On Tuesday, during Amazon’s Prime Day, festivities, the online retailer’s credit card partner Visa joined in the fun with a promotion where customers who made a $150 purchase using their Amazon-branded Visa card would receive a $30 discount. That’s an appealing bargain, and plenty of customers prepared to take advantage of it. What they didn’t do was read the fine print, or take it seriously, and a lot of customers missed out. [More]

subprime

Amazon Prime Day Kicks Off With Deals, Problems Actually Buying Those Deals

Prime Day is a shopping holiday, so actually being able to shop should be an important part of that. Or not. Users are reporting problems actually checking out when they try to make purchases on Amazon, which would sort of defeat the whole point of having a shopping-themed holiday. [More]

Obama To Call For Financial Watchdog Agency

Tomorrow, President Obama is expected to call for the creation of a new watchdog agency that would help protect consumers from abusive credit card, mortgage, banking practices. The banking industry is not happy about the idea, reports CNN. But hey, they’re just looking out for us: “It’s bad for consumers,” a banking industry lobbyist told the network. Oh, well, never mind then, and pass me some more delicious subprime!

Affidavits On How Wells Fargo Gave "Ghetto Loans" To "Mud People"

Here’s the official court filing (PDF) so you can get the full details on how Wells Fargo pushed or even fraudulently placed black borrowers into sub-prime loans, even when those borrowers could afford prime loans, along with an office environment where employees threw around racist slurs, calling black borrowers “mud people” and their mortgages “ghetto loans.” The official statements referenced in the NYT article are in this document in full. The affidavits begin on page 48. Two screenshots inside…

Loan Officers Detail Wells Fargo's Blatantly Racist Subprime Loans

UPDATE: Read the affidavits here.

Congresswoman Marcy Kaptur Urges Squatting In Foreclosed Homes

Last week I was watching Lou Dobbs while scrubbing my dentures and complaining about joint pain (two of those things are true, sadly), and I saw a segment on Ohio congresswoman Marcy Kaptur, who is encouraging homeowners to stay put in their foreclosed houses. She argues that many of the loans made during the subprime fiasco may not be legit, and that you should seek legal counseling and demand a mortgage audit from the bank before leaving. Kaptur admits her advice doesn’t trump the sheriff knocking at your door with an eviction notice, but a real estate lawyer told the Toledo Blade that otherwise she has a point.

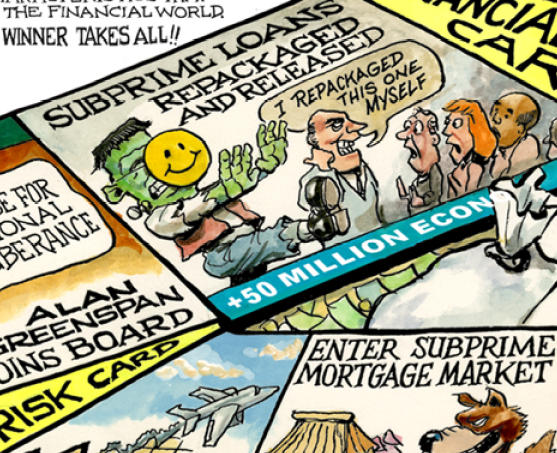

The Economist's Credit Crunch Game Makes Subprime Loans Fun Again!

We think the idea of “Credit Crunch,” a print-it-yourself board game in this week’s issue of The Economist, is great. We’re not convinced it’s exactly cost-effective to print the board, cards, and money with your own equipment, though—as someone suggests in their comments section, maybe a web-savvy reader should create an online version.

Illinois And California Are Suing Countrywide For Deceptive Lending And Fraud

The Attorneys General of Illinois and California announced today that they are suing Countrywide Financial for its role in the subprime mortgage meltdown.

Consumer Bankruptcies Up Nearly 50% From A Year Ago

The number of people filing for bankruptcy continues to increase, as bad mortgages and the rising price of [insert noun here] squeezes every last penny out of debt-laden consumers. The American Bankruptcy Institute says the number of filings was up 47.7% in April from a year ago, and up 7.1% from March ’08.

33% Of Homeowners Say Their Homes Depreciated In Value In February

A new survey from Reuters and the University of Michigan found that a third of homeowners felt their homes lost value in February, compared to 16% a year ago.

Bankruptcies Up 40% In 2007

Although December marked a slight decrease in Chapter 13 filings from November, 2007 overall logged a whopping 40% rise in the number of bankruptcy filings compared to 2006, reports the Wall Street Journal—over 800,000 filings in 2007, versus around 570,000 the previous year.

Rumors: Merrill Lynch CEO Forced To Resign After Disasterous Third Quarter?

Rumors are flying that Stanley O’Neal is being forced to step down after a disastrous third quarter— making him the most prominent casualty of the subprime meltdown.

Subprime Meltdown Kicks WaMu's @#$, Profits Down 75%

It must not be fun around WaMu headquarters today. Profits are down a whopping 75%.

Ameriquest Is Dead

Ameriquest, the lender the epitomized everything that was f*cked up about the subprime mortgage meltdown, is dead.

The World's Worst Credit Card

Golb at Money, Matter, and More Musings has located the worst credit card in the world. It is designed to prey on subprime borrowers who, sadly, cannot get a better card…