H&R Block is an extremely generous company! They’ve sent you a $5,666.10 refund check and you didn’t even file your taxes with them! Isn’t that nice?

taxes

H&R Block Sends You A Refund Check For $5,666.10, Even Though You Haven't Filed Your Taxes

H&R Block Doesn't "Support" Gay Civil Unions

After 23 months of same-sex, civil-union bliss, Jason Smith and Settimio Pisu had grown accustomed to some institutions being not quite ready for the concept of gay spouses.

../../../..//2008/03/25/if-youre-on-ssdi-social/

If you’re on SSDI (Social Security Disability Insurance) and used Taxcut Online from H&R Block to file for your stimulus payment, it may have told you to print out the wrong form. The right form is 1040A, not 1040EZ.

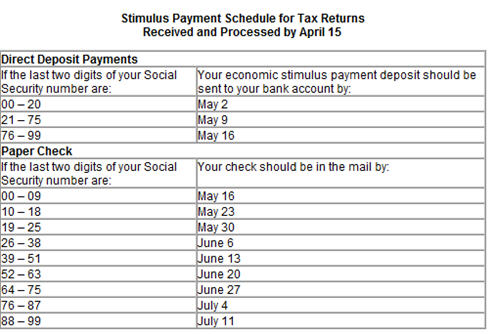

Economic Stimulus Reminder Notes Are Here!

We recently received our “Economic Stimulus Payment Notice,” and it seems worth far less than the $41.8 million the Treasury spent on printing and mailing. The letter contained no surprises, but did extend the tantalizing possibility that we would receive “a notice and additional information shortly before the payment is made.” Check out the full letter and a handy eligibility chart, after the jump.

../../../..//2008/03/20/the-irs-is-holding-12/

The IRS is holding $1.2 billion in unclaimed refunds for 1.3 million people who still haven’t filed a 2004 tax return. [IRS]

Check Out The IRS's Economic Stimulus Payment Calculator

The IRS has more information about the upcoming economic stimulus payments. Woohoo!

../../../..//2008/03/13/wondering-where-the-tax-money/

Wondering where the tax money you pay into the NYC public school system is going? Well, part of it goes to pay the salaries of about 700 teachers who are forced to sit in special rooms that are located all over the city. All day. And do nothing. Sometimes for years at a time. [Rubber Room via BuzzFeed]

Don't File Taxes? You Gotta To Get A Stimulus Check

People who are not normally required to file taxes will have to do so this year if they want a piece of the 2008 economic stimulus rebate. This applies to low-income works, and Social Security, Veterans Affairs Recipients, and Railroad Retirement recipients. In partnership with the IRS, the following sites are offering free tax prep and electronic filing if the only reason you need to files is to receive a stimulus check:

If You Buy A Car (Okay, Truck) In Texas, Make Sure You Don't Pay The Inventory Tax

Texas levies an inventory tax of .02% on the retail value of all products in a company’s inventory each year, but lots of car dealerships try to sneak the fee over to the consumer. Even worse, they do it year-round.

Using A Free Tax Service To Prepare Your State Return? If You Don't Pay, They May Delete Your Work

Last week we wrote about the IRS’ free tax filing program and pointed you to a blog that reviewed all 19 services. Only two offer free state filing, but the blog, Flife, pointed out that you could always use your chosen service to prepare your state return—using it as a sort of worksheet—and then switch to one of the totally free services to do the actual filing. But be careful: a reader just wrote in to say free-tax-return.com completely deleted his state filing when he declined to pay the $13.50 fee.

Choose A Qualified Tax Preparer

A qualified tax preparer can be the difference between a meaty refund and a soul-crushing audit. The Washington Attorney General has several excellent pointers to help you find the right professional to prepare your return.

19 Free Tax Services Tested And Rated

Still looking for an affordable e-filing solution for your taxes? The finance blog FiLife “tested every one of the free tax filing services available through the IRS’ Free File program, then posted the results in a detailed, easy-to-read comparison chart.

Tax Cat: Let's Learn About "Necessary And Ordinary Business Expenses"

If you have your own business, you can write off your expenses. This reduces you income, and lowers your tax bill. Sadly, you can’t just write off whatever you want.

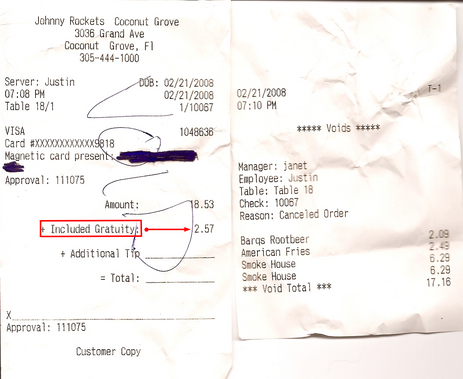

Johnny Rockets Automatically Adds 15% Gratuity To Takeout Orders

She writes:

When I went to pay for the order, I noticed a gratuity already included on the bill. I told the waiter, “this is take out gratuity is not included.”

../../../..//2008/02/19/commenter-witeowl-points-out-in/

Commenter Witeowl points out in another thread that if your adjusted gross income was $54,000 or less last year, the IRS can direct you to 19 different companies that will allow you to e-file your 2007 taxes for free. When this writer took advantage of it in the past, “free” meant jumping through a series of GoDaddy-like pages, but in the end it was free to use. [IRS]

I-Can! E-File Not Quite Ready For Primetime

Last week we wrote about I-Can! E-File, a free electronic filing service for your federal income taxes. It’s a great idea, and we’re thankful to the Legal Aid Society of Orange County for doing something like this—but you might want to find an alternative this year and give them some time to work out the kinks. Today a reader emailed us to point out that icanefile.org’s password system can be easily cracked, because instead of letting you choose an original password, it requires you to use your name and social security number to set up an account.

Tax Tip: Mortgage Forgiveness Debt Relief Act of 2007

Tax Cat knows that it’s a hard subject, but if your home has been foreclosed there’s something you should know about changes to the tax laws.

../../../..//2008/02/15/a-roundup-of-places-to/

A roundup of places to find deals on TurboTax products. [ProBargainHunter]