one of these cards I’m convinced they’re part of a scam meant to let Verizon and/or Visa skim pennies off the tops of rebates owed to customers because once there’s only chump change left on your card, you can apparently no longer use it.

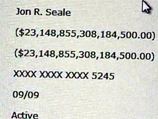

The $23 Quadrillion Meal

I hope he cleaned his plate. Jon Seale was another of several VISA customers who were charged $23 quadrillion for mundane purchases. This time it was his July 13th meal a Dallas restaurant, reports KXAS. VISA said a temporary programming error affecting prepaid accounts was responsible for the error . Jon spent the rest of the day calling between Wachovia and VISA to try to clear the $23,148,855,308,184,500 charge.

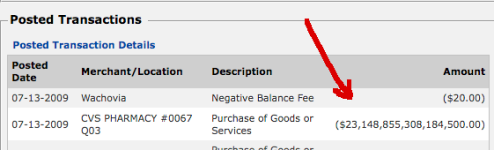

Unruly Teen Charges $23 Quadrillion At Drugstore

Kids these days! Hawkins writes, “My lectures about financial responsibility appear to have failed: yesterday [my teenaged daughter] charged $23,148,855,308,184,500.00 at the drug store.” You would think Visa would have caught the error and addressed it, if you were high. What Visa actually did was slap a $20 “negative balance” fee on it, of course. Update: Here’s what happened!

Your Visa Gift Card Will Self-Destruct If Used Within 24 Hours

Stephanie bought a $100 Vanilla Visa gift card at her local CVS in Richmond, VA. She went right home and tried to use it to make some purchases online. When the card was declined, she studied the fine print that came with the card: “Funds may not be available for 24 hours after purchase.” So she waited the 24 hours and tried it again the next day. Still no luck. When she called the customer service number she was told to go back to CVS. At CVS, a manager told Stephanie (and apparently many others before her) that by using the card within 24 hours she had rendered her card agreement invalid. Bang, there goes $100.

Blog Gets Some Stupid Capcom Credit Card Fees Removed

It turns out that Chun-Li, of Street Fighter fame, does not want to charge you so many onerous fees on your Capcom credit card that attack over and over on your neck like that stupid bitch, Blanka. Just some of them.

Get The Best Cash Back Credit Card

Tired of using a two credit card system to maximize his cash back returns, I did an analysis to determine the single best cash back credit card. Here’s what I found:

Visa Covers Butt By 'Delisting' Breached Credit Card Payment Processors

Visa has removed Heartland Payment Systems and RBS WorldPay, the two huge payment processors that suffered recent data breaches, from its list of companies that are in compliance with Payment Card Industry (PCI) rules. It says they can get back on the list when they recertify that they have proper security in place. While this may sound like a significant change in the status of the companies, in reality it does little to change how the three companies do business with each other or with merchants. It’s just a way for Visa to protect itself from any upcoming lawsuits by banks and credit unions against the payment processors.

Visa And Capcom Announce Street Fighter Hyper Fee Edition Card

Video game maker Capcom has partnered with Visa to offer a pre-paid debit card with so many fees that it will shrink your wallet from an E. Honda to a Dhalsim. The hurricane kick of fees, inside.

Another Month, Another Massive Credit Card Data Breach

Don’t be too surprised if you get a letter from your bank or credit union in the next few weeks telling you it’s replacing your credit card. If your data was among the latest set compromised, Visa and Mastercard are already alerting financial institutions so they can cancel the account number.

VISA Won't Replace Dusty PS3 After All

Remember that guy with the PS3 Sony said was too dusty to repair? The saga continues.

Credit Card Squeeze Is Pushing Consumers Toward Foreclosure

USAToday says that panic by the credit card industry is squeezing customers who ordinarily would be able to pay their bills — pushing them toward financial ruin and foreclosure.

Don't Assume That Rebate Will Be Redeemable For Cash

Companies love rebates because they are difficult to redeem and easy to forget. But you clever shoppers are getting too good at their game, so instead of paying out your rebate in cash, you’ll get something different altogether. Take, for example, Buy.com’s supposed “$26 mail in rebate…”

Morning Deals

- Apple: Refurbished iPod touches on sale, 8GB for $180, 16GB for $240, 32GB for $320

- Amazon: Rewards points upgrade for existing Amazon.com Visa holders

- Apple: Free Select iTunes TV Shows in HD (requires iTunes 8

Highlights From Dealnews

- Travelocity: United Airlines Sale: Round-trip flights from $108

- Amazon.com: Amazon.com Men’s Watch Deals: Timex, Marc Ecko, more from $40 + free shipping

- Sears: Seven7 Women’s Jeans for $18 + $6 s&h, more

Highlights From Buxr

- Budget Truck Rental: $50 Gift card when paying w/American Express

- Reverie: T-Shirt Sale: Buy 1 TEE get 1 free TEE

- BestBuy: Westinghouse 42″ 1080p LCD HDTV and portable DVD Player for $749.99 + shipping

Highlights From Dealhack

- Drugstore.com: New Customers: Save $5 or $10 off First Order

- Vann’s: Panasonic FZ28 10.2MP Digital Camera $340 Shipped

- Amazon: Get Savings of up to 75% off Bargain Books

Amex Tops JD Power Credit Card 2008 Customer Satisfaction Survey

JD Power and Associates ranked American Express at the top of their 2008 Credit Card Satisfaction Study. Customers gave the company high marks in interaction, billing and payment processes, reward programs, fees and rates, and benefits and services, with the first three factors standing out in particular. Capital One and HSBC, which target revolvers with lower credit scores, received the worst marks. Oddly, Discover got second place. People must really like their two-cycle billing (see “Two-Cycle Billing And Why It’s Evil“). Full rankings inside…

Consumers: We're Mad As Hell And We're Not Going To Charge It Anymore!

Once upon a time, Peter Finch won an Oscar for telling us to go to our window, open it, and yell, “We’re mad as hell and we’re not going to take this anymore!” Now thousands and thousands of consumers are doing just that, but instead of yelling out their windows, they’re yelling at the Federal Reserve in the form of a record breaking number of public comments about some proposed credit card reforms. Not as sexy as yelling like a madman, but far, far more effective.