If you pulled in more money than you’re used to making — especially if it came from untaxed work — you could be facing a higher-than-expected tax bill that will grow even higher due to a prepayment penalty of 3 or 4 percent if you owe more than $1,000. There’s not much you can do to avoid the penalty for your 2011 taxes, but you can take steps to avoid it next time. [More]

taxes

Why Is TurboTax Asking Me For A Donation?

Well, that headline is a little disingenuous. We know exactly why. K. filed his federal return using the free e-file service through Intuit’s TurboTax. It nagged him to upgrade to the paid service here and there during the process, which you expect when using any free service. What he didn’t expect was a pop-up with Lisa the Friendly Accountant acting like a public radio host during pledge drive week. “Intuit is a multi-billion dollar corporation,” he pointed out in his e-mail to Consumerist. “I just found this a bit greedy.” [More]

White House Begins Public Push For Support Of "Buffett Rule"

On the same day that President Obama is scheduled to speak about the topic at Florida Atlantic University, the White House has released a report on the so-called “Buffett Rule,” the proposition that households earning more than $1 million a year should not pay less than their fair share of federal income taxes. [More]

Tax Nuances That Could Get You Audited

By most accounts, Internal Revenue Service auditors aren’t much fun to meet with. Even if you’ve filed your taxes with impeccable precision, facing an audit can be nerve-wracking, so you’re best off making sure you aren’t tossing up any signs that draw attention to yourself. [More]

Do Not Confuse The Chase Bank ATM With Your Weird And Scary 'Checks'

Tom and his wife got married last year (congratulations!) but still have separate checking accounts. Tom never had a problem depositing checks also made out to his wife in his Chase checking account, so he didn’t foresee any problems with depositing their joint $2,000 tax refund check in that same account. But this is The Consumerist, not Satisfied Chase Customers Weekly, so you can guess how that turned out. Now Tom and Mrs. Tom get to wait patiently and hope that the check doesn’t get lost in the mail on its way back to them. [More]

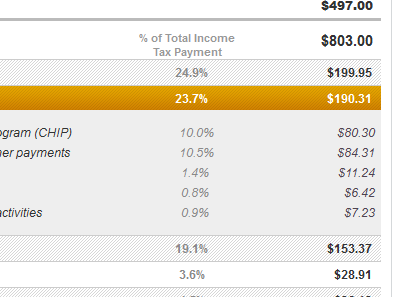

White House 'Tax Receipt' Shows Where Your Tax Dollars Are Being Spent

With only a few days to go before we’re all supposed to have filed out tax returns, the White House has launched an updated version of its interactive Tax Receipt to show people where their tax dollars are going. [More]

Help Donald Duck File His 1941 Federal Tax Return

Filing a federal tax return is an ingrained habit now, but most middle-class Americans didn’t have to before World War II. The Revenue Act of 1942 made 15 million more people eligible to pay taxes. How could the government explain this to the masses? Cartoons! The U.S. Treasury department commissioned Disney to make a short animated film that explained how to fill out a simple tax return, and why paying income taxes was so important. (Spoiler alert: Defeating the Axis powers.) [More]

Tax Nightmare: What Did I Do To Deserve An Audit By The IRS?

Moaning and groaning won’t make it go away when the IRS comes a’calling with an audit. Ask the auditor what you did to deserve such a terrifying experience and you’ll likely be met with a shrug, or perhaps a vague reason involving some kind of forms. So really, why did they pick you? [More]

Federal Student Aid Service Doesn't Know When The Federal Tax Filing Deadline Is

UPDATE: FAFSA has sent out an email correcting their earlier assertion that the deadline to file federal income taxes has already passed. They’ve admitted they were wrong and apologized for any confusion. [More]

Responsible Ways To Spend Your Tax Refund

Every year around this time, people tend to engage in bragging contests about how big their tax refunds are. These folks are oblivious to the fact that savvier planning would have let them keep their money rather than giving it to the government in a tax-free loan. [More]

You Might Have To Pay Taxes On That Canceled Credit Card Debt

That credit card debt you had was canceled or forgiven — yay! But you might have to pay the Internal Revenue Service taxes on it anyway, so — boo. You’ll find out you owe money when a 1099-C tax form comes in the mail from your lender, and probably not before then. [More]

If You've Got A Nanny, The IRS Has A Tax For You

You may not think of yourself as an employer just because you have someone drop by the house to watch your kids, but the Internal Revenue Service sees things differently. Many parents are taken by surprise by the “nanny tax,” which requires parents to pay FICA and FUTA taxes. [More]

What To Do If Your 1099 Is Wrong

It’s tough enough for freelancers to calculate and pay the taxes they owe on income from which no funds have been withheld, but even more difficult if their bosses screw up their tax info. If the company you work for incorrectly reports your income on a 1099 form, you’ll be on the hook for paying taxes on that amount unless you can set things straight. [More]

Anxious To Get Your Tax Refund? IRS Says 'Go Get Another Job'

Emily is a law student, and she spent last summer doing lawyer-type work and earning lawyer-type money. She mistakenly set up her withholding as if she were earning that much money year-round, though, so the government owes her a pretty sweet refund now that she’s returned to the poor, ascetic life of a student. She even filed her taxes super early so she can get that money back. Only the IRS has flagged her for extra-special review, delaying her refund, and no one she can get in touch with seems to care. “You should just get another job,” one helpful representative told her. [More]

Beware Of Identity Thieves Filing Fraudulent Tax Returns To Steal Your Refund

So you finally drag yourself to your desk/computer/accountant and get your taxes done. Good job. Now wouldn’t it just totally stink if you found out someone had already filed a tax return using your information, and that they’d snagged whatever refund you had coming to you? Yes, it would, which is why the Internal Revenue Service is warning people of just such a scam. [More]

Why You Probably Shouldn't Use A Credit Card To Pay Your Taxes

As the deadline for filing your federal tax return draws near, so does the anxiety of how you’re going to pay Uncle Sam the money you owe. If you can’t write a check for the full amount, the simplest and fastest way could be to put it on your credit card. But that’s probably not a good idea. [More]

Ask Tax Cat: What The Heck Is Going On With The Business Mileage Rate For 2011?

Every year around this time, Tax Cat emerges from his basket to answer questions and offer advice to you, the fine people of the internet. [More]

Citi Says Those Free Rewards Miles You Received Are Taxable

If you received a bunch of miles from Citi for signing up for one of the bank’s credit cards or rewards-earning accounts, be on the lookout for a 1099-Misc tax form coming in the mail, as Citi has decided that these miles have a taxable value. [More]