Monday is your lucky day, taxpayer, that’s when rebate checks start arriving, ahead of schedule. That’s right, the rebates were originally slated for May 2nd, but thanks to “a new computer program that updates records daily – faster than an older program that updates weekly,” Americans will start getting their free beer money on April 28th. Wow, IRS and efficiency together in the same sentence?

taxes

Corporations: "Tax-es? What Are These Things You Call Tax-es?"

Hope you enjoyed your tax burden this year, because you’re helping carry the weight of loophole-savvy corporations that enjoy many of the legal benefits of real, live human citizens, but exist in a weird, semi-tax-free world.

A 2004 U.S. Government Accountability Office (GAO) study found that 61% of American corporations, including 39% of large companies, paid no corporate income taxes between 1996 and 2000. Last year, corporations shouldered just 14.4% of the total U.S. tax burden, compared with about 50% in 1940.

Trends: Kroger Offers You A Bonus If You Put Your Stimulus Check On A Gift Card

Kroger is getting into the stimulus bonus action! Unwilling to be outdone by Sears, Kroger is offering a bonus if you put your stimulus check on a Kroger gift card. They have Kroger gift cards? My what a sexy gift. Honey, you shouldn’t have.

../../../..//2008/04/16/yahoo-has-a-list-of/

Yahoo! has a list of celebrities that are probably worse at doing their taxes than you are. Now that the pain is over, laugh at someone else’s misfortune. Judy Garland lost her house! Ha! [Yahoo!]

5 Myths About The Upcoming Tax Rebate Stimulus Check

There are a lot of myths and rumors going around out there about the upcoming stimulus check. Tax Cat is in full debunk mode this morning. Careful of the claws, ladies and gentlemen. He gets touchy when tax season ends and he has to retire the glasses for another year and go back to ruining things in Chad’s apartment.

../../../..//2008/04/15/reminder-we-posted-instructions-for/

Reminder: We posted instructions for filing a tax extension the other day. Perhaps you were still feeling optimistic when the story first went up, but now reality has settled in and you’d like to re-read that post. We understand.

It's Tax Day! Here Are Some Post Offices That Are Open Late…

Today is the day, folks. You’ll need to finish up your taxes and send them on their way to the IRS.

New York State To Start Taxing Amazon Purchases

One of the budget-related changes voted in last week by New York State’s politicians included a new “Amazon tax”:

“Another $50 million will come from requiring online retailers like Amazon that do not have a physical presence in New York to collect sales taxes on purchases made by New Yorkers and remit them to the state.

New York’s argument, based on a reading of the 1992 Quill vs. North Dakota U.S. Supreme Court ruling, is that because Amazon makes sales through affiliates who live in the state, it can be considered to have a physical presence there—which means the new law wouldn’t apply to retailers who don’t use affiliate programs.

Scammers Want Your Stimulus Check And Tax Refund

Phoung Cat Le from the Seattle Post-Intelligencer reports that a colleague of hers is the victim of income tax ID theft. A scammer filed her income taxes before she did, hoping to get a hold of her refund and stimulus check.

Did You Do Your Taxes Yet?

Taxes are due in two days and change. Did you pay them yet? If you still haven’t sat down with your W2s, don’t worry, there’s still time to fire up the old Casio.

Tax Tip For Lazy People: How To Get An Extension On Your Income Taxes

You need an extension.

../../../..//2008/04/11/heres-an-informative-slideshow-that/

Here’s an informative slideshow that breaks down how your tax dollars are spent (spoiler alert: nearly half goes to the military). [CNBC]

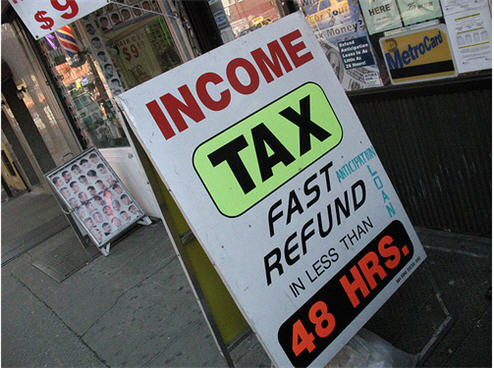

Corruption: Mystery Shoppers Expose Refund Anticipation Loan Abuse

As an educated consumer you may wonder why people would choose to use a Refund Anticipation Loan when they can e-file and receive their refund in only a few days.

Tax Cat: Help! I Owe The IRS Money And I Don't Have Any!

The IRS knows you owe them money and they realize that you may not actually have any to give them. Don’t worry, they’re not going to come in the night and steal all your Nerf footballs and catnip.

H&R Block Says It Does Not Refuse Tax Returns For Same-Sex Civil Unions

H&R Block recently got into trouble because when a Connecticut same-sex couple tried to file their taxes through H&R Block’s website, the system spat back, “”We don’t support Connecticut Civil Union returns.” One of our readers wrote H&R Block about our post and their VP of Marketing actually wrote back to him to describe what she felt was media sensationalization of the story. She says that the problem happens because the Federal government doesn’t recognize same-sex civil unions. The information for state tax returns gets inputted based on the federal, so in this specific case, it’s not “flowing” correctly. It sounds like they’re working on fixing that, though. Here’s her email in full:

Canceling A ResortQuest Reservation? It'll Cost You $190 In Taxes And $95 In Fees

ResortQuest hit William’s wife with over $285 in fees when she canceled less than a day after making her reservation. Over $190 ostensibly went towards taxes, which raised William’s eyebrow and led him to fire off an Executive Email Carpet Bomb demanding an explanation.

Avoid An IRS Audit

How can you avoid an IRS audit? There’s a .58% chance if you make 20-50k that you’ll be audited by the IRS, but that still adds up to 259,794 unlucky people. Here’s some strategies on how you can avoid becoming one of them:

What to Do If You Can't File Your Taxes on Time

File Form 4868 (download a copy from irs.gov or your tax prep program will provide one), and use last year’s return to estimate what you owe or let your tax software do it for you. It’s better to overestimate and get a refund later; if you’re under by more than 10%, you’ll owe interest of 7% on the amount you underpaid by, plus a penalty of up to 25% of the underpayment.