Just a day after in-the-know sources revealed that teen-clothing retailer Aeropostale was headed for bankruptcy, the company was delisted from the New York Stock Exchange. [More]

trading

Trading Resumes On Floor Of New York Stock Exchange [Update]

UPDATE 2: The New York Stock Exchanged reopened today shortly after 3 p.m. ET and resumed floor trading. [More]

SEC Fines Brokerage Firm $2M For Improper Use Of Customer Data

When a company breaks its promise of securing your personal information, that’s a problem. When the company does so for three years and used consumer trading data for its own benefit, that elicits a hefty fine from U.S. regulators. [More]

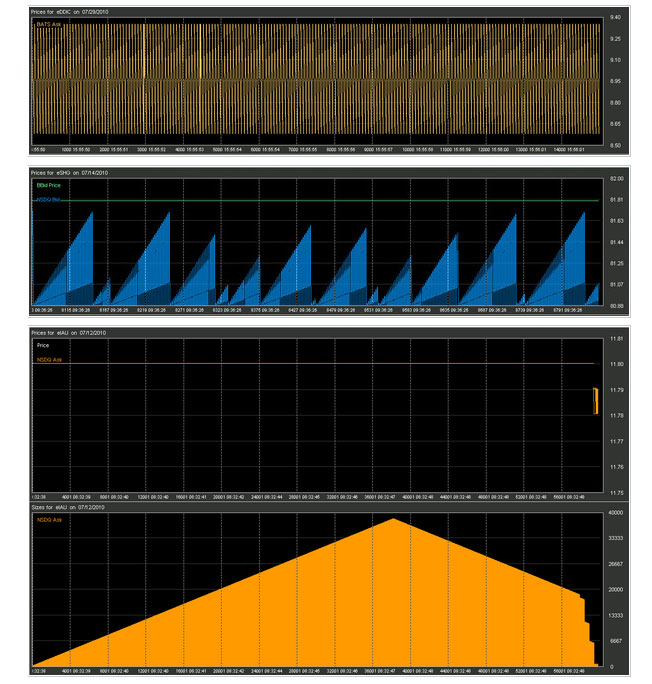

Robot Traders Leaving Behind Bizarre "Crop Circles" In Market Data

Following the May 6 “flash crash” in which the market plunged 1,000 points in just a few minutes, a data firm started looking at the trades being made by the high-frequency computerized trading bots that have come to loom over over the stock market. By zooming into the trades being placed by the millisecond the firm spotted several strange algorithmic patterns. Plotted on a chart, they look like the freakin’ the stock market equivalent of crop circles. [More]

Wall Street's Biggest Drop Ever Caused By Typo?

The AP says that a computerized selloff that may have been caused by a typo (the theory is that someone typed $16 billion when they meant $16 million) caused the biggest ever drop during a trading day. How could one typo result in such massive turmoil? The idea is that the erroneous trade triggered other computers to sell. [More]

Zecco Accidentally Increasing Some Customers' Buying Power Was Not Intentional April Fool's Joke

On April 1, 2009, one of our vendors provided Zecco Trading with an incorrect data feed which caused some customers to see erroneously high buying power. This error was quickly corrected, but about 1% of our customers were impacted.

Zecco Accidentally Increases Some Customers' Buying Power By Millions

Online brokerage site Zecco accidentally increased 1% of their customers’ Buying Power balances by millions on April 1st, leading some customers to wonder whether it was a system glitch or some horrible April Fool’s joke. It turned out to be the former.

Single Men Trade Stocks Too Much

Nick Kapur at The Motley Fool says that men trade stocks more frequently than women. This is not a good thing; the result of all this hyperactivity and overconfidence is lower earnings on your investment. He writes, “Worse still (for unmarried guys like me) is that single men trade a whopping 67% more than single women, earning them annual net returns of 2.3% less! The authors cite increased trading costs, taxes, and a greater tendency to speculate as reasons for this underperformance.”

U.S. Markets Down Sharply Despite Emergency Rate Cut

Despite the fact that the Fed cut the federal funds rate on overnight loans between banks to 3.5 percent from 4.25 percent in an attempt to prevent a sell-off in U.S. markets, the Dow Jones Industrial average opened down by more than 460 points.

Comcast Announces It Expects To Lose Customers In 2008

Yesterday Comcast lowered its growth expectations for 2008—not by much but down from 12% to 11% for the year. This morning at a media conference, Comcast’s CFO Michael Angelakis cited a “challenging economic and competitive environment,” with companies like Verizon and AT&T poaching its video customers to their new services. Oh, and also because nobody wants to be a Comcast customer unless it’s the only game in town.