MasterCard’s quest to make paying for things easier already includes a few out-there systems: verification via selfie for online orders, anyone? And it doesn’t appear that the credit card company is holding back in its latest endeavor, partnering with a fashion designer and other companies to create an array of consumer products-turned-mobile payment systems. Because, you know, paying with pieces of plastic and phones was so last year. [More]

transactions

Could You Soon Be Making Purchases By Scanning Your Face? That’s The Plan At MasterCard

Who has time to memorize the special code or password when you could just scan your face to approve an online purchase? While using facial recognition as confirmation you’re, well, you, might seem a little far-fetched, it could be a reality this fall according to MasterCard. [More]

PayPal Buys Online Money Transfer Company Xoom For $890M

PayPal appears to be preparing for its upcoming separation from parent company eBay later this month by buying an online money-transfer company to increase its international and online presence. [More]

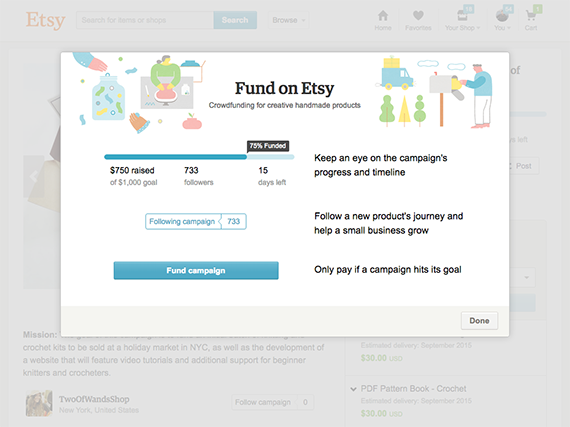

Etsy Launches Pilot Crowdfunding Program To Help Sellers Grow Their Businesses

While Etsy has long been a marketplace where sellers could launch small businesses, the site has not had a Kickstarter-like crowdfunding platform for sellers to raise money to grow their businesses. Today, Etsy announced it is finally giving crowd-sourced funding a shot with the launch of a new pilot program. [More]

Does Postdating A Check Prevent Anyone From Depositing It Early?

Thanks to automated payments and online banking, many of us rarely (if ever) write checks, but millions of Americans still pull out their checkbooks every day to pay their bills. Because they might not always have enough money in their accounts on the day they write those checks, some folks will postdate their checks so that they aren’t deposited or cashed until after that date. Unfortunately, the fact is that there’s generally no actual obligation to honor the date on a check. [More]

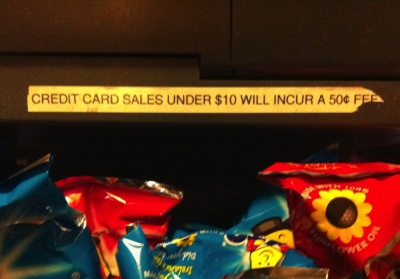

Shop Charges $.50 Fee For Credit Card Purchases Under $10

I spotted a coffee shop charging customer a $.50 for using a credit card on any purchase that is under $10. It doesn’t break any laws, but it does violate their agreement with the credit card companies. [More]

Chase Approves Transaction Anyway After Customer Declines Overdraft Protection

Paul opted not to sign up for Chase’s overdraft fee trap–oh wait, they call it “protection”–but Chase happily ignored this fact and approved a transaction anyway, which led to a $34 overdraft fee that they refuse to reverse. The loophole they’re using to get around Paul’s opt-out is that the vendor was someone he’d authorized in the past, and therefore this new transaction isn’t protected from the bank’s “protection” fee. [More]

Hey Stores! How About Offering Some Cash Back With That Receipt Check?

In the comments to our most recent receipt check story, I noticed a reader argued that as long as the store wasn’t willing to reimburse him for his time, he wasn’t willing to give it to them. It makes sense; nothing in the marketplace is free, right? Why shouldn’t consumers be compensated for bag searches and receipt checks?

Another reader, Adam, suggested a similar idea in his email to us this morning. In fact, he thinks maybe the exiting-the-store moment could be a chance to make a little extra cash.

Beware Credit Cards Charging Foreign Transaction Fees On Domestic Purchases

Banks are increasingly charging foreign transaction fees on domestic purchases, a dangerous practice that’s likely to expand as banks look for new ways to generate profit. Tripso tells us the story of Sunil, who bought tickets with Qatar airlines, which sounds ever so expensively foreign. Citi charged a 2% foreign transaction fee, even though the tickets were bought in U.S. dollars and processed by the airline’s central reservation system based in Washington D.C.

Apple Sells You The Wrong AppleCare Package, Then Loses Your Refund

Apple sold reader Melody the wrong AppleCare package, but instead of switching her to the proper coverage, they issued a refund and told her to re-purchase the warranty extension. They even gave her American Express transaction reference numbers so she could track the refund, but AmEx says the numbers are invalid and that they have no record of a refund posting. Melody’s been out $195 since February, and thinks it’s time for Apple to cough up her money.

H&R Block's Refund Anticipation Loan Card Eats Your Refund

Poor Sam didn’t take our advice. He let H&R Block do his taxes and then took out a refund anticipation loan. The money, which was deposited on an H&R Block Emerald Card, is now tied up by several inexplicable holds for transactions he didn’t make. The companies supposedly holding the funds have no clue who Sam is, or why they’d be holding his money. H&R Block’s only response is to charge Sam $2 whenever he calls their customer service line for help.

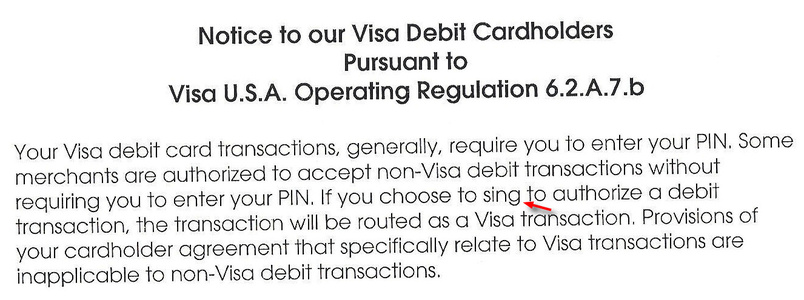

Why Do Lenders Want You To Use Your Debit Card Like A Credit Card?

A reader wants to know why Chase is pushing him so hard to use his debit card like a credit card when paying for things—they’re promoting a contest for people who do this, and on every insert or blank space in the paperwork that accompanied his newest card, they encourage him to always select “credit” over “debit” at checkout. Why?

Best Buy Forgets It Sold Laptop, Won't Take Customer's Money

The Best Buy where Toni bought a laptop earlier this month has no record of the sale, and it won’t collect the funds that have already been released from her account. This sounds like a fun problem to have—$1500 extra dollars, free laptop, woo hoo!—but it’s actually pretty annoying. Toni doesn’t want this phantom $1500 messing up her balance indefinitely, and she doesn’t want to feel like she’s stolen a laptop.

Credit And Debit Card Breach May Affect Over 100 Million

The Washington Post has reported that Heartland Payment Systems, a payment processor that services “more than 250,000 businesses,” has had more than 100 million transactions compromised via malicious software that was installed on its network; it will likely turn out to be the largest data breach ever reported. The “good” news is that the criminals were only capturing credit card numbers, the names on the cards, and expiration dates—the info encoded onto the magnetic strip on the card. Because no addresses, SSNs or PINs were stolen, the prospect of full-blown identity theft is pretty small—which must explain why Heartland isn’t offering any sort of credit monitoring package as compensation. Instead, their CFO says, “We recognize and feel badly about the inconvenience this is going to cause consumers.”

../..//2008/12/31/if-you-used-your-debit/

If you used your debit card at Macy’s on the Saturday before Christmas, you might have been charged twice.