Reader Nathan’s wife unfortunately fell for a “Free Credit Report” offer from a TransUnion service called “Zendough.” They say they are being repeatedly billed even after they cancel, and the only customer service contact number they have is staffed by people who can’t help. [More]

transunion

Thief Runs Up $10,000 Credit Card Bill Using Only Name, Address, Social, DOB

John says that his wife’s identity was stolen two weeks ago and since TransUnion shows your full credit card numbers on your credit report, the thief was able to run up a $10,000 credit card bill in his wife’s name.

36 Risk Factors Creditors Use To Deny You Credit

Lenders can use the data from your credit report to deny you credit for any one of several reasons. If you are denied, you receive a letter identifying the credit reporting agency that provided the report, along with a risk factor reason code. Bargaineering published a list of the common risk factor codes that lenders use to deem you unworthy of credit. For all three reporting agencies, the cardinal sins are owing too much and failing to pay your bills. The list of codes, inside.

Experian Yanks FICO Score Away From Consumers

Soon consumers will only be able to see two out of the three credit scores lenders use to judge their credit worthiness. Out of nowhere, Experian announced it will no longer be selling its version of the FICO score through myFICO.com.

How Credit Bureaus Correct, Or Fail To Correct, Errors On Your Report

SmartMoney’s Anne Kadet looked into the process by which the three major credit bureaus—Experian, TransUnion, and Equifax—investigate and correct errors on credit reports. What she found was that the process is “almost entirely automated,” and that “many lenders respond by simply rereporting the erroneous data.” Here’s how it works, and your meager options when something goes wrong.

Debunking Five Credit Score Myths

Your credit score. It’s amazing how one little score can have such an impact on our finances and how misunderstood that number can be. We’ll debunk five common myths about it right here, right now.

Check Your Credit History Year-Round, For Free

Statistics show that 80% of credit histories have at least one error. Most of them are minor and inconsequential but some can have an adverse effect on your credit score, often costing your thousands on mortgages and car loans. I believe credit bureaus were so lackadaisical about accuracy because it forced consumers to buy their credit reporting services. You wouldn’t know there’s an error unless you paid Equifax for a copy of your report. Fortunately, federal law now makes it possible for us to police our own records and force bureaus to correct them, all on their dime. Here’s how:

Judge Orders Credit Reporting Bureaus To Strike Forgiven Debts From Records

The three big credit reporting agencies—Experian, TransUnion, and Equifax—have been inaccurately reporting debts on millions of consumers’ credit reports even after the debts have been forgiven during bankruptcy filings. Once forgiven, the debts are supposed to be removed from credit reports, but the agencies are continuing to report them as active. They have until October 1st to comply with Judge David O. Carter’s order to “revamp their systems,” writes Jane J. Kim on the Wall Street Journal’s finance blog. Now if you’re in debt trouble, you can look forward (?) to having either unpaid debts on your credit report, or a bankruptcy filing, but hopefully no longer both at the same time.

Consumer 101: Get Your Free Credit Report From "Annual Credit Report.com"

You’ve probably seen those commercials featuring a friendly looking jackass and his factually inaccurate songs about what can happen to you if you don’t check your credit report. It’s true, checking your credit report is a good idea, but you can avoid subscription-hawking pay sites and, instead, go to AnnualCreditReport.com.

One Day Left To Register For TransUnion Class Action Lawsuit

September 24, tomorrow, is the last day to register for the class action against TransUnion for selling consumer’s private data to businesses without permission. If you held a credit card between January 1, 1987 to May 28, 2008, you’re eligible to receive benefits. You can choose from one of three options:

../../../..//2008/09/11/just-a-reminder-you-can/

Just a reminder: you can get free credit reporting services for at least six months by participating in a class action settlement against TransUnion. Carey posted details about it back in June; the deadline to participate is September 24th. (Thanks to Michael!)

Really, Credit Bureaus, I'm Not Dead

I have been battling with a silly preconception the federal government has concerning my status as a deceased person, that causes them to routinely shut down credit cards that I am using, and stresses my ability to build credit. (All this despite being actively enlisted in the US Navy)…

Mailing Addresses For TransUnion, Experian, Equifax

Having trouble finding the mailing address for any of the three major credit bureaus, TransUnion, Experian, Equifax? Here they are:

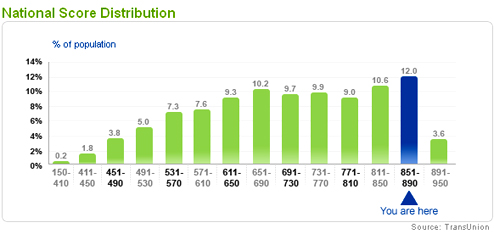

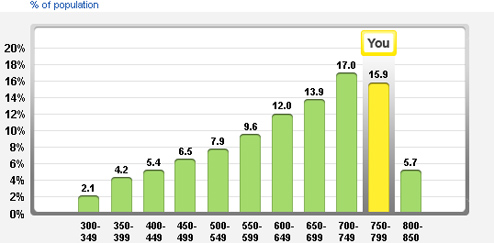

CreditKarma.com Makes Free Credit Score More Like FICO's

The CreditKarma.com site we told you about in our roundup of “5 No BS Ways To Get A Credit Score For Free” has changed its calibration system so the free, advertising-supported, credit score it gives you is now on the 300-850 range, just like your FICO score. It’s still not your FICO score, but it does make the approximation, based on TransUnion data, more relevant. If you’re do some major money moves, like getting a mortgage, you would still want to pay for the FICO score for total accuracy, but if you just want a general sense of how you’re doing, CreditKarma.com is a great way to do it for free.

Massive TransUnion Settlement To Reveal Credit Scores

Did you have a credit card between Wednesday and 1987? Great! You’re part of a massive class action settlement with TransUnion. The credit reporting agency has agreed to fork out services worth over $100 to every cardholder as a way of saying “sorry for grossly violating federal privacy laws by selling your private data to businesses!”

Round 38: TransUnion vs Diebold

This is Round 38 in our Worst Company in America contest, TransUnion vs Diebold!Here’s what readers said in previous rounds about why they hate these two companies…