Just because someone else helps you with paying an expense doesn’t necessarily mean you can’t legally itemize that expense on your 1040 come tax time. [More]

taxes

Consumer Groups Scold Airlines For Pocketing Tax Money During FAA Shutdown

Surely you remember the recent FAA shutdown, during which the government couldn’t collect taxes on airfares, leading the airlines to temporarily raise their base prices and pocket an estimated $70 million a day. Now a coalition of consumer groups, including our benevolent benefactors at Consumers Union, are voicing their displeasure for this and other anti-consumer behavior. [More]

Should New Homeowner Have To Pay For Sidewalk Repair It Took City 14 Years To Perform?

A homeowner in Queens, NY, is none too thrilled after she paid the city more than $1,100 for repair on sidewalk cracks that went un-repaired for more than a decade before she purchased the building in 2008. [More]

Government Agencies Are Big Targets For Phone Bill Cramming

Crammers are ripping off taxpayers across the country by getting fake charges put on the phone bills of government agencies. [More]

Buffett Begs Congress To Raise His Taxes

Famous uberrich guy Warren Buffett has penned a NYT editorial begging Congress to please, please, raise his taxes. Last year, he writes, they were only 17.4 of his taxable income. He says folks like him, who make over $10 million a year, are treated by Washington “as if we were spotted owls or some other endangered species.” It’s time to stop the “coddling,” he says and make the super-rich pay their fair share. [More]

Southwest Leads Airfare Rollback Following Return Of Taxes

Late last week, when legislators took a vacation from vacation to hammer out a deal that put FAA employees back to work and millions of tax dollars back into federal coffers, a number of you expressed skepticism about predictions that airlines would lower their fares to where they were before the FAA lost its authority to collect taxes. But it looks like all the major airlines have now rolled back their prices over the last two days. [More]

Will Airlines Roll Back Fare Hikes Now That The FAA Can Collect Taxes Again?

Immediately after a standoff in Congress left the FAA without the authority to collect taxes on airfares, almost every major airline moved to jack up their ticket prices. But now that the shutdown has ended — at least temporarily — will the airlines respond by lowering prices to where they were before? [More]

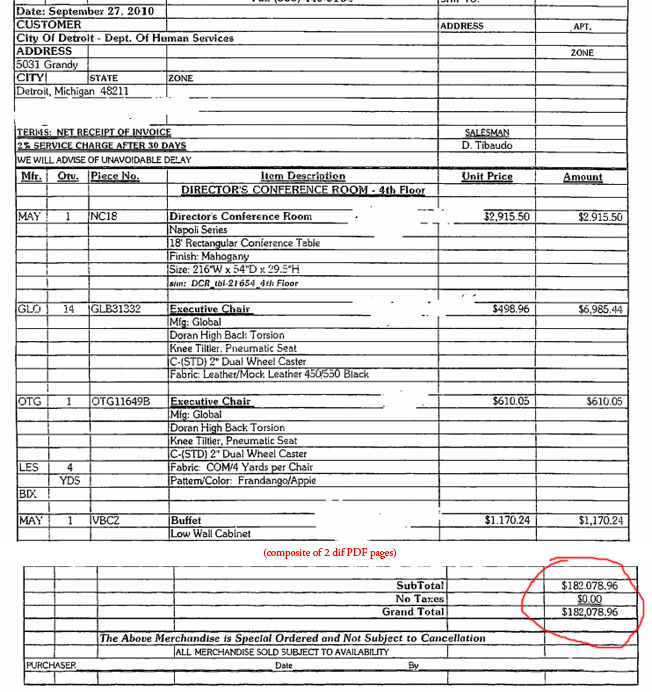

Detroit Bureau Uses Money Meant To Feed Poor To Buy $314 Trash Cans

Three stainless-steel trash cans with motion-activated sensor lids: $314.93 each. A 500-lb capacity ottoman for the cafeteria: $469. Mahogany-finished conference room table: $3,000. The line items sound extravagant enough on their own. When you learn that they were to makeover a Detroit city office that handles the federal money for feeding and clothing the poor, and the credenzas and sofas and such came out of that money, it’s time to get livid. [More]

Delta And US Airways Will Refund "Taxes" Collected During FAA Shutdown

Delta was the first airline to start giving out refunds for the extra money they’ve been scalping from passengers while the FAA remains shut down. After the airline made the announcement Monday, US Airways on Tuesday said they would follow suit. [More]

Airlines Not Passing On Savings Of Not Having To Pay FAA Taxes

When Congress failed Friday to extend a bill that would have kept the Federal Aviation Administration (FAA) running, they handed airlines a $25 million a day gift. Without the extension, the FAA doesn’t have the authority to collect taxes. But rather than pass on the savings, nearly all airlines actually raised fares to about the same amount as the federal taxes. Most consumers won’t notice because prices are the same, even though it’s effectively a price hike. [More]

Delta, Continental, Others Jack Up Fares After Federal Tax Takes Vacation

As we reported last week, the inability for Congress to come to terms on a bill that would extend the FAA’s operating authority means that airlines are not currently charging federal taxes on airfares. But if you’re not seeing any difference in the final price of your ticket, that’s because most airlines have increased their fares since Saturday. [More]

Potential FAA Shutdown Could Mean Tax-Free Airfares For Travelers

Unless Congress can hammer out their issues over extending the FAA’s operating authority by midnight tonight, 4,000 agency employees will be temporarily out of a job, but travelers will be able to but airline tickets without paying federal taxes. [More]

"Secret" Way To Keep Buying Paper Savings Bonds After 2012 Deadline

The Treasury announced last week that, in order to save money, they’re going to stop selling paper saving bonds after Jan 2012. Gone will be the days when a grandparent could walk down to the bank and sock away $50 every year to make an ironclad investment for their grandchildren. But there is a bit of a “backdoor” way you can still buy them without having to go through their weird online “gift box.” It will also let you buy more bonds than the $5,000 limit. What you do is use your tax refund to buy them through the IRS using form 8888. [More]

Homeowner Overcharged On Property Taxes For Two Decades. How Much Should City Repay?

An 84-year-old widow recently found out she’s been paying too much property tax on her home for more than two decades because of an error by the original assessor. But the city has only offered to pay her back for one year of the overcharge. [More]

Beer Company Says It Will Come To Rescue Of Man Who Caught Derek Jeter's 3,000th Hit

The saga of the NY Yankees fan who caught — and then gave back — the baseball Derek Jeter knocked out of the park for hit number 3,000 continues. First, the team rewarded the fan with memorabilia and luxury box tickets for the rest of the season. Then came reports that he could be on the hook for thousands of dollars in taxes for the freebies. Today he got some potentially good news, as the folks at Miller High Life say they’ll foot the bill for any potential tax liability the guy might have. [More]

Amazon Wants To Bring Sales Tax Battle To California Voters

Amazon wants California voters to reverse a new law that requires online retailers to collect sales tax on purchases made in that state. Amazon previously dropped its California affiliates in response to the law. [More]

Study: California Spends $308 Million Per Execution

A study by a California judge and his law clerk, a law professor suggests that the state should do away with the death penalty in order to save money. The state has spent $4 billion on capital punishment since 1978, but has only executed 13 convicts in that span. And costs are projected to increase to $9 billion by 2030. [More]

IRS Gives $110,000 To Wrong Guy, Now He's In Jail

A California father is in jail and faces charges after the IRS deposited $110,000 in his account that should have gone to another taxpayer, reports KCAL. [More]